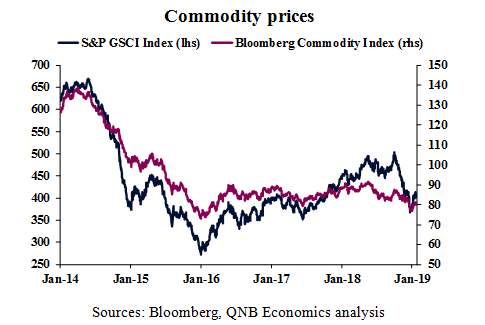

Commodity prices have started to recover since their recent lows in late December, after having plummeted from their recent highs in May-October 2018. In fact, the Standard & Poor’s Goldman Sachs (GS) Commodity Index, a leading benchmark for general commodity price movements, was up 9.3% from late December to the time of writing in late January 2019, after falling by 26.9% from early October to late December 2018. The less energy-intensive Bloomberg Commodity Index has followed a similar trajectory, albeit with a more contained magnitude, with prices recovering by 4.6%since late December, after a 16.2% drop from their May 2018 peak to the late December trough. Our analysis delves into the two reasons behind the recent trend in commodity prices and the three factors that are set to limit the upside in prices over the coming years.

The ongoing recovery in commodity price is associated with two main supporting elements. First, the FX markets, with a weakening USD favoring commodities. As most commodities have their prices benchmarked in USD, non-U.S. demand tends to increase whenever the USD is down, pushing prices up. The USD has depreciated by 1.8% against the U.S. Dollar Index (DXY) basket since November 2018.

Second, a reversal of overshooting commodity prices in the context of still healthy global growth and the beginning of late-cycle price movements. While growth is softening in the U.S., the euro area, China and Japan, the demand for commodities is expected to hold up at reasonable levels. The IMF projects that global growth in 2019 should still hover around the post-Lehman average of 3.4% y/y. Moreover, the key U.S. economic cycle is gradually moving towards late cycle or late expansion, which often presents higher inflation and less accommodative monetary policies, i.e., conditions that favor commodities versus equities or fixed income assets.

There are, however, three factors or caveats that are set to limit the upside in commodity prices during the coming years.

First, inflation and inflation expectations, which have a positive relationship with commodity prices, are contained by long-run or secular changes in advanced economies. Historically, commodities rally the most after inflation starts to accelerate, as a positive feedback loop is created and investors turn to commodities as safe-haven trades against inflation. But the so-called Phillips Curve, or the long-run relationship between unemployment and inflation, has flattened, as wages struggle to grow on the back of several structural changes in labor markets. Despite positive output gaps or demand running above GDP potential in several advanced economies, inflation is not going to pick up in a more substantial way if salaries do not respond to tighter labor markets.

Commodity Prices

Sources: Bloomberg, QNB Economics analysis

Second, lower demand for durable goods in advanced economies. Structural demand for big-ticket items (houses, white goods, automobiles) has clearly moved downwards since the Great Financial Crisis of 2008, as de-leveraging became the norm and millennials started to change consumer preferences. With less demand for such items, material intensive capital expenditure suffers, affecting the prospects for energy, diesel and base metals.

Third, a shift in the price elasticity of supply of key commodities, i.e., the responsiveness of output or quantity supplied to a change in prices. Typically, commodity markets suffer with very different frequencies between supply and demand, with supply being sticky over the short-term, a problem that is often referred to as the “hog cycle.” This contributes to create periods of severe under-supply or over-supply, breading violent price movements. While this still holds for commodities such as copper or conventional oil, technological progress and innovation are closing the frequency gap and making supply more responsive to prices over shorter horizons. The best such example is the impact of shale oil in energy markets.

All in all, commodities are poised to gain as the USD weakens and the U.S. economic cycle gradually matures, but the upside to higher commodity prices is limited by important structural changes.