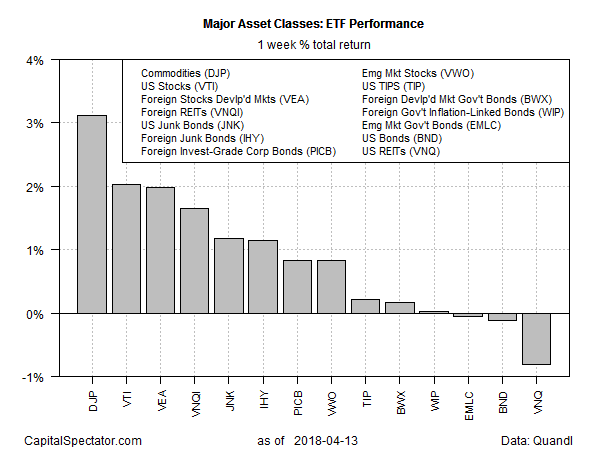

Most of the major asset classes scored gains last week, with broadly defined commodities leading the way, based on a set of exchange-traded products.

The broadly defined iPath Bloomberg Commodity (DJP) posted its biggest weekly calendar advance in 2018 for the five trading days through April 13. The exchange-traded note was up 3.1%, closing at the highest price since February 1.

A key driver for last week’s rally in commodities: oil, which jumped amid rising geopolitical tension. Saturday’s missile strike on Syria followed the runup in oil prices in preceding days, although early trading on Monday, April 16, reflects a pullback.

Harry Tchilinguirian, global head of commodity market strategy at BNP Paribas told Reuters:

As far as developments in Syria are concerned, the market has had a sigh of relief in the sense that there is no escalation, either diplomatically, or on the ground, following the intervention by the US, France and the UK.

As a macro asset-allocator, if you want to hedge your portfolio against geopolitical risk, your prime candidate is oil, especially if that risk is in the Middle East.

Last week’s biggest loser among the major asset classes: real estate investment trusts in the US Vanguard Real Estate (VNQ) slumped 0.8% — the ETF’s third weekly decline in the last four weeks.

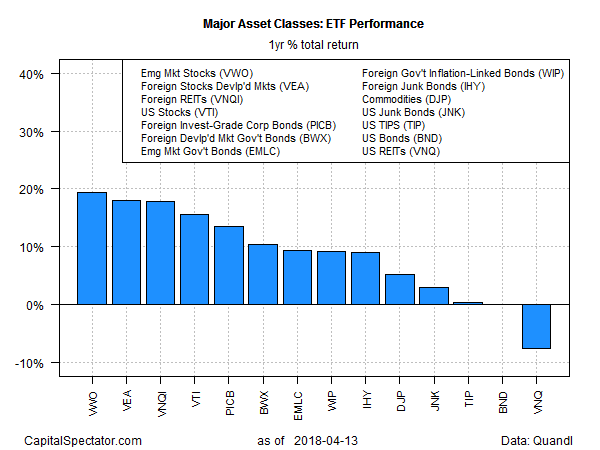

For the one-year trend, most asset classes are still firmly in the black, led by stocks in emerging markets.

Vanguard FTSE Emerging Markets (VWO) posted a strong 19.4% total return for the year (252 trading days) through last week’s close. In close pursuit is the second-place performance via equities in developed markets: Vanguard FTSE Developed Markets (VEA) is up 18.0% for the 12 months through April 13.

US REITs are in last place at the moment for the annual trend. VNQ was off 9.2% at the end of trading on Friday, even after factoring in payouts from the ETF.