I’ve been forecasting for the past few years that the stealth crisis for the next global debt and financial crisis would be the vicious cycle of commodity prices declining setting off falling stock markets and low economic growth in the more demographically-vibrant emerging world, slowing export growth for China and world trade and then lower commodity prices created by less demand from major manufacturing exporters like China.

Even though it’s a minor commodity and oil importer, in recent articles I’ve argued that the U.S. will see more harm than good from this bursting fracking bubble that will in turn pop the high-yield debt bubble of 2009 to 2014. That scenario will look a lot like the subprime mortgage bubble that brought on the last global financial crisis that began in 2008.

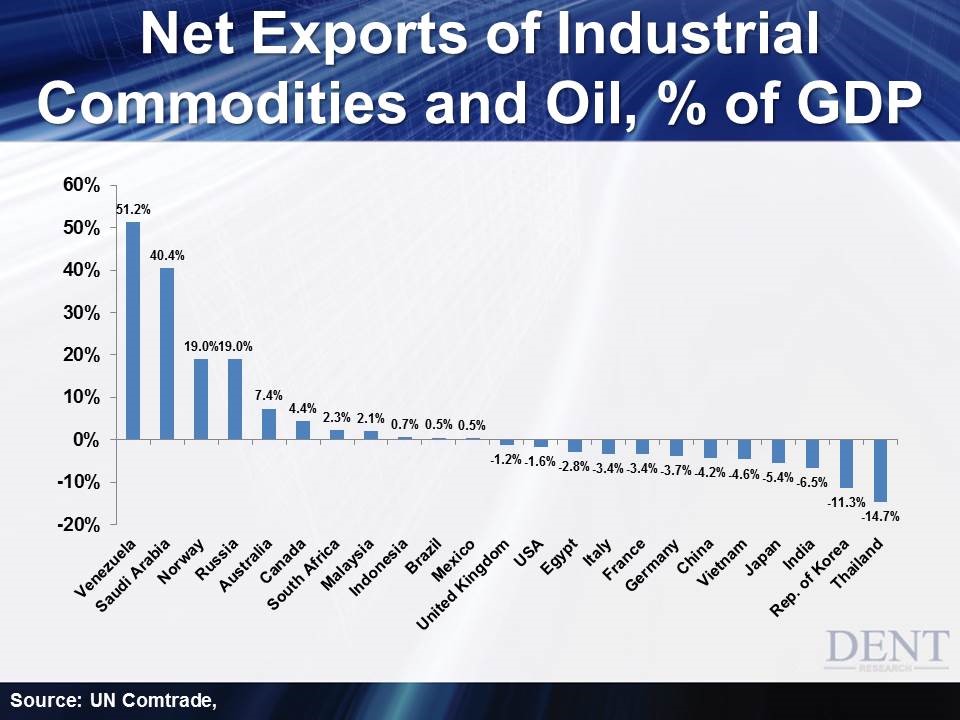

Outside of the unique fracking bubble occurring today in the U.S., the best way to look at who will benefit more or be hurt more by falling commodity and oil prices is to look at which major countries are net exporters or importers of such commodities.

For that purpose I take out the agricultural commodities that are less price-sensitive as food demand is the most primary and more subject to changing climate conditions that tend to restrict supply more than expand it.

Take a look at the net exports of industrial commodities plus oil/energy in major countries around the world.

Breakdown of the Numbers

The countries that are the biggest losers are Venezuela at 51.2% net exports and Saudi Arabia at 40.4%. In this case, this is largely from oil and that’s the very reason why it’s so extreme. That would also include Iran and Iraq, most other Middle East countries, most of Africa, much of Latin America and parts of Asia.

Norway’s super-high $100,000 per capita income (almost twice the U.S.) is also very vulnerable at 19.0% net exports (largely oil) and of course, Russia at 19.0% (oil and minerals). Russia and Iran are already suffering from heavy sanctions and now they get hit by collapsing oil prices… ouch!

No wonder the ruble has collapsed over 50% and Iran is finally negotiating with the U.S. to lift sanctions over their nuclear ambitions.

Australia is highly exposed to commodity exports at 7.9% and Canada at 4.4%. That being one of the reasons why Australia’s stock market is 25% off its 2007 highs while the U.S. and Germany attain new highs.

Canada’s stocks are 10% off of their highs.

Australia is the highest in industrial commodity net exports (ex-oil) at 5.7% of GDP, as is South Africa. Iron ore, its largest commodity export is down 65% in recent years, even more than oil.

Canada, Malaysia, Indonesia, Brazil and Mexico are slight losers, while the U.K., the U.S., and Egypt are slight winners.

Italy, France and Germany come next as moderate winners. Then it accelerates with China at 4.2% net importers, then Vietnam and then Japan at 5.4%.

But the biggest winners are countries we have been touting down the road in this long-term commodity decline: India at 6.5% net imports, South Korea at 11.3% and Thailand at 14.7%.

India has the strongest demographics of any major country ahead especially with their new progressive and pro-business leadership and they are also one of the few winners in the emerging world from falling commodity prices (as I covered in the November issue of Boom & Bust).

As commodity prices continue to fall into 2020 to 2023 or so, $5.7 trillion of U.S. dollar loans and bonds to emerging country corporations will begin to fail, especially as we have forecast that the U.S. dollar would rise and will continue to do so in the years to come.

Those loans will be doubly hard to pay back in U.S. dollars of higher value.

In addition to that, more emerging countries depending on high oil prices will see their budgets go to constantly rising deficits. Iran needs $140 oil prices to meet their government spending needs, Venezuela $121, Nigeria $119, Iraq $106, Saudi Arabia $93… good luck with that!

Emerging countries are already paying 1% more for high-grade corporate debt than those in the U.S. companies and will continue to rise even more ahead… hurting their profits and competitiveness.

High-yield debt is starting to spike beginning with a move from 5.4% to 10.3% for energy and fracking companies in the U.S. and 5% to 7% in general.

Can you see a global crisis coming from the very realm that has seen the highest growth since the 2008 crisis as we’ve been warning?

It’s just a matter of how long it’ll take for the crack-delusional stock market to figure out the obvious and that could still take a few months!

Oil just broke down again below the trading range between $54 and $58 and the stock markets are flat. This is death for the frackers. How blind, deaf and dumb can you be?