On Aug 8, we issued an updated research report on Teaneck, NJ-based Cognizant Technology Solutions Corporation (NASDAQ:CTSH) , a leading provider of information technology, consulting and business process outsourcing services.

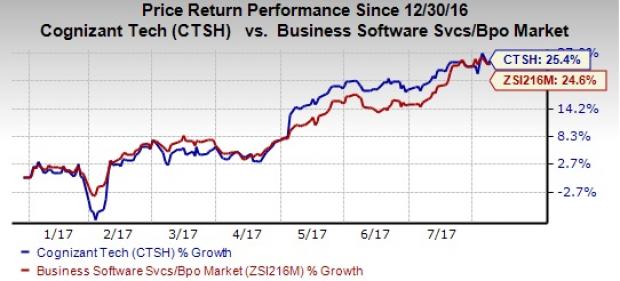

Cognizant’s shares have traded neck and neck with the industry on a year-to-date basis. This is primarily driven by solid earnings and top-line growth in the first half of 2017. Notably, the company has beaten the Zacks Consensus Estimates in three out of trailing four quarters, with an average positive surprise of 4.53%.

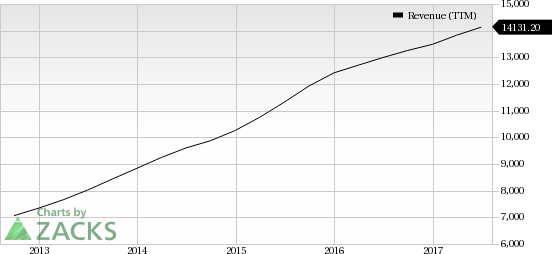

Cognizant reported impressive earnings growth in the second quarter of 2017 that can be attributed to strong top-line, which is benefiting from significant exposure to the fast-growing verticals like Financial Services and Healthcare.

Cognizant narrowed its top-line guidance for 2017, which reflects improved visibility. Moreover, the company raised its earnings guidance. We believe that the impressive results and the guidance indicate the company’s ability in harnessing the ongoing digital transition.

Cognizant shares are up 25.4% as compared with industry’s return of 24.6%.

Domain Expertise, Acquisitions Driving Growth

Cognizant’s domain expertise is a key catalyst. The company is consistently developing its capabilities to benefit from the ongoing digital transition especially when it comes to integration of the new digital framework with legacy technology platforms.

Additionally, the company has gained deep industry expertise and knowledge of the fast-growing verticals, like Financial Services and Healthcare, through partnerships with top firms like Microsoft (NASDAQ:MSFT) . This has helped it to outpace Tier-1 peers.

Moreover, accretive acquisitions such as the TriZetto, Mirabeau BV and the technology and business process services unit of Frontica Business Solutions AS are likely to benefit the company.

We believe that these positive factors somewhat offset concerns related to H1B visas under President Trump’s administration as well as intensifying competition in the IT services industry.

Zacks Rank & Key Picks

Cognizant currently carries Zacks Rank #2 (Buy). Alibaba (NYSE:BABA) and Applied Optoelectronics (NASDAQ:AAOI) are couple of better-ranked technology stocks. Both stocks sport a Zacks Rank #1 (Strong Buy. You can see the complete list of today’s Zacks #1 Rank stocks here.

Long term earnings for Alibaba and Applied Optoelectronics are pegged at 28.97% and 18.75%, respectively.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential.

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Cognizant Technology Solutions Corporation (CTSH): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Applied Optoelectronics, Inc. (AAOI): Free Stock Analysis Report

Original post

Zacks Investment Research