Cohort’s (LON:CHRT) earnings performance in FY17 once again exceeded our expectations. Stronger performances from EID and MCL more than outweighed the sharp contraction at SCS, where a swift response from management has already improved profitability. The cash performance was also better than expected and the dividend increase to 7.1p was also ahead of our forecast. We expect further solid progress in the current year, and our fair value estimate currently stands at 471p.

Progress in a year of change

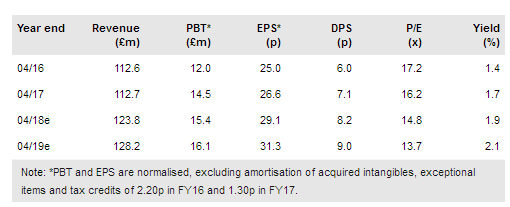

The strength of performance at MCL and the initial 10-month contribution from EID more than offset a sharper than we expected decline in activity at SCS, and lower than anticipated contributions from MASS and SEA. Proactive management action to reduce costs by integrating SCS into MASS and SEA in early November ensured that the ongoing activities returned a modest profit for the rest of FY17. Overall, Cohort delivered lower revenues than we expected, but an adjusted operating profit 1.4% ahead of our forecast. Adjusted EPS of 27.9p was 3% higher than FY16 (or 7% excluding the tax credits in each year) and 10.5% better than we forecast, due partly to the buy-in of the MCL minority, which should enhance FY18 EPS. Net cash at the year end was £8.5m (FY16: £19.8m) after spending £9.1m on EID and MCL net of cash acquired. The dividend rose 18% to 7.1p (FY16: 6.0p), 3.9x covered.

To read the entire report Please click on the pdf File Below: