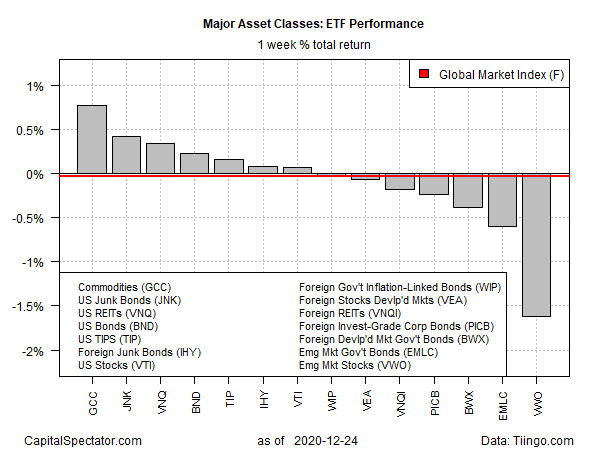

The year’s penultimate trading week was short but it didn’t lack for drama. A broadly defined, equal-weighted measure of commodities led a mixed run for the major asset classes, while stocks and bonds in emerging markets posted the deepest losses, based on a set of exchange traded funds at the close of last week’s trading (Dec. 24).

WisdomTree Continuous Commodity Index Fund (NYSE:GCC) (GCC) rose 0.8%, posting its second straight weekly gain. The fund, which holds an equally weighted mix of commodities, surged earlier in the week before pulling back on Dec. 24 and posting a moderate advance vs. the previous Friday’s close. The gain left the ETF near its highest close since mid-2018.

Overall, last week delivered mixed results for the major asset classes, with about half of markets rising and the rest posting losses. The biggest setback: stocks in emerging markets. Vanguard FTSE Emerging Markets Index Fund ETF Shares (NYSE:VWO) fell 1.6% for the trading week. Despite the slide, VWO remains close to a record high, thanks to the fund’s strong rally in recent months.

U.S. stocks posted comparatively middling results last week. Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI) (VTI) edged up 0.1%, which left it fractionally below a record high.

The Global Markets Index (GMI.F) fell last week, slipping by a tiny fraction. This unmanaged benchmark holds all the major asset classes (except cash) in market-value weights via ETF proxies. The latest dip left GMI.F slightly below a record high.

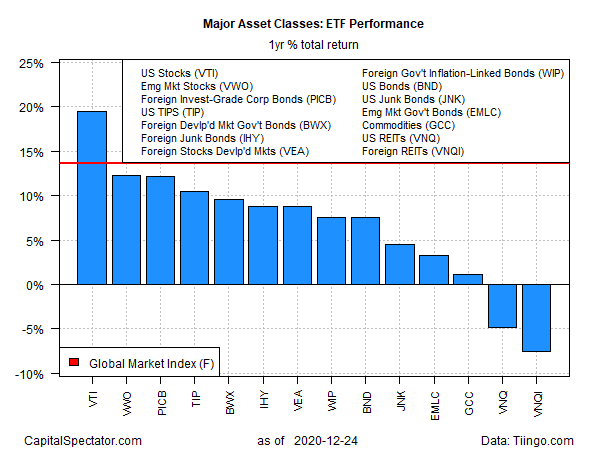

For the one-year window, U.S. equities continue to lead the major asset classes by a wide margin. VTI ended last week’s trading with a 19.9% total return for the past 12 months. That’s well ahead of the second-best one-year performer: stocks in emerging markets via VWO, which is up a distant 12.5%.

U.S. and foreign property shares remain the only one-year losers. Vanguard US Real Estate (VNQ) and its offshore equivalent (VNQI) are in the red by -4.4% and -7.0%, respectively, vs. their year-ago levels after factoring in distributions.

GMI.F is up a strong 13.6% over the past year.

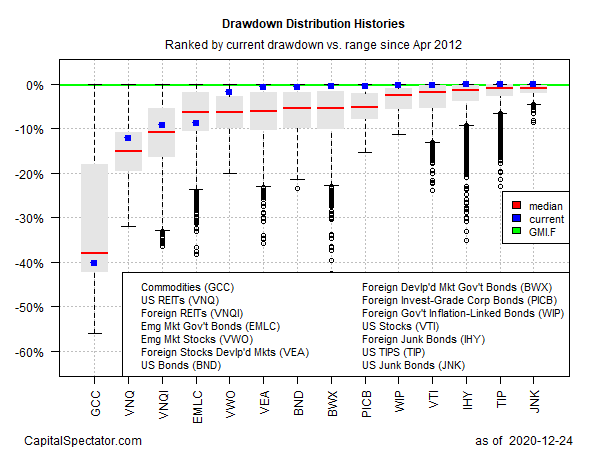

Ranking global markets by current drawdown continues to show that most of the major asset classes are at or near price peaks. In first place: SPDR® Bloomberg Barclays (LON:BARC) High Yield Bond ETF (NYSE:JNK), which closed at another record high on Christmas Eve.

Broadly defined commodities (GCC) are at the opposite extreme. The ETF remains in a deep drawdown with a peak-to-trough slide of roughly -40%.

GMI.F’s current drawdown is a slight -0.3%.