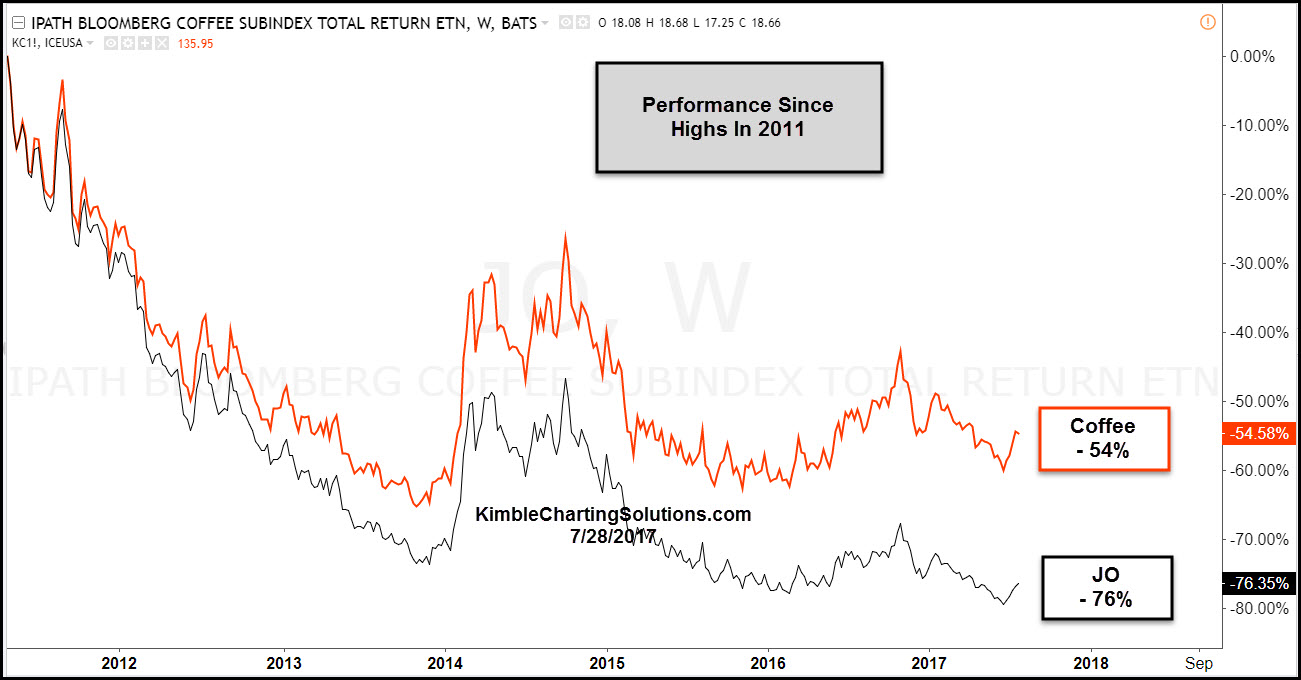

Coffee futures and Coffee ETF JO have had a rough go of it the past few years. Below looks at the performance of both since 2011.

Do these large declines represent a coffee-buying opportunity? It's very possible. The chart below looks at an interesting pattern in JO.

Over the past few years, the decline in JO took it down to test 4-year support at (1). While testing support line (1), JO looks to have created a bullish wick (bullish reversal pattern). This took place at long-term support AND at the bottom of a bullish descending triangle. Over the past few weeks, the coffee ETF has rallied and broken above bullish falling wedge resistance.

So far this week, JO appears to be creating another bullish wick (bullish reversal pattern) following the breakout at (2).

This breakout is taking place with few investors bullish coffee and dumb-money traders have a huge short position in play, which is the largest in years. A rally in coffee has the potential to catch many off guard and could create a short-covering rally.

No doubt, the trend remains down in both Coffee and JO. We'll see if two large bullish reversal patterns in the past 6 weeks are sending a short-term bullish message or if it's nothing more than a counter-trend, short-term rally.