Comcast Corp. (NYSE:S) reported strong financial results in the second quarter of 2017 wherein both the top and the bottom line outpaced the Zacks Consensus Estimate.

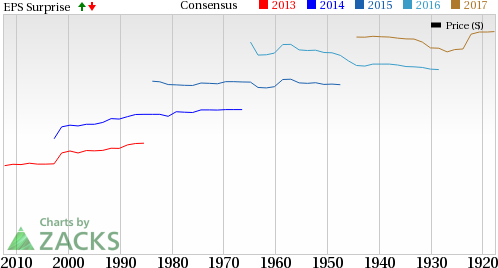

GAAP net income came in at $2,513 million or 52 cents per share compared with $2,028 million or 41 cents in the prior-year quarter. Quarterly earnings per share of 52 cents outpaced the Zacks Consensus Estimate of 48 cents.

Total revenue was $21,165 million, up 9.8% year over year and ahead of the Zacks Consensus Estimate of $20,816 million.

Operating income came in at $4,558 million, up 12.1% year over year. Operating margin rose to 21.5% compared with 21.1% in the year-ago quarter. Adjusted EBITDA was $7,099 million, up 10% year over year. During the second quarter, Comcast repurchased 35.2 million common shares for $1,400 million and paid dividends of $747 million.

In the second quarter of 2017, Comcast generated $5,158 million of cash from operations compared with $4,395 million in the year-ago quarter. Free cash flow, in the reported quarter was $2,219 million compared with $1,420 million in the prior-year quarter.

Cash and cash equivalents were $2,693 million, down from $3,301 million at the end of 2016. Total debt at second quarter end was $63,568 million compared with $61,046 million at the end of 2016. The debt-to-capitalization ratio at the end of the reported quarter was 0.51 compared with 0.50 at the end of 2016.

Cable Communications Segment

Quarterly total revenue of $13,122 million reflected a 3.9% rise year over year. Adjusted EBITDA was $5,320 million, advancing 5.4% year over year. Video revenues were $5,797 million, up 3.9% from the prior-year quarter. High-Speed Internet revenues totaled $3,679 million, up 9.2% year over year. Voice revenues were $856 million, declining 4.1% year over year. Advertising revenues totaled $574 million, down 2.1% from the year-ago quarter. Business Services revenues were $1,531 million, rising 12.6% year over year. Other revenues were $685 million, up 5% from the prior-year quarter.

As of Jun 30, 2017, Comcast had 25.306 million (up 5.5% year over year) high-speed internet customers, 11.659 million (up 0.2% year over year) voice customers, and 22.516 million (up 0.5% year over year) video customers. The company added a net of 175,000 high-speed internet customers but lost 34,000 video customers and 22,000 voice customers in the reported quarter. Comcast also gained 8,000 double-play subscribers and 70,000 single-play subscribers.

NBC Universal Segment

Quarterly total revenue of $8,331 million displayed a 17.3% year-over-year increase. Adjusted EBITDA was $2,071 million, exhibiting a rise of 22.6% year over year. Cable Networks revenues were $2,696 million, up 5.1% year over year. Broadcast TV revenues came in at $2,241 million, rising 5.3% year over year. Filmed Entertainment revenues were $2,155 million, up a whopping 59.6% from the year-ago quarter. Theme Parks revenues were $1,314 million, up 15.6% year over year.

Latest Developments

Comcast has launched wireless service under the “Xfinity Mobile” brand. However, stiff pricing competition in the industry is a genuine concern. As we have seen, the four major wireless telecommunications companies – Verizon Communications Inc. (NYSE:VZ) , AT&T Inc. (NYSE:T) , Sprint Corp. (NYSE:S) and T-Mobile US Inc. (NYSE:T) – have joined the unlimited postpaid data plan war in order to stand out in the crowd. In this scenario, the entry of non-wireless giants like Comcast will further intensify the competition.

Comcast currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential.

AT&T Inc. (T): Free Stock Analysis Report

Sprint Corporation (S): Free Stock Analysis Report

Verizon Communications Inc. (VZ): Free Stock Analysis Report

Comcast Corporation (CMCSA): Free Stock Analysis Report

T-Mobile US, Inc. (TMUS): Free Stock Analysis Report

Original post

Zacks Investment Research