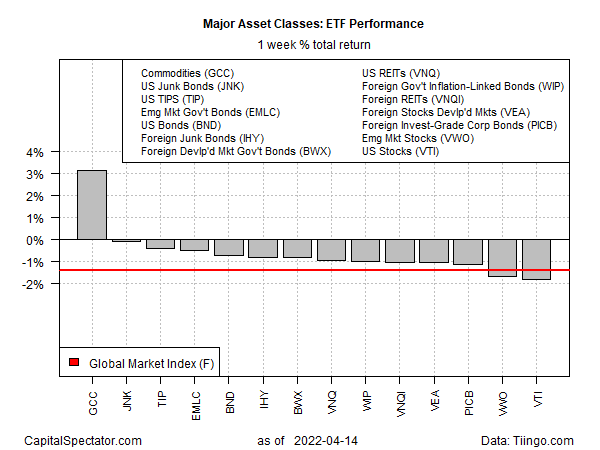

Broadly defined commodities posted the only gain for the major asset classes—again, based on set of proxy ETFs for last week’s shortened holiday trading schedule through Thursday, Apr. 14.

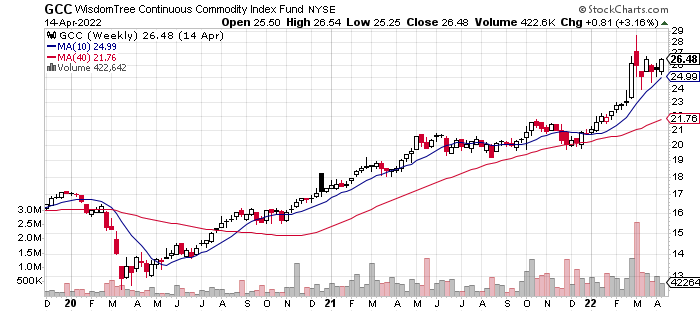

WisdomTree Continuous Commodity Index Fund (NYSE:GCC) rose for a second week, popping 3.2% and lifting the price close to a record high. Raw materials markets have been especially strong recently, but some analysts advise managing expectations down for the near term.

“We do see them [commodities] as stretched in the short term,” says Tom Essaye of Sevens Report Research.

But the tight supply-demand constraint isn’t easily solved in the foreseeable future, which convinces some analysts to remain bullish. “Inventories across energy, agricultural and metals are critically low everywhere,” notes Tracey Allen, commodities strategist at JPMorgan Chase. The investment bank expects commodities prices to remain elevated through 2022.

Last week was another washout for the major asset classes ex-commodities. The deepest setback: US stocks via Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI), which fell 1.8%.

The Global Market Index (GMI.F) continued to slide, losing 1.4% last week. This unmanaged benchmark, maintained by CapitalSpectator.com, holds all the major asset classes (except cash) in market-value weights via ETF proxies.

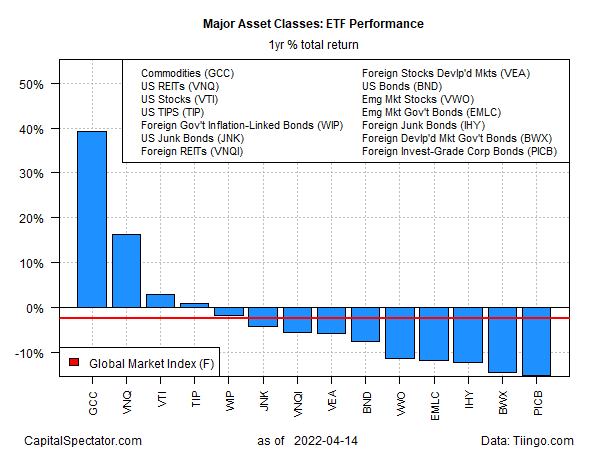

For the one-year window, commodities are still the upside outlier. GCC has surged 40% over the past 12 months, far ahead of the rest of the field. The second-strongest one-year performer for the major asset classes: US real estate investment trusts via Vanguard Real Estate Index Fund ETF Shares (NYSE:VNQ), which is up a relatively moderate 16.4%.

Most of the major asset classes are underwater for the trailing one-year period. The deepest decline: foreign corporate bonds via Invesco International Corporate Bond ETF (NYSE:PICB), which is down 15.4% vs. the year-ago level.

GMI.F is lower by 2.4% for the past year.

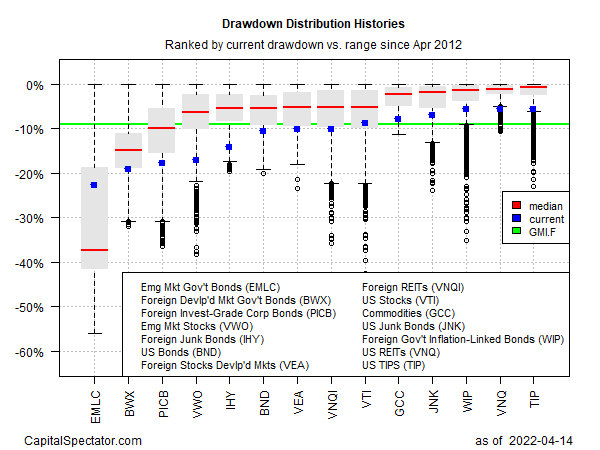

The majority of the major asset classes continue to post deeper drawdowns than GMI.F. The steepest peak-to-trough decline at last week’s close: government bonds issued in emerging markets via VanEck J.P. Morgan EM Local Currency Bond ETF (NYSE:EMLC), which closed more than 20% below its previous peak.

The smallest drawdown at the moment: inflation-indexed bonds issued by governments ex-US: SPDR® FTSE International Government Inflation-Protected Bond ETF's (NYSE:WIP) peak-to-trough decline is a relatively soft 5.6%.

GMI.F’s current drawdown: -9.1%.