This article was written exclusively for Investing.com

- Natural gas fell to a quarter-of-a-century low last June

- A value investor invested $10 billion in the energy commodity at the low

- US energy policy supports higher lows over the coming months and years

- Inventories are below last year and the five-year average with production likely to slip

- Buying dips in the volatile natural gas market with futures or the BOIL ETN product

Natural gas is now at the start of the injection season when demand declines and inventories rise. The winter months tend to be the energy commodity’s peak season for demand.

The dynamics of the US natural gas market changed dramatically over the past years. Massive discoveries in the Marcellus and Utica shales regions increased reserves by quadrillions of cubic feet. Technological advances in fracking and favorable drill-baby-drill and frack-baby-frack policies under the Trump administration increased the supply side of natural gas’s fundamental equation. Since necessity is the mother of invention, natural gas replaced coal in power generation. Moreover, the liquification of gas made it possible to supply US gas to areas of the world where the price is higher. Natural gas now travels by pipeline domestically and ocean vessels in liquid form. The fundamental equation’s demand-side increased along with the supply side.

Meanwhile, US energy policy is now addressing climate change, and fossil fuels will see increased production and consumption regulations. The shift could mean that higher lows are on the horizon for natural gas prices. The ProShares Ultra Bloomberg Natural Gas (NYSE:BOIL) moves higher and lower with the energy commodity’s price.

Natural gas fell to a quarter-of-a-century low last June

In late June 2020, nearby NYMEX natural gas futures fell to a low of $1.432 per MMBtu. The last time the energy commodity reached that level was in 1995. The two and one-half decade low gave way to higher lows since last June.

Source: CQG

The weekly chart shows the series of higher lows in the nearby natural gas futures market. After falling to $1.432 last June, natural gas reached lows of $1.605 in July, $1.795 in late September, $2.238 in late December, and $2.422 per MMBtu in mid-March 2021 as the peak demand season was ending. Nearby May futures were at the $2.68 level at the end of last week.

Last June, just as natural gas reached its twenty-five-year low, a value investor gave the energy commodity a boost of confidence for the future.

A value investor invested $10 billion in the energy commodity at the low

In early July 2020, Warren Buffett announced that Berkshire Hathaway (NYSE:BRKa) acquired Dominion Energy's (NYSE:D) natural gas transmission and storage assets for $10 billion. Berkshire paid $4 billion in cash and assumed $6 billion in debt. The purchase expanded Berkshire’s control of US interstate natural gas transmission from 8% to 18%.

Warren Buffett invested $10 billion in natural gas’s future, and so far, the bet looks like a winner. The investment came before the November 2020 Presidential election. President Biden’s victory is likely to increase the base price for the energy commodity, enhancing the value of the transmission, pipeline, and storage assets.

US energy policy supports higher lows over the coming months and years

On the campaign trail, President Biden pledged to address climate change by encouraging alternative energy sources and inhibiting the production and consumption of fossil fuels. Natural gas, a hydrocarbon, faces increased regulations when it comes to fracking.

On his first day in office, on Jan. 20, 2021, President Biden canceled the Keystone XL pipeline project that carried petroleum from the oil sands in Alberta, Canada, to Steele City, Nebraska, and beyond to Cushing, Oklahoma, the NYMEX crude oil delivery point. Further regulations on extracting oil and gas from the earth’s crust via fracking are on the horizon.

Meanwhile, the demand for natural gas is rising. Gas replaced coal in power generation as natural gas is a cleaner fuel. US LNG now travels worldwide by ocean vessels to areas where the price is substantially higher. The Biden administration will address climate change by decreasing gas and oil production via regulations that curtail the drill-baby-drill and frack-baby-frack era under the Trump administration. As the demand for energy rises in the aftermath of the global pandemic, fewer supplies are likely to cause fossil fuel prices to make higher lows.

We can already see the impact of the shift in US energy policy in natural gas stockpiles as we head into the offseason for demand.

Inventories are below last year and the five-year average with production likely to slip

At the end of the 2019/2020 peak season for demand, when withdrawals from storage caused natural gas supplies to decline, the total amount of gas in storage reached a low of 1.986 trillion cubic feet.

