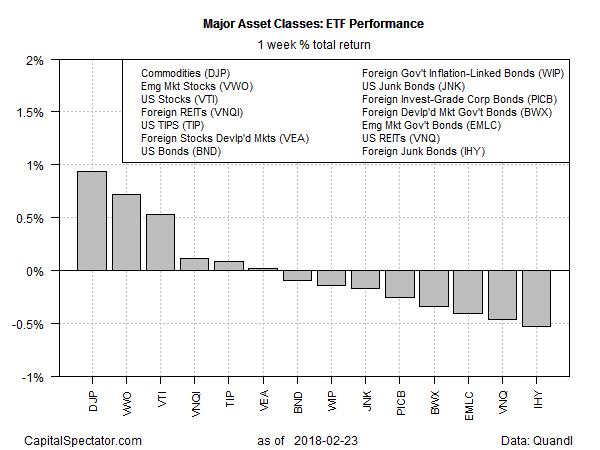

Commodities posted the strongest performance last week among all the major asset classes, based on a set of exchange-traded products. The gain follows renewed expectations that inflationary momentum may be firming up in the US and around the world.

iPath Bloomberg Commodity DJP gained 0.9% in the shortened trading week in the US through Feb. 23. The gain marks the second weekly advance, although for the year so far DJP is up a modest 1.3%.

Foreign high-yield bonds posted the biggest setback last week. VanEck Vectors International High Yield Bond IHY slumped 0.5% over the four trading days through Friday. The ETF has stumbled in three of the past four weeks.

A firmer inflation outlook is a factor weighing on high-yield bonds. Although official inflation statistics continue to print at moderate levels, a review of Google searches linked to inflation indicates a “surge of interest” in the topic, notes Callum Thomas at TopDown Charts.

Meanwhile, Bloomberg reports that

Federal Reserve Chairman Jerome Powell and his colleagues may be willing to accept inflation rising as high as 2.5 percent as they seek to extend the almost nine-year economic expansion.

I’ve had some hawks on the committee surprise me and say they wouldn’t be worried about a modest overshoot” as long as it’s below 2.5 percent, former Fed governor Laurence Meyer said, without identifying who those anti-inflation stalwarts were. Inflation currently is 1.7 percent.

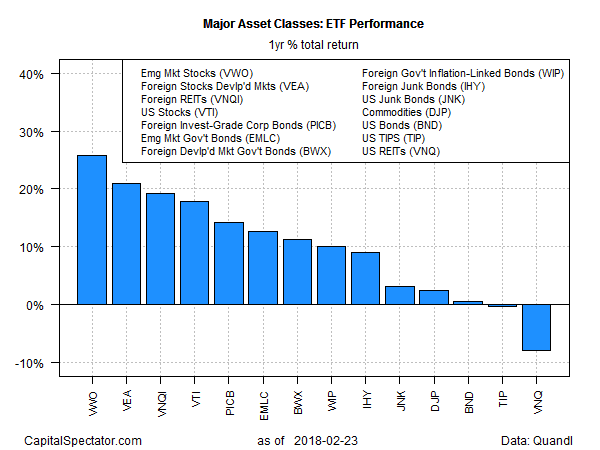

For the one-year trend, emerging-markets stocks still hold the lead for the major asset classes. Vanguard FTSE Emerging Markets VWO posted a 25.9% total return for the trailing 12-month period at the close of trading last week. The ETF has regained roughly half the loss from the sharp selloff that roiled stock markets around the world earlier this month.

Meanwhile, real estate investment trusts (REITs) in the US continue to suffer the biggest one-year loss for the major asset classes. Although Vanguard Real Estate ETF VNQ has increased in each of the past two weeks, the ETF is still nursing a negative 8.0% decline for the year through Feb. 23.

Josh Brown, CEO of Ritholtz Wealth Management, notes that if the recent rise in the 10-year Treasury yield has run its course for the near term, REITs and other yield-sensitive securities could rally.

Lots of people have become emotionally invested in the idea that the bond bear market has begun, and that as the economy picks up steam yields will continue to rise as bonds get sold. Could be. Or – and hear me out – maybe the rapid rise of the last few months has priced in more hopes and dreams than reality. We’ve certainly seen that before.