Cohort (LON:CHRT) continues to make progress in a tough UK defence trading environment. Our earnings forecasts remain largely unchanged as performances at MASS and EID continue ahead of expectations, compensating for pressures at MCL and SEA. Our fair value calculation currently stands at 483p implying significant unrecognised potential. The recent share price fall seems unwarranted given the maintained outlook.

H118 results

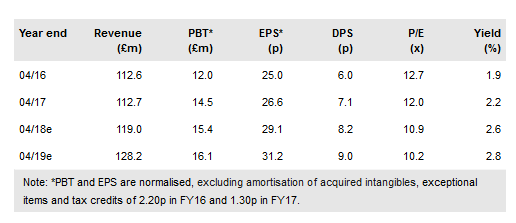

The H118 closing order book of £132.1m (H117: £129.6m) was slightly down from £136.5m at the start of the year. £55m of the current order book is scheduled for delivery in H218, demonstrating good order cover of 83% of FY18 consensus forecast revenue expectations. Reported revenues were £44.8m (H117: £50.0m) and reported adjusted operating profit was £3.6m (H117: £3.9m). Reported adjusted EPS was 6.31p (H117: 5.99p). The interim dividend of 2.55p (H117: 2.20p) is up 16%, in line with the group’s progressive dividend policy. Net cash of £5.7m reflected the outflow of the final £2.5m payment against the Marlborough Communications Ltd (MCL) minority purchase.

To read the entire report Please click on the pdf File Below: