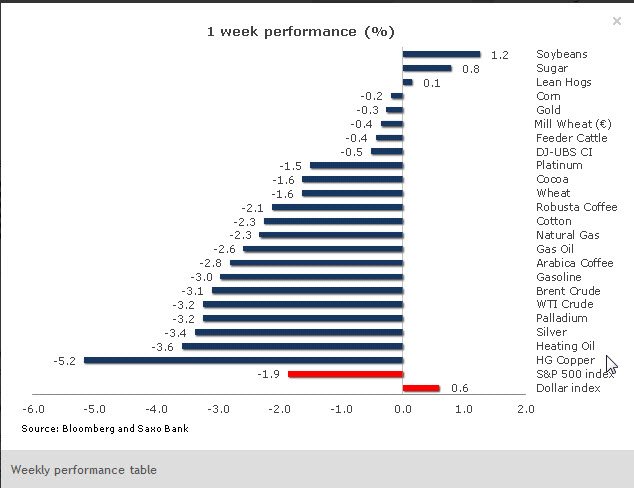

Commodity prices were mostly weaker over the past week, as macroeconomic concerns triggered selling across all the major sectors. The surprise weakness in the US jobs report last Friday triggered some additional selling in markets where liquidity was at a premium, with most traders being away for the Easter break. The only sector that has escaped relatively unscathed is the agriculture sector as worries about tight supplies this summer has kept the price of grains, particularly soybeans, well supported.

The pattern of range trading between 1.30 and 1.35 that has been witnessed in EUR/USD, the world’s most traded currency pair, since late January has also had an impact on the trading behaviour surrounding some of the major commodities, such as Brent crude and copper. With the bottom of the EUR/USD range being tested once again, traders will be keeping a close eye on whether support will again present itself, thereby helping commodities to stay rangebound.

The broad-based DJ-UBS commodity index lost 0.5 percent over the past week and is currently trading flat on the year, as investors have been looking for better opportunities elsewhere. The second quarter could be rather challenging to investors across most asset classes, as some consolidation following the first quarter can be expected, combined with some signs of emerging weakness in economic data from the major economies.

The energy sector has seen some light selling as of late with Brent crude touching its lowest level in a month, following the weaker-than-expected US employment report, which could lower sluggish US fuel demand even further. Iran agreed to resume talks on its nuclear programme and hopes have been raised that a deal can be struck when negotiations starts April 14.

The most recent data on speculative positioning covering the week ending April 3 showed that speculators reduced their bullish bets on both WTI crude and Brent crude by the largest amount in more than three months. Money managers have stubbornly been holding onto long positions in Brent crude, given the geopolitical risks and perceived tightness of oil for prompt delivery.

Last week, however, saw an 8 percent reduction in these net longs, which was triggered by a growing short base, indicating that money managers are increasingly willing to play the range that has been established over the last two months. In order to see a major change in traders’ positioning, a break below 120 on Brent and 100 on WTI crude needs to occur.

Precious Metals Driven By Stimulus Expectations

Gold and silver markets continue to act like liquidity junkies, with the on/off talk about additional stimulus having been the main driver since January. The sluggish US employment report last Friday once again raised hopes for another round of quantitative easing, and gold in particular found some support from this idea.

Traders have been increasingly wrong-footed over the last couple of months, and probably at this stage would like to see solid proof of central bank action before getting properly involved on the buy side again. Until then, trend-following trading models will probably provide most of the support, as they undoubtedly will be buying on any additional upside break.

The end of a 21-day strike by Indian jewellers in protest against rising import taxes also failed to ignite the market. Given the current low involvement by speculative traders, the physical aspect of the gold market will become increasingly important in order to find a floor under the market.

The 55-week moving average is currently located at 1,647 and being tested at the time of writing. A weekly close below that level could signal further weakness, but as this level has rarely been broken and then only for shorter periods, some may view a break below as a buying opportunity applied with a relatively tight 3 to 4 percent stop loss.

Copper Drops To A Seven-Week Low

Rising Chinese inflation and the weak U.S. job report triggered a selloff in copper, which fell to the bottom of its recent range at 370.50, the lowest price for seven weeks. Higher Chinese inflation could reduce the government's ability to stimulate growth, thereby reducing demand from the world’s biggest consumer.

Rising Agriculture Prices Once Again Causing Concerns

Tight supplies of old crops, strong exports and a reduced South American crop have all helped lift the price of May Soybeans to their highest level since last September. Added to this we have seen unseasonal warm weather across the US, which has seen farmers turning towards early planting of corn with a record 7 percent already in the ground at this early stage.

This drive towards corn may turn out to be at the expense of soybeans and it carries the risk of keeping prices elevated over the summer. Speculative traders believe so and they have been building a record net long position during the last couple of months.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Commodities Mainly Softer After Last Week's US Jobs Report: April 11, 2012

Published 04/11/2012, 03:17 AM

Updated 03/19/2019, 04:00 AM

Commodities Mainly Softer After Last Week's US Jobs Report: April 11, 2012

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.