A broad measure of commodities continued rising last week, delivering the strongest performance by far for the major asset classes, based on a set of ETFs for trading through Friday’s close (Feb. 11).

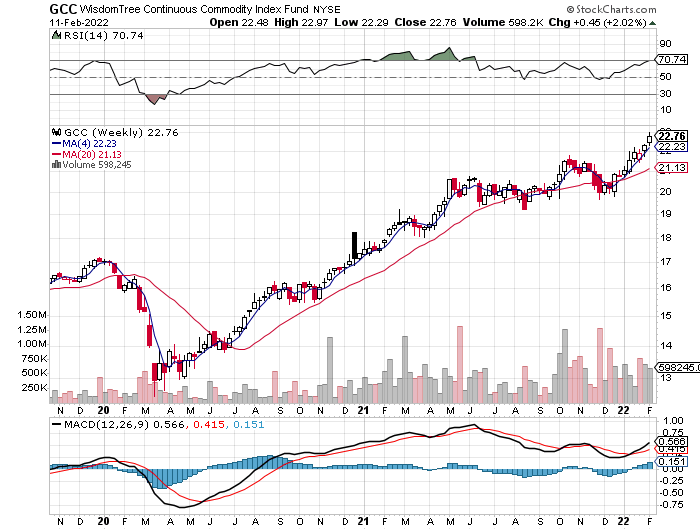

WisdomTree Continuous Commodity Index Fund (NYSE:GCC) rose 2.0% last week, extending a rally that began more than two months ago. The ETF is up 15% from its previous low on Dec. 1.

The fundamentals of supply and demand are providing the bullish backdrop for commodities. Nicholas Snowdon, analyst at Goldman Sachs) said:

“This is the most extreme inventory environment. It’s a completely unprecedented episode. There is no supply response.”

In the energy space, the threat of a Russian invasion of Ukraine is the critical factor at the moment. Amid a backdrop of rising demand that’s outpaced supply, adding the potential for disruption in Russian supply is pushing the price of crude closer to $100 a barrel. As The Wall Street Journal observes today:

“Russia is the world’s third-largest oil producer, and if a conflict in Ukraine leads to a substantial decrease in the flow of Russian barrels to market, it would be perilous for the tight balance between supply and demand.”

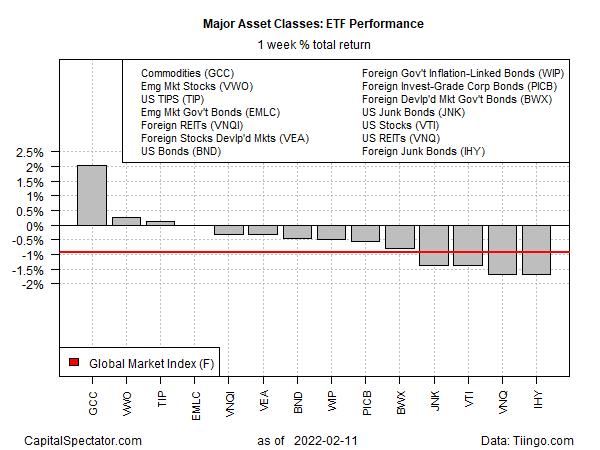

Most of the major asset classes fell last week. Only stocks the Emerging Markets Index Fund (NYSE:VWO) and inflation-indexed Treasuries (TIPS) posted gains along with commodities. Otherwise, red ink dominated weekly results.

The biggest loss last week was essentially a tie between US real estate (NYSE:VNQ) and foreign high-yield bonds (NYSE:IHY), with each ETF sliding roughly 1.7%.

The downside bias for assets last week took a bite out of the Global Market Index (GMI.F). This unmanaged benchmark, which is maintained by CapitalSpectator.com and holds all the major asset classes (except cash) in market-value weights via ETF proxies, lost 0.9% last week. GMI.F has fallen in five of the past six weeks.

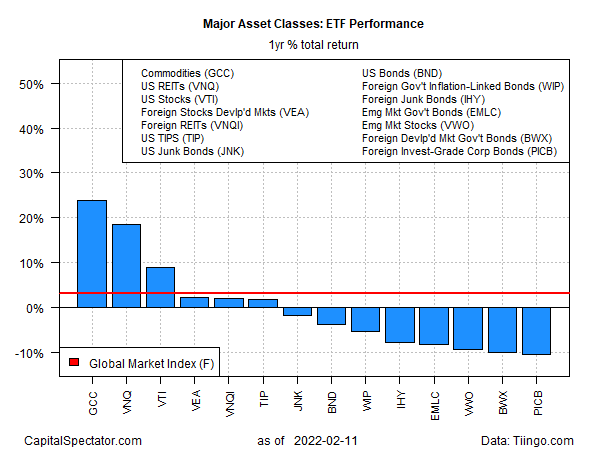

Commodities continue to post the strongest one-year performance for the major asset classes. GCC is up nearly 25% over the past 12 months as of Friday’s close. That’s well ahead of the second-best one-year performance: a gain of 18.6% for US REITs (VNQ).

The biggest one-year loss is currently in foreign corporates: Invesco International Corporate Bond (PICB) has shed nearly 11% over the trailing 12-month window.

GMI.F’s one-year change is a modest 3.1% gain.

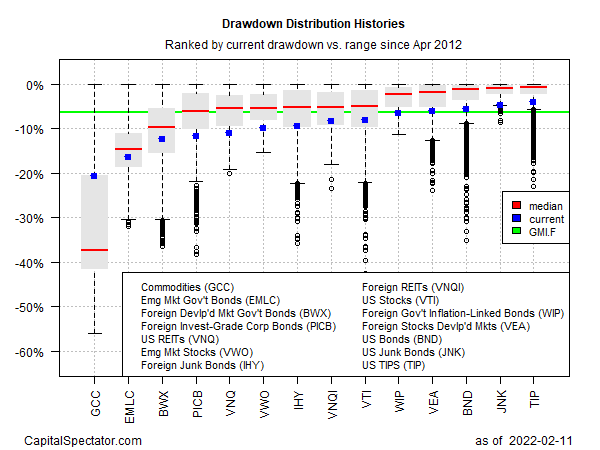

Reviewing markets in terms of drawdown reveals that the majority of the major asset classes are currently posting peak-to-trough declines that are below GMI.F’s drawdown, which is 6.5% at the moment.

The smallest drawdown at Friday’s close: inflation-indexed Treasuries via TIP, which has lost a relatively light 4.1% from its previous high.