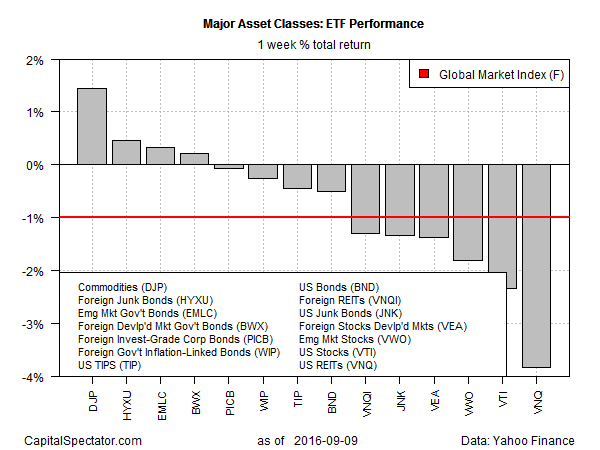

Friday’s sharp selloff left most markets in the red last week, although commodities and foreign bonds (in unhedged US dollar terms) bucked the downside bias and posted gains, based on a set of proxy ETFs for the major asset classes. A factor in the firmer pricing for offshore fixed income via ETFs: a slightly weaker dollar in last week’s trading.

The softer greenback also played a role in pushing commodity prices up last week. The US dollar and commodities tend to exhibit an inverse relationship. No wonder, then, that the broadly defined iPath Bloomberg Commodity (DJP) grabbed the top performance spot for last week’s abbreviated four-day US trading week. The ETN posted a 1.5% gain at the final tally on Friday, Sep. 9. Three flavors of foreign bonds also ticked higher last week.

The rest of the field was in the red. Last week’s biggest loser: US real estate investment trusts (REITs), which tumbled 3.8% for the four trading days through Sep. 9, based on Vanguard REIT (VNQ). Renewed worries about rate hikes weighed on real-estate stocks, which are prized for their relatively high yields. But this rate-sensitive corner took it on the chin as the crowd agonized about the possibility that the Federal Reserve is planning on raising interest rates.

US bonds were caught up in Friday’s slide. The Vanguard Total Bond Market ETF (BND), which has a broad mandate for holding US investment-grade fixed-income securities, ticked lower last week, dipping 0.5%.

The selling wave on Friday also took a toll on an ETF-based version of the Global Markets Index (GMI.F), an investable, unmanaged benchmark that holds all the major asset classes in market-value weights. GMI.F retreated 1.0% last week—the biggest weekly decline for the benchmark in nearly a year.

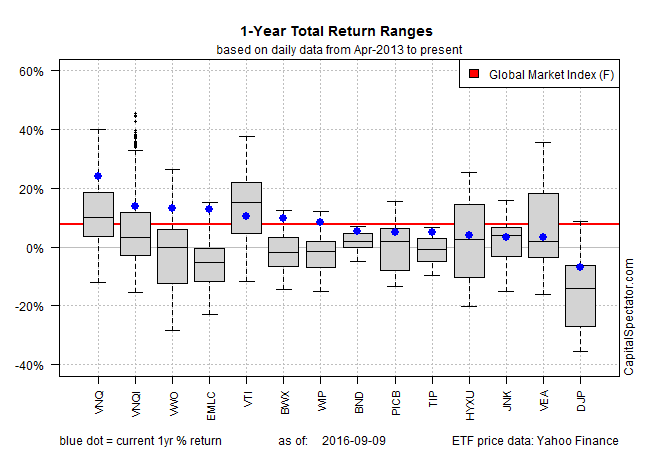

Although broadly defined commodities made a rare appearance in the weekly winner’s circle last week, there was no sign of renewal in the trailing one-year results. DJP remains dead last among the major asset classes for the past 12 months. As of Friday’s close, DJP was off nearly 6% over the last year.

Meantime, US REITs continue to hold the top spot for one-year results. Despite Friday’s setback, VNQ is still at the head of the pack, posting a 24.1% total return for the 12 months through Sep. 9.

GMI.F remains in the black for the trailing one-year period as well. As of Friday, GMI.F was up a respectable 7.7% in total-return terms.