Comcast Corp. (NASDAQ:CMCSA) is the largest cable MSO (multi service operator) in the U.S. and a leading media and entertainment company. Comcast provides basic video, digital video, high-speed broadband (Internet) and telephony services to individuals and business enterprises. In addition the company provides filmed entertainment, cable networks, broadcast TV services and operates theme parks.

Comcast's decision to venture into the U.S. wireless space bodes well with its diversified business model. The company acquired 73 licenses of 600 MHz low-band wireless spectrum in the Incentive Auction. It has completed the nationwide rollout of its wireless services under the Xfinity Mobile brand, along with plans to include YouTube in its X1 video platform.

On the other hand, we are concerned about Comcast’s operation in a saturated and competitive multi-channel U.S. video market. Like other cable operators, the company continues to lose subscribers to online video streaming service providers because of their cheap source of TV programming. In the second quarter of 2017, Comcast lost 34,000 video customers and 22,000 voice customers in the residential segment.

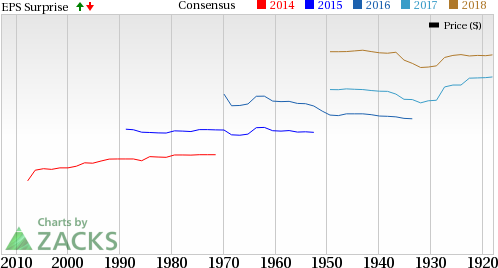

Zacks Rank: Comcast currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here. The company has generated a positive average earnings surprise of 7.77% in the previous four quarters.

We have highlighted some of the key stats from this just-revealed announcement below:

Earnings: Comcast Beats Q3 2017 earnings estimate. Our consensus earnings estimate called for an adjusted EPS (earnings per share) of 49 cents and the company reported adjusted EPS of 52 cents. Investors should note that these figures take out stock option expenses.

Revenue: Comcast reported total revenues of $20,983 million missing our estimate by nearly $140 million.

Key States to Note: In the reported quarter, high-speed broadband customer addition was 214,000. At the end of the third quarter, the company had 25.518 million high-speed Internet subscribers, up 4.9% year over year. However, Comcast lost 125,000 video customers. At the end of the reported quarter, the company had 22.390 million video subscribers, down 0.2% year over year. It also lost 94,000 voice customers. At third quarter end, the company had 11.565 million voice subscribers, down 0.7% year over year.

Stock Price: At the time of writing, the stock price of Comcast was down nearly 0.62% in the pre-market trade on Nasdaq. Clearly the initial reaction to the release is negative. The company lost significant numbers of video and voice customers. We believe this unimpressive performance is the primary reasons for this initial negative sentiment.

Check back later for our full write up on this Comcast earnings report later!

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Comcast Corporation (CMCSA): Free Stock Analysis Report

Original post

Zacks Investment Research