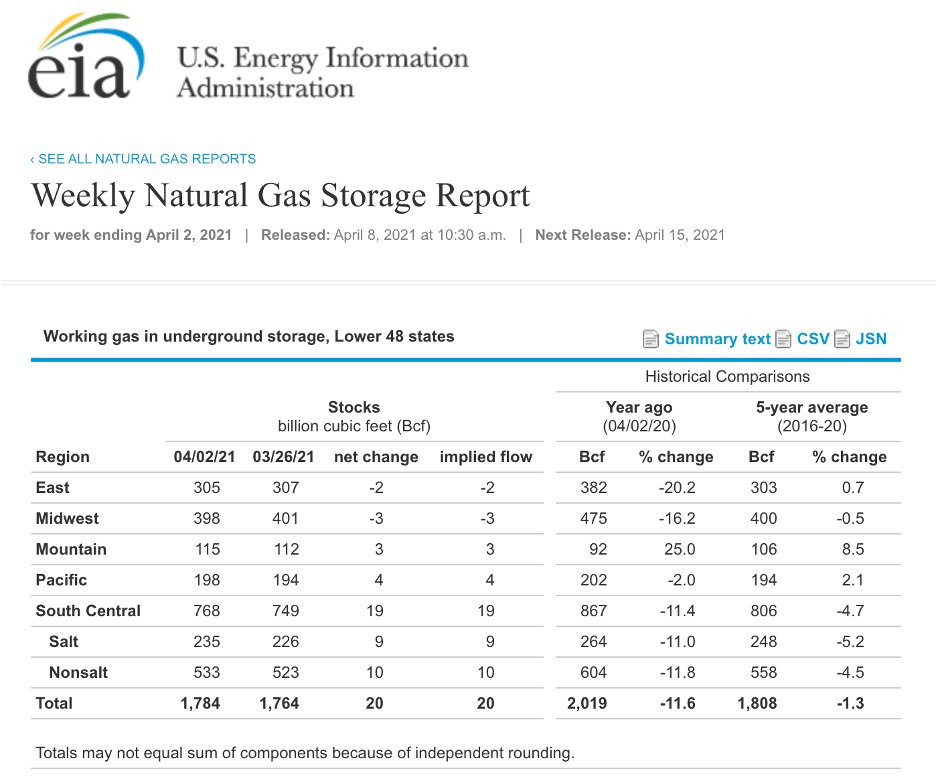

The withdrawal season ended in March, with natural gas supplies falling to 1.750 trillion cubic feet, 236 billion cubic feet or 11.9% below the previous year. In the latest report, inventories remain historically low compared to the past years.

Source: EIA

The chart shows that at 1.784 tcf for the week ending on Apr. 2, stockpiles were 11.6% below the previous year and 1.3% under the five-year average at the beginning of the offseason for demand in April. Increasing regulations on fracking and rising demand for LNG could keep natural gas supplies below the averages over the coming months. Less gas will flow into storage over the coming months, putting upward pressure on the energy commodity’s price. Last week, stocks rose by 61 bcf for the week ending Apr. 9. Stocks were 11.6% below the prior year, and edged 0.6% above the five-year average in the latest stockpiles report.

Buying dips in the volatile natural gas market with futures or the BOIL ETN product

The natural gas price is not likely to run away on the upside over the coming weeks and months as demand is now at a seasonal low. However, we could see a continuation of higher lows as the energy commodity’s fundamental equation will reflect the Biden Administration’s shift to address climate change.

The optimal approach to the natural gas market over the coming weeks and months could be to buy on price weakness and take profits on rallies. The most direct route for a risk position in natural gas is via the futures and futures options that trade on the CME’s NYMEX division.

For those looking to participate in the volatile natural gas market without venturing into the futures arena, the ProShares Ultra Bloomberg Natural Gas product (BOIL) provides an alternative. BOIL’s bearish counterpart is KOLD. BOIL and KOLD products provide some leverage, so they are only appropriate for short-term risk positions in the natural gas market.

BOIL has net assets of $67.927 million, trades an average of over 1.0 million shares each day, and charges a 0.95% management fee. The most recent rally in the May natural gas futures contract took the price from $2.453 on Apr. 6 to a high of $2.700 on Apr. 16, or 10.1%.

Source: Barchart

Over the same period, BOIL moved from $18.79 to $22.13 per share or 17.8% higher. BOIL and KOLD seek to deliver two times the price action in NYMEX natural gas futures on the up and downside. However, rolls from one active month to the next often interfere with the goals. Moreover, natural gas trades around the clock from Sunday evening through Friday evening in the US. The BOIL and KOLD products are only available for trading during US stock market hours of operation. The products will miss highs or lows that occur outside of US stock market hours.

The shift in US energy policy could cause higher lows in the natural gas futures arena over the coming weeks and months. Buying natural gas on dips via the futures market or the BOIL product could be the optimal approach to the market throughout 2021 and beyond.