For the last five weeks a base has been building in March coffee futures just above the $1.05 level. Two significant developments this week: we will see a settlement above the 20-day MA and -- with futures trading at their highest trade in seven weeks -- it appears we will get a settlement above the down-sloping trend line that had capped upside for the last seven months. Current trade has futures 3.50 cents below the 50-day MA (light blue line), which has not been penetrated in all of 2013. I expect that to play out in the coming weeks with my objective being the 38.2% Fibonacci level near $1.30 on this contract. The train is just leaving the station and I believe there's time to get on board. The seven-year low that was reached in recent weeks may not be revisited for many years to come.

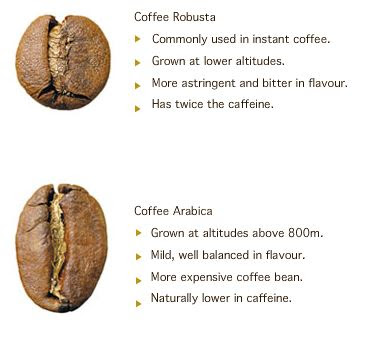

The recent appreciation has been accentuated by short covering and the idea that a near-term shortage of Robusta beans has the potential to drive up demand for Arabica. Growers in top Robusta producer Vietnam have been holding back their beans, waiting for higher prices despite harvesting a bumper crop. That has lifted coffee prices on the Liffe to a near 3 1/2-month high. The gap between the two blends narrowed last week to a five-year low near 28 cents/lb. A rise in consumption is expected by 1.6% year-over-year in Arabica -- the largest jump since 07-08'.

Cash Out On Spike

But before traders get too excited, they must recognise that 2014 is expected to be the third year of surplus production. so Bulls should take their profits on a spike higher in the coming weeks.

Trade Ideas

- Selling March 14' puts. Using the premium collected to buy upside calls. For example, selling the KCH14 $110 put -- currently collecting just over $1,000 per. Buy the $120 calls -- currently at $1250. 61 days until expiration.

- Long March futures and sell at the money $115 calls 1:1. providing a safety net of 5 cents or $1875, current delta of 52%.

In either scenario, remember we are targeting a trade to $125-$130 as our exit window.