At the beginning of the year, I said my one prediction for 2014 was that commodities were too beaten down and could rally. We finished 2013 with sentiment at historic lows and it seemed everyone had turned their back on this asset class.

In Phil Pearlman’s Yahoo! Finance article, 2014 Predictions from Some of the Smartest Market Watchers I said:

Sentiment for agriculture and metals are at or near historic lows. For example, nearly all three categories of the Commitment of Traders report, Commercial, Large Traders, and Small Traders are short or near a net-short position for gold. Typically we see the most hated areas of the market one year rotate back to strength the following year. I’ll be watching to see if this happens for the commodities market in 2014. While commodities are very weather dependent, there’s a chance we see at least a partial rotation back to the beaten down agriculture and metal markets.

Well I didn’t expect commodities to rally as fast as they have. Year-to-date the PowerShares Agriculture ETF (DBA) is up nearly 11% and gold (GLD) has advanced 7% while the equity market has gained just 1%. I still think commodities could see higher prices, especially with the awful winter most of the country has been having as well as the drought that’s hit the west coast.

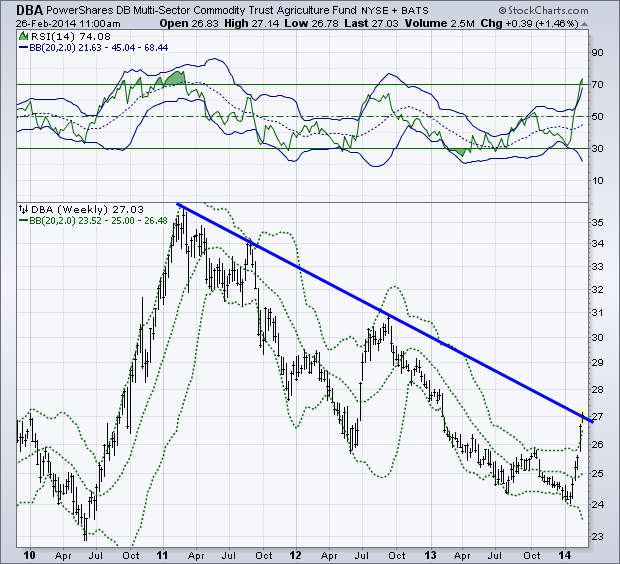

However, I think the current rally is becoming a little overextended and must now contend with trend line resistance. Below is a weekly chart of the PowerShares Multi-Sector Agriculture ETF (DBA) going back to 2010. I’ve drawn a blue line to connect the previous highs and this takes us to where price currently sits this week. DBA has broken out of its weekly Bollinger® Bands, as has the Relative Strength Index which is in the top panel of the chart. With stocks not replicating the 2013 pattern of “never go down,” traders appear to have come to the realization that there are in fact other asset classes to own! The difference in the current rally, compared to what we saw in 2010, was the slow advance that took commodity prices to historic highs. We rarely saw prices break above their upper Bollinger Band on the weekly chart as buyers formed an orderly line to pick up their shares.

I would be comfortable seeing DBA consolidate at current levels, or test the previous high near $26 from last October. This would allow those that have missed the boat the opportunity to participate and potentially take the ETF to its 2012 high of $31.

Taking a look at sentiment, specifically the COT data set, we can see that traders have pushed this measure near historic levels. SentimenTrader creates this Commodity COT Master Indicator to show a global picture of commodity sentiment and how traders are currently positioned. While we aren’t there at highs yet, we are approaching a level that has previously cooled off rallies in the past.

Commodities are still an asset class I am watching for 2014 and are a place we may see traders seek shelter during any increase in volatility within the stock and bond markets. We’ll see what happens.

Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this post is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in the blog. Please see my Disclosure page for full disclaimer.