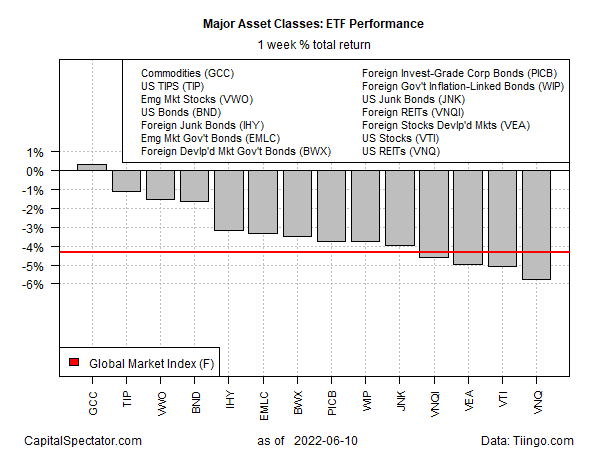

Broadly defined commodities posted another gain for the trading week through Friday, June 10 while the remaining slices of the major asset classes fell, based on a set of ETF proxies.

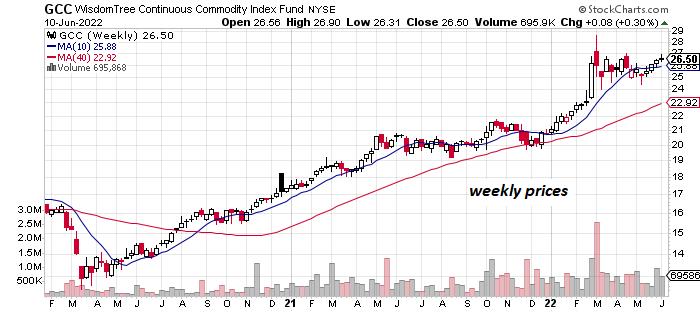

WisdomTree Continuous Commodity Index Fund (NYSE:GCC) ticked up 0.3%, posting its fourth-straight weekly advance. As an asset class, raw materials have been a rare source of strength for portfolios this year and the upside bias remained in force last week in relative and absolute terms.

“The combination of the war and the supply and demand imbalances that were already in place before the war began, especially in energy, will really push up ag, base metals, precious metals and energy together,” predicts Paul Christopher, head of global market strategy at the Wells Fargo Investment Institute.

“We favor strongly a broad-based commodity basket there going into the end of the year.”

Otherwise, it was a losing week for the major asset classes. The biggest setback was logged in US real estate investment trusts (REITs) via Vanguard Real Estate Index Fund ETF Shares (NYSE:VNQ), which tumbled 5.8% and closed at the lowest level in over a year.

The Global Market Index (GMI.F) fell for a second week, dropping a hefty 4.4%. This unmanaged benchmark, maintained by CapitalSpectator.com, holds all the major asset classes (except cash) in market-value weights via ETFs and represents a useful benchmark for portfolio strategies overall.

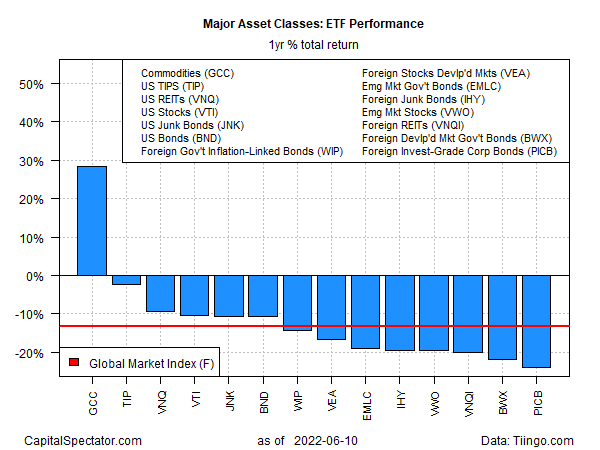

In a sign of the times, commodities are now the only winner on a trailing one-year basis for the major asset classes. GCC surged nearly 30% through Friday’s close compared with its close from a year earlier.

Otherwise, all the major asset classes are posting losses for one-year results. The biggest one-year loss: foreign corporate bonds via Invesco International Corporate Bond ETF (NYSE:PICB), which is down more than 20%.

GMI.F’s one-year loss: -13.2%.

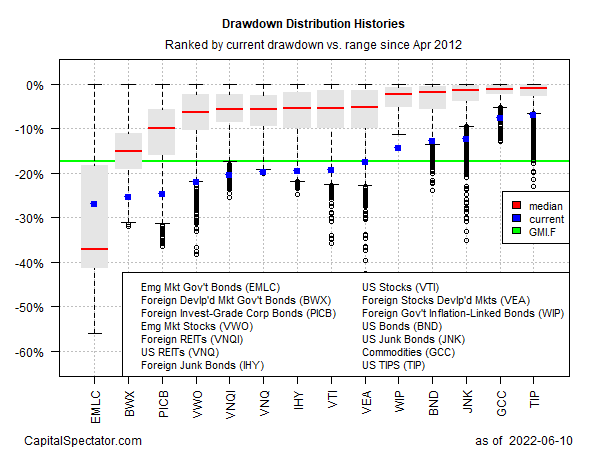

Profiling the ETF proxies noted above through a drawdown lens highlights that commodities (GCC) and inflation-protected Treasuries via iShares TIPS Bond ETF (NYSE:TIP) are the upside outliers at the moment. Each ETF is currently posting a peak-to-trough decline of nearly -8%, a relatively mild drawdown vs. the rest of the field.

The biggest drawdown for the major asset classes: emerging-markets government bonds via VanEck J.P. Morgan EM Local Currency Bond ETF (NYSE:EMLC), which closed on Friday at more than 27% below its previous peak.

GMI.F’s current drawdown: -17.4%.