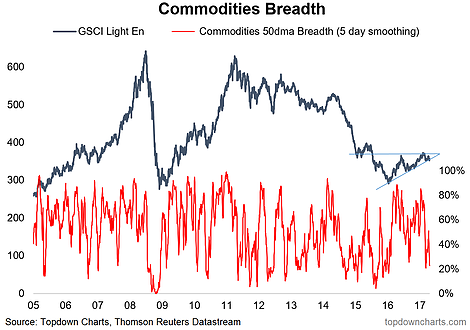

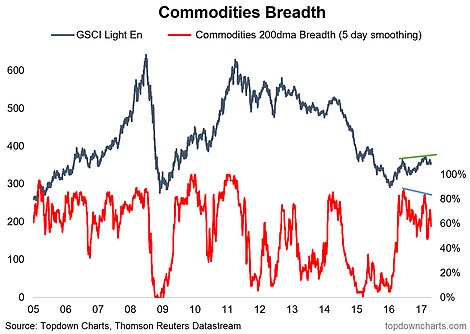

Commodity market breadth measures show a market that looks vulnerable. The below charts apply market breadth measures to the GSCI (Light Energy) Commodities Index by examining what proportion of its components are above their respective 50-day and 200-day moving averages. The first thing to note is what is referred to as "bearish divergence" with the index making higher highs but the 200-day moving average breadth indicator making lower highs. This type of pattern often occurs at significant market turning points. The second point is that 50-day moving average breadth has deteriorated notably.

The global macro backdrop for commodities has improved significantly since the bottom back at the start of 2016, with the rebound in China and emerging markets a fundamental driving force in the recovery. At the same time some of the appreciation pressures for the US dollar have waned. So it is possible that these indicators below may be calling time on these positive macro-dynamics. It also reflects a more mixed and idiosyncratic outlook for individual commodities e.g. in the latest edition of the Weekly Macro Themes report we outlined the case for a bearish medium term view on gold, and short-term upside risk in grains.

Bearish breadth divergence for commodities: not necessarily a show-stopper but it is a warning sign.

Commodity breadth on the 50-day moving average time frame has deteriorated to soft levels.