Global growth still supportive for commodities in 2012

During the autumn we have seen a pronounced change in financial sentiment. The combination of the serious escalation of the European debt crisis that it likely to have pushed the eurozone into recession, the fear of a more severe global slowdown and a stronger dollar have dented optimism. This environment has pushed risky assets including most commodities significantly lower. However, the sell-off in energy, in particular, has in fact been modest compared with equities and base metals, which have suffered badly.

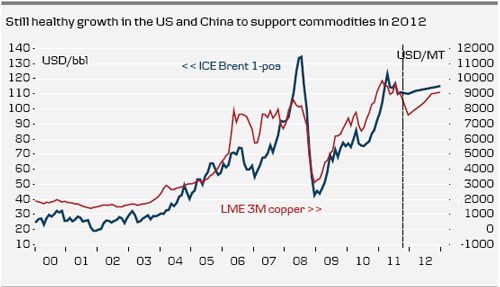

The cyclical outlook is still a clear headwind for commodities going forward but, in our view, a far too negative scenario regarding the global growth outlook is now expected in financial and commodity markets in general. Furthermore, we continue to see new supportive factors for commodities in 2012. We still expect the market balance to tighten in areas such as copper, oil, corn and soy beans in 2012. The Fed is still expected to continue with its aggressive monetary policy and a further easing is a clear possibility going forward. Hence, we expect the current dollar strength, which we expect to push EUR/USD to 1.30 over the next three months and temporarily weigh on dollar-denominated commodities, to reverse during the course of 2012. Our FX analysts look for EUR/USD at 1.40 on a 12-month horizon. However, as we elaborate below, the most important issue for commodities, in our opinion, is whether the global economy that is the US and Emerging Markets (read commodity intensive China) can decouple from the expected recession in the eurozone. We adhere to the view that both the US and China will recover in 2012.

Overall we have revised our price forecasts lower for Q4 11 and 2012 in general. However, the price revisions, particularly for H2 11, are relatively modest given the recent financial turmoil. We still expect oil prices (Brent) to average USD110/bl in 2011 and USD112/bl (previously USD114/bl) in 2012. We no longer expect copper to reach USD10,000 a metric tonne in 2012 and the average forecast has been lowered to USD8,625 (was USD9,313) a metric tonne. We expect aluminium prices to average USD2,275 (previously USD2,525) a metric tonne in 2012.

Our economists still expect a recovery in activity data later this year and in 2012 and forecast that the global and US economy will avoid a recession. However, this is not the same as saying that the market will not continue to price a risk of global recession. Hence, we should brace ourselves for a few more months or quarters of high volatility in commodity markets, as the jury is still out regarding the global outlook.

Global growth outlook: eurozone in recession, US and China to recover

While market focus is on the weakness in the euro area, our macroeconomists believe that the global economy is increasingly decoupling. They believe that the euro area cannot escape a recession in Q4 and that it will be followed by another, albeit small, decline in activity in Q1.

However, this is in sharp contrast to the US and China, where we expect growth to improve. The US has already seen its growth rate rise to 2.5% in Q3 and indicators support a further increase to 2.8% in Q4. In China, we are starting to see the first indications of a possible upturn in growth following the weak first three quarters and our economists expect a decent growth increase in Q4 and Q1, as they expect inflation to fall sharply.

The diverging growth pattern is likely to stem from a different pace in inventory adjustment as well as stronger drags in the euro area due to the euro crisis. The euro area performed much better in H1 than the US (relative to their different trend growth rates). The average growth rate in the euro area was 1.9% in H1, whereas the US grew by 0.8% on average (q/q annualised). The US has adapted more quickly to the changing environment, being dragged down quickly by the headwinds from higher oil prices and the earthquake in Japan. The euro area has lagged in response though, partly because the euro area is much more driven by exports and companies are responding later to the decline in global growth. This means inventory building has supported euro area activity. However, on the other hand, this is now working as a drag, pulling activity down in coming quarters.

Hence, although there is a lot of focus on the weak situation in the euro area, the global growth picture is actually improving for the coming quarters. This is because the stronger performance in the US and China is more than compensating for the decline in euro area GDP. We expect the improvement in the US and China to further underpin risk appetite in coming quarters. A sharp fall in Chinese inflation would also be likely to contribute to more positive sentiment for commodities. In our view, both “consensus” and the commodity market price in a much more downbeat outlook for the global economy.

However, as our macroeconomists also point out, the risks to the global economy are still significant, with the main risk coming from a sharp worsening of the euro crisis. We expect the euro area to continue to feel sharp pressure from markets and we expect fire fighting to continue for a long time, as the euro area stays close to the brink of large-scale turmoil. However, our main scenario is that the euro area is not allowed to fall over the cliff but that the EU – and ultimately the ECB if necessary – will do what is necessary to keep the euro together.

