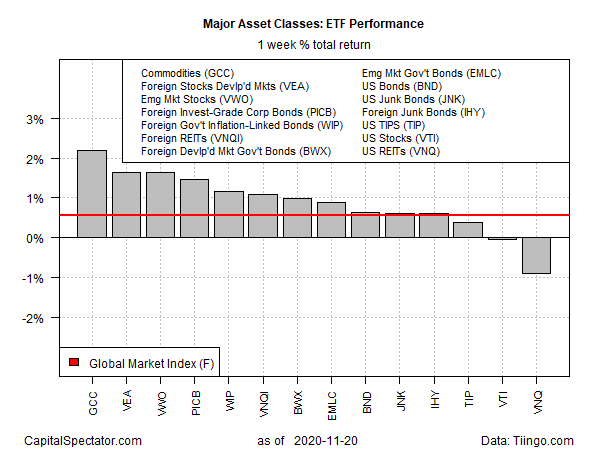

Broadly defined commodities rose for a third straight week for trading through Friday’s close (Nov. 20), posting the best gain for the major asset classes, based on a set of exchange traded funds.

WisdomTree Continuous Commodity Index Fund (NYSE:GCC), which tracks a broadly defined, equal-weighted measure of commodities, increased 2.2%. The gain left the fund at its highest close since January.

Most of the broad cuts of the major asset classes participated in last week’s runup, with two notable exceptions: a wide-ranging measure of US equities and US-listed real estate investment trusts (REITs).

Vanguard Total Stock Market (NYSE:VTI) was fractionally lower last week, effectively hanging on to the gain from a strong rally earlier in the month. US REITs, by contrast, posted a sharper loss. Vanguard Real Estate (NYSE:VNQ) tumbled 0.9%, leaving the fund at the upper end of a trading range that’s prevailed since the summer.

The Global Markets Index (GMI.F) continued to rise last week. This unmanaged benchmark, which holds all the major asset classes (except cash) in market-value weights via ETFs, increased 0.6%, marking its third straight weekly gain.

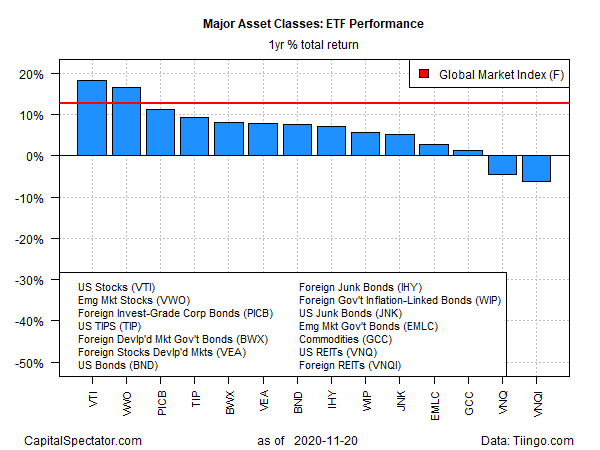

For the one-year trend, US stocks are still in the lead for the major asset classes, although the edge is dwindling as equities in emerging markets continue to rally.

VTI is up 18.1% on a total return basis for the trailing one-year window. A close second-place performance: Vanguard FTSE Emerging Markets Index (NYSE:VWO), which is up 16.6% from the year-ago level.

Foreign real estate continues to post the worst performance for the major asset classes for one-year results. Vanguard Global ex-U.S. Real Estate (NASDAQ:VNQI) has lost 6.6% over the past 12 months.

GMI.F continues to post a strong one-year gain, rising 12.8% through Friday’s close.

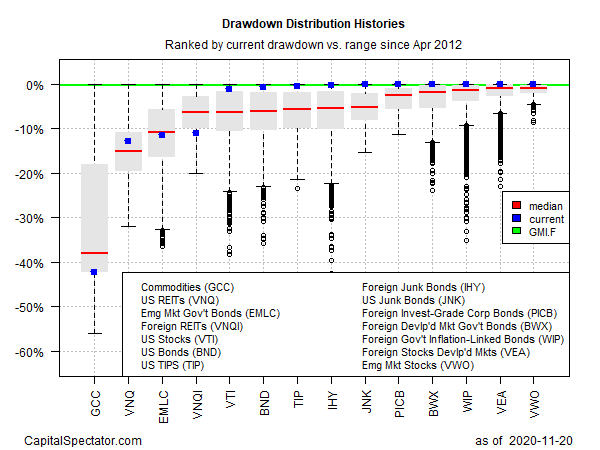

Ranking global markets by current drawdown still shows that broadly defined commodities (GCC) are posting the deepest peak-to-trough decline: in excess of -40%.

Meanwhile, several buckets of the global markets are posting virtually nil drawdowns, led by equities in emerging markets: VWO ended last week at a record close.

GMI.F’s current drawdown is a slight -0.4%.