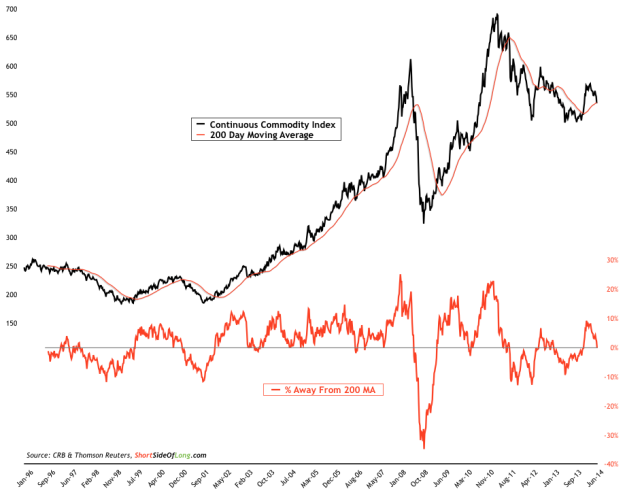

Chart 1: Commodity rally is in reversal, as CCI trades below 200 MA

The rally that started at the beginning of this year is quickly reversing. While not all of the gains have been given back (yet), the truth is that the current price conditions are not looking that good for commodities. Continuous Commodity Index has now fallen below its 200 day moving average, something that rarely happened during 2001-08 and 2009-11 bull markets. The more common CRB Index is also not too far off either. Let us look at some of the individual commodities that represent four major sub sectors: energy, industrial metals, grains and softs.

We start with the granddaddy of all commodities and a barometer of global economy, Crude Oil. Personally, I prefer to use Brent Crude Oil, as it represents global demand and supply story a lot better. As you may recall from a few weeks back, we were discussing a technical breakout in Brent Crude Oil out of its multi-year triangular consolidation pattern (see Chart 2).

Chart 2: The granddaddy of all commodities has now sharply reversed

Normally a tradable pattern for me, I hesitated to trade this setup as risk and reward did not look good to me. Oil was breaking out on Iraq issues (I never like following the herd in euphoria), while WTI contracts remained in backwardation (signal of a coming decline) and volatility at multi-year lows.

Interestingly, the recent breakout turned out to be a false move on the upside, sucking in remaining bulls, as they chased the price higher. A sharp reversal has now followed, as Brent Crude Oil breaks the triangle on the downside. Usually, a fake move like this leads to a more powerful correction in the opposite direction, so do not be surprised if oil drops rapidly in coming months.

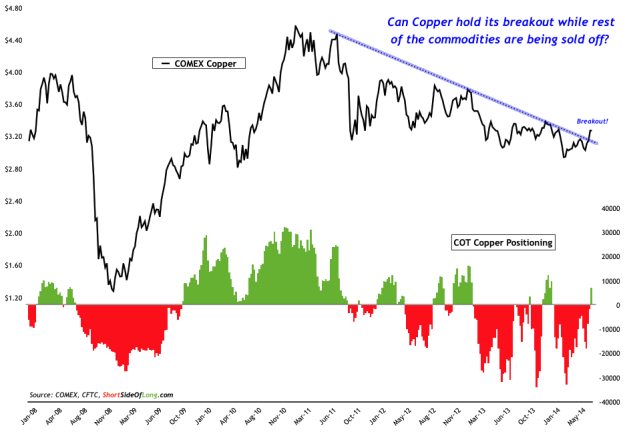

Chart 3: Can metals like Copper continue higher with selling pressure?

Brent crude wasn’t the only commodity staging a breakout at the time. We have also been watching the overall metals sector wake up a bit too. In particular, Copper made a run above its 3 year downtrend, just as majority of hedge funds were holding huge amount of shorts. Now that the short squeeze has run its course and funds have turned net long, the question is whether or not metals like Copper can continue rallying higher with the ongoing commodity selling pressure?

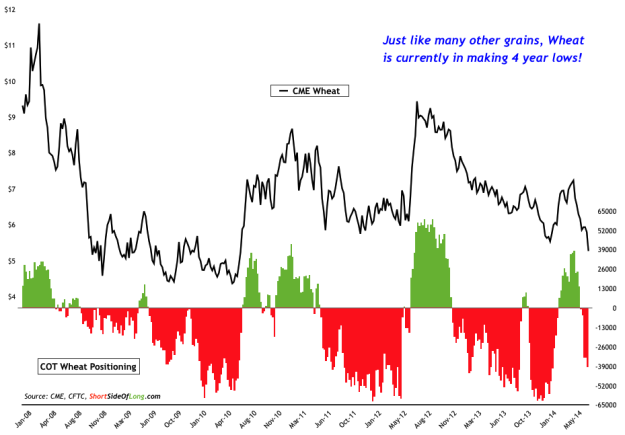

Chart 4: Grains have been slaughtered, with Wheat making 4 year lows

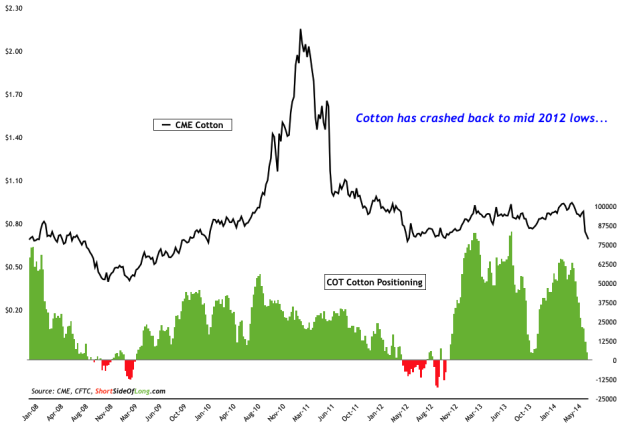

Agriculture is currently taking the biggest beating within the commodity sector and is the main reason for CC Index dropping below the 200 day MA. Grains have been thrown out together with the bathwater, while some softs like Cotton are also experiencing large price drops. For a recent write-up on the grains sell off, I would urge you to read the previous post titled “Agriculture Thrown Out The Window” post just a few days ago (that way I do not repeat the same old stuff).

Chart 5: Cotton has crashed all the way back to its middle of 2012 lows

Disclosure: I am now in process of closing all of my recent metals trades, including CEF and RJZ. I admit, it doesn’t say much about my recent call on the metals sector.