New York City-based Colgate-Palmolive Co. (NYSE:CL) , a global consumer products manufacturer, looks promising, backed by its international brand recognition and innovative strategies, both underscoring its inherent strength.

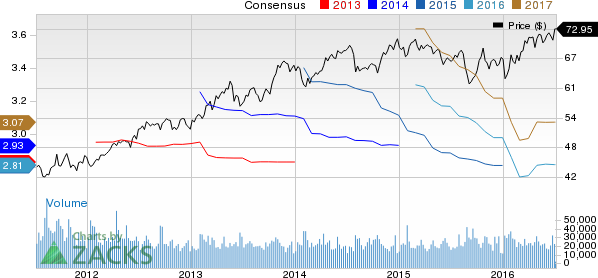

Driven by these factors, this Zacks Rank #3 (Hold) company hit a 52-week high of $73.42 on Jul 1, though it eventually closed lower at $72.95. Moreover, the stock witnessed a nearly 13% hike over the past six months.

COLGATE PALMOLI Price and Consensus

Colgate has been consistently gaining from its business strategy to improve its leadership positions in key product categories. These categories are further prioritized based on their capacity to utilize the company’s core competencies and strong global equities at optimal levels to achieve sustainable long-term growth. Also, Colgate commands a market-leading position in the oral care and personal care product categories.

The company is progressing well with its savings programs, as both, its Global Growth and Efficiency Program or 2012 Restructuring Program and its Funding the Growth undertakings are delivering impressive results. The company’s Global Growth and Efficiency Program of four years focuses on reducing structural costs, standardizing processes to enhance the decision-making procedure, and improve its market share position worldwide. These factors will also contribute significantly toward the improvement of gross and operating margins over the long term.

Going forward, this world leader of oral care products intends to take strategic steps to optimize its capital allocation, by making investments to develop business, while using the excess cash to enhance shareholder returns through dividend payouts and share buybacks.

Despite currency headwinds and macroeconomic woes, Colgate’s first-quarter 2016 earnings were in line with the Zacks Consensus Estimate. Its sales, however, topped our estimate, marking the company’s first sales beat in eleven quarters. Also, Colgate’s top-and bottom-line results improved year over year, on a currency-neutral basis. The company achieved a key milestone with adjusted gross margin reaching the 60% mark.

We believe that Colgate’s continued focus on product innovation, along with globally recognized brands and presence in both developed and emerging economies will enable it to capture growth opportunities and boost profitability.

Apart from Colgate, many other stocks hit 52-week highs on Friday, like Leggett & Platt, Incorporated (NYSE:LEG) , B&G Foods Inc. (NYSE:BGS) and The Clorox Company (NYSE:CL) , which hit highs of $51.40, $48.44 and $138.86, respectively, on Jul 1.

B&G FOODS CL-A (BGS): Free Stock Analysis Report

LEGGETT & PLATT (LEG): Free Stock Analysis Report

COLGATE PALMOLI (CL): Free Stock Analysis Report

CLOROX CO (CLX): Free Stock Analysis Report

Original post

Zacks Investment Research