Overall, our global macro view would underpin commodities in 2012 and help support commodities at the current crucial stage for the global economy. Our macro view is the main reason why we have not lowered our forecasts any more despite the current turmoil. However, it also implies that if a global recession unfolds, commodity prices are, in our view, vulnerable to further sell-offs. In particular, the business cycle sensitive base metals, which we do not believe will be supported by a supply adjustment like that in oil (Opec supply cut), could be exposed.

Oil: global growth continues to support demand

We would not be surprised to see Brent crude trade in the USD105-115 per barrel range for quite a while. Despite the global financial jitters, oil prices have been well supported over the last couple of months.

The removal of Colonel Gadaffi in October has put a lot of focus on the restoration of Libyan oil production. The first numbers show an impressive development. Crude oil supplies rose from a very modest 75 kb/d in September to 350 kb/d in October and the first estimates for November point to 500 kb/d. The International Energy Agency now expects year-end Libyan production of 700 kb/d. Libya had a pre-war capacity of 1.6 mb/d.

The surprisingly fast production recovery in Libya should alleviate the current fears that the upcoming heating season will result in a significant draw in global oil stocks. The important question now is how Saudi Arabia will react to the return of Libyan oil. The latest data do not indicate that the Saudis have lowered production after it was ramped up significantly during the summer. However, we continue to assume that both the Saudis and the Kuwaitis will lower production in 2012 as a response to the higher Libyan production.

However, the removal of Colonel Gadaffi has not removed geopolitics from the oil agenda. Iran is once again attracting a lot of attention after the International Atomic Energy Agency warned that Iran’s government has the necessary expertise and materials needed to build a nuclear weapon. The report has fuelled speculation about the possibility that attacks on Iranian facilities by, for example, Israel could be in the pipeline.

The forthcoming Opec meeting on 14 December is expected to be much less dramatic than the June meeting, which saw a significant split among the member countries. However, we expect the notorious hawks Iran and Venezuela to call for lower production in the midst of the current fears of a global slowdown.

Overall, we see USD105-115/bl as fundamentally justified and expect an oil price in this range for the next six months. However, in the second part of 2012 we expect to see a renewed tightening of the market balance and expect prices to close the year at USD120/bl.

Oil: global growth continues to support demand

We would not be surprised to see Brent crude trade in the USD105-115 per barrel range for quite a while. Despite the global financial jitters, oil prices have been well supported over the last couple of months.

The removal of Colonel Gadaffi in October has put a lot of focus on the restoration of Libyan oil production. The first numbers show an impressive development. Crude oil supplies rose from a very modest 75 kb/d in September to 350 kb/d in October and the first estimates for November point to 500 kb/d. The International Energy Agency now expects year-end Libyan production of 700 kb/d. Libya had a pre-war capacity of 1.6 mb/d.

The surprisingly fast production recovery in Libya should alleviate the current fears that the upcoming heating season will result in a significant draw in global oil stocks. The important question now is how Saudi Arabia will react to the return of Libyan oil. The latest data do not indicate that the Saudis have lowered production after it was ramped up significantly during the summer. However, we continue to assume that both the Saudis and the Kuwaitis will lower production in 2012 as a response to the higher Libyan production.

However, the removal of Colonel Gadaffi has not removed geopolitics from the oil agenda. Iran is once again attracting a lot of attention after the International Atomic Energy Agency warned that Iran’s government has the necessary expertise and materials needed to build a nuclear weapon. The report has fuelled speculation about the possibility that attacks on Iranian facilities by, for example, Israel could be in the pipeline.

The forthcoming Opec meeting on 14 December is expected to be much less dramatic than the June meeting, which saw a significant split among the member countries. However, we expect the notorious hawks Iran and Venezuela to call for lower production in the midst of the current fears of a global slowdown.

Overall, we see USD105-115/bl as fundamentally justified and expect an oil price in this range for the next six months. However, in the second part of 2012 we expect to see a renewed tightening of the market balance and expect prices to close the year at USD120/bl.

However, risks are still primarily on the downside in the short term: demand growth may turn out weaker than we currently project and/or Saudi Arabia could refrain from lowering supplies as we believe it will in Q1 12. Furthermore, the weekly CFTC data indicate that the market has speculative long positions in oil. If these positions are unwound it could temporarily push oil lower.

On the other hand, it should be noted that the market is, in our opinion, pricing in a much more downbeat outlook for the global economy that we do. Hence, if our global growth outlook turns out as we expect, it could spur another round of price surges in oil.

