The U.S. dollar quietly crept higher over the last 2 months as sinking stocks masked its move. The last 4 weeks have seen it start to settle into a consolidation, tightening against resistance with higher lows. What is next when this consolidation ends? Several signs point to a move higher.

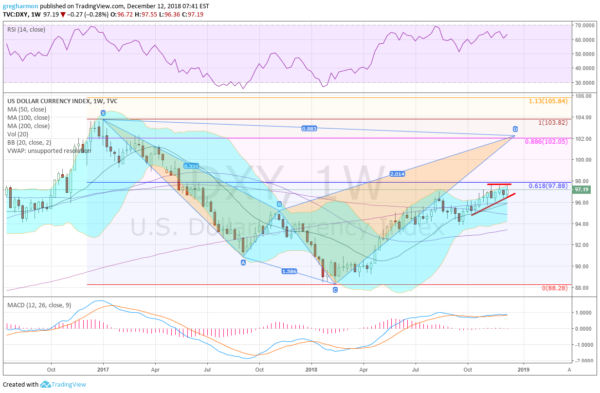

The US Dollar Index chart above shows the details. To the far right there is tightening consolidation. This is happening at the 61.8% retracement of the move lower from the beginning of 2017. The price action suggests that it will complete a bearish shark harmonic pattern.

That would mean a touch at either the 88.6% retracement at 102 or the 113% retracement at 105.84. Either would mean continued strength. And it has momentum on its side. The RSI is strong and holding in the bullish zone with the MACD flat but positive.

The Dollar Index can do whatever it wants, but a push above 98 would be a strong signal that 102 or maybe even 105.84 is in the cards. It would take a move under 96 to throw this thesis out.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.