Our oil projection is somewhat above that of the forward curve, which is currently in backwardation. As a result, we advise clients with unhedged 2012 oil expenses to use the current setback to position for higher prices next year. In particular, we advise clients to be aware that the current high negative correlation between EUR/USD and oil prices could break down in 2012. It would remove the often-quoted implicit currency hedge for European oil consumers. Basically, we see a risk that the European debt crisis could push EUR/USD significantly lower, whereas oil prices continue to surge on a global demand recovery in the US and Asia.

We have revised our short-term oil profile down slightly since the latest issue of Commodities Quarterly and we now see Brent averaging USD112/bl in 2012 (previously USD114/bl).

Finally, we have revised up our WTI forecast, as we now forecast a lower spread to Brent going forward. The WTI–Brent spread has narrowed significantly during November. The move had little to do with changes in global supply and demand balances or geopolitics. Instead, it reflects new plans to reconnect landlocked Cushing, Oklahoma, to the Gulf of Mexico. Elevated stocks in Cushing, the delivery point for WTI, have pushed this blend significantly lower compared with similar oil types. The new pipeline should help drain the significant stocks at Cushing and push WTI prices higher compared with other US blends.

We continue to hold the view that Brent is the best proxy for global oil prices and that despite the latest development WTI is dislocated as a global oil price representative.

Base metals: Chinese re-stocking and US recovery supportive

While current metal prices in general imply poor to no recovery in 2012, risks remain on the downside, in our view. With 2008 price experiences – when copper prices plummeted an astounding 60% in the final quarter of the year and aluminium fell over 40% – fresh in the memory, the probability of a much larger and steeper correction in base metals in the event of a further escalation of the eurozone crisis will, in our view, undoubtedly rise. Having said this, however, our baseline macro scenario looks for China and the US to produce respectable growth in 2012.

In this light, while our base metals forecasts have been reduced for the near future (chiefly Q4 of this year and Q1 12) on the back of continued eurozone debt worries and worsening European 2012 growth outlook and we look for overall lower 2012 averages in comparison with our previous forecasts, we remain upbeat and continue to see prices edging cautiously higher during the remainder of 2012.

Further, we look for copper to outperform in relative terms its grey counterparty in the coming months. Year-to-date, both copper and aluminium are down notably, around 14% and 20%, respectively, which leaves scope for relative outperformance in favour of copper.

Copper prices are set to be supported by steady demand from China, globally the biggest user of the red metal. While for most of this year, Chinese users have been observed to be operating in a destocking mode, there are now signs that this may have come to an end and that the Chinese are again beginning to restock, also encouraged by lower prices. After a 21% m/m import growth of refined copper by China, up for four consecutive terms, the October import numbers showed 40.2% y/y growth in unwrought and semi-finished copper products, the first truly significant annual growth.

From a global perspective and according to CRU reports, global copper consumption has grown by about 1.3% y/y in Q3 from the same period last year and projected expectations for the final quarter are for stable sequential growth, which would imply about 3% y/y growth. Given that these numbers have significant growth slowdown embedded in them, we remain positive in terms of 2012 consumption levels.

In aluminium, the picture is a bit more complicated. While aluminium has suffered from the same bout of risk aversion fed by eurozone debt issues as copper, aluminium is less supported by the market balance dynamics than copper as for much of 2011 world production has tended to exceed world consumption. At the same time, while low LME prices are now eating into cost curves (CRU estimates in its latest report that 30% of smelters in October had costs above the LME prices, of which 75% were Chinese), fairly little price support can be expected from this development, as outside of China few producers are expected to switch into idle mode due to higher idling costs compared with production at above costs.

The most significant risk to our base metals forecasts lies in a prolonged and potentially escalating European debt crisis and the failure of American and Asian led growth to materialise. While the former could potentially cause very steep and rapid corrections in the short to medium term and can be expected to keep market volatility levels elevated, the latter risks a more structural and longer term downward revision for global base metals demand.

Grains: look out for crop progress

We have also revised our grains forecast somewhat lower for Q4 but left our 2012 forecast more or less unchanged. The outlook for wheat continues to look bearish. However, given we assume that 2012 grain planting will swing strongly towards corn and soybeans, we believe that wheat prices are about to bottom. We expect European milling wheat prices (EUR denominated) to be supported by a weaker euro over the next six months.

Despite higher plantings of corn and soybeans in 2012, we believe that the link to energy will keep corn in particular well supported.

For more on our grains outlook. see the September issue of Commodities Quarterly, where we elaborate on our grain forecasts in detail.