Coffee is a sector I have been watching for while and think this is a good long for 2013 and longer term. Coffee has declined over 50% from its highs in 2011, which has helped companies like Starbucks (SBUX), Smuckers and GMCR as their margins where much higher. But these lower prices really affect the growers; the lower the prices get the harder it is for them to make money. Now it appears this decline could be over and growers could start benefiting while roasters and sellers might start feeling a squeeze.

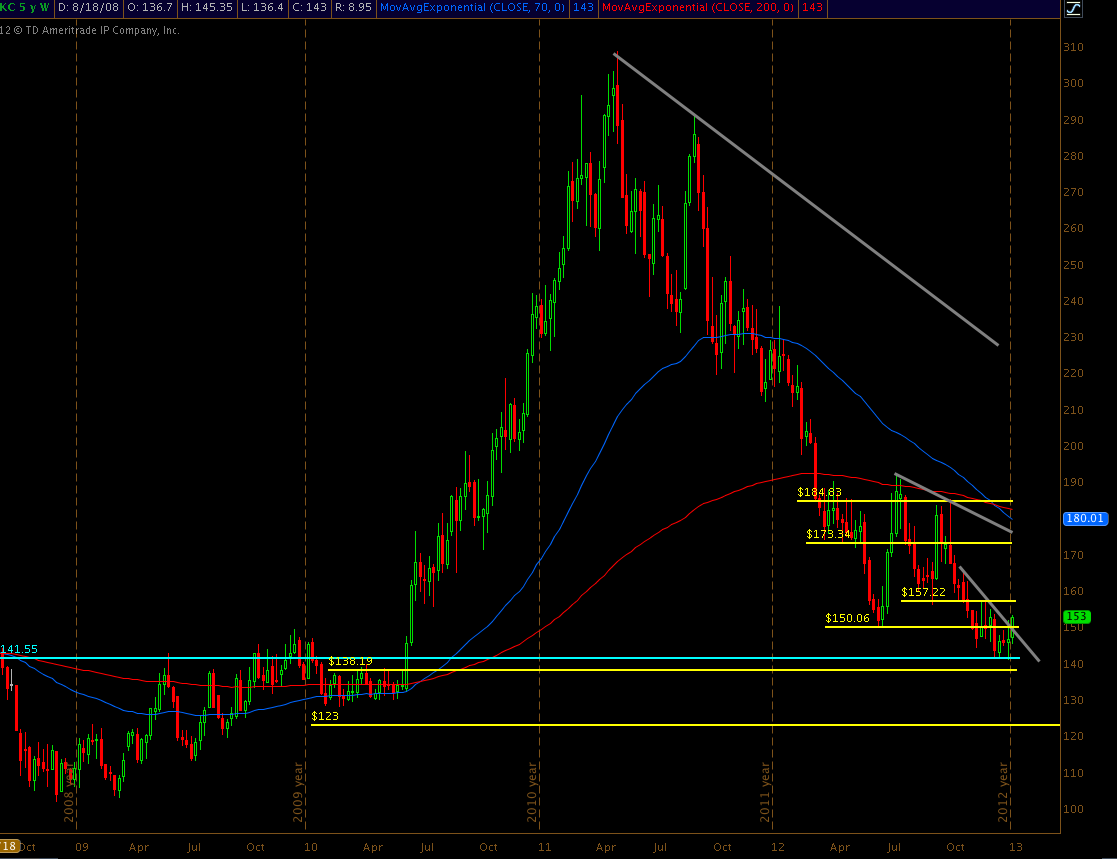

Historical Charts: Over last couple of weeks coffee had been basing around 141.55 level where it seem to finally stop and slow down the current downtrend. Looking at the weekly chart this level is strong support. The 141.155 support level comes from the breakout level from 2010 when coffee prices rose to highs at 310 are a 120% increase.

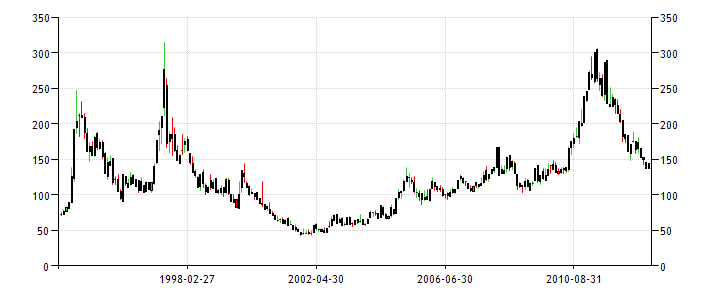

In fact, the 141 level has been the normal bottom price for coffee over the last few decades. Even if coffee is to move lower, the lower prices just add to continued support. Historically coffee has bottomed around 123, so there is the potential for coffee to move lower. The drop in 1998-2002 was caused by a coffee crisis, which will do not appear to be having now and safeguards and industry standards are in place to prevent the crisis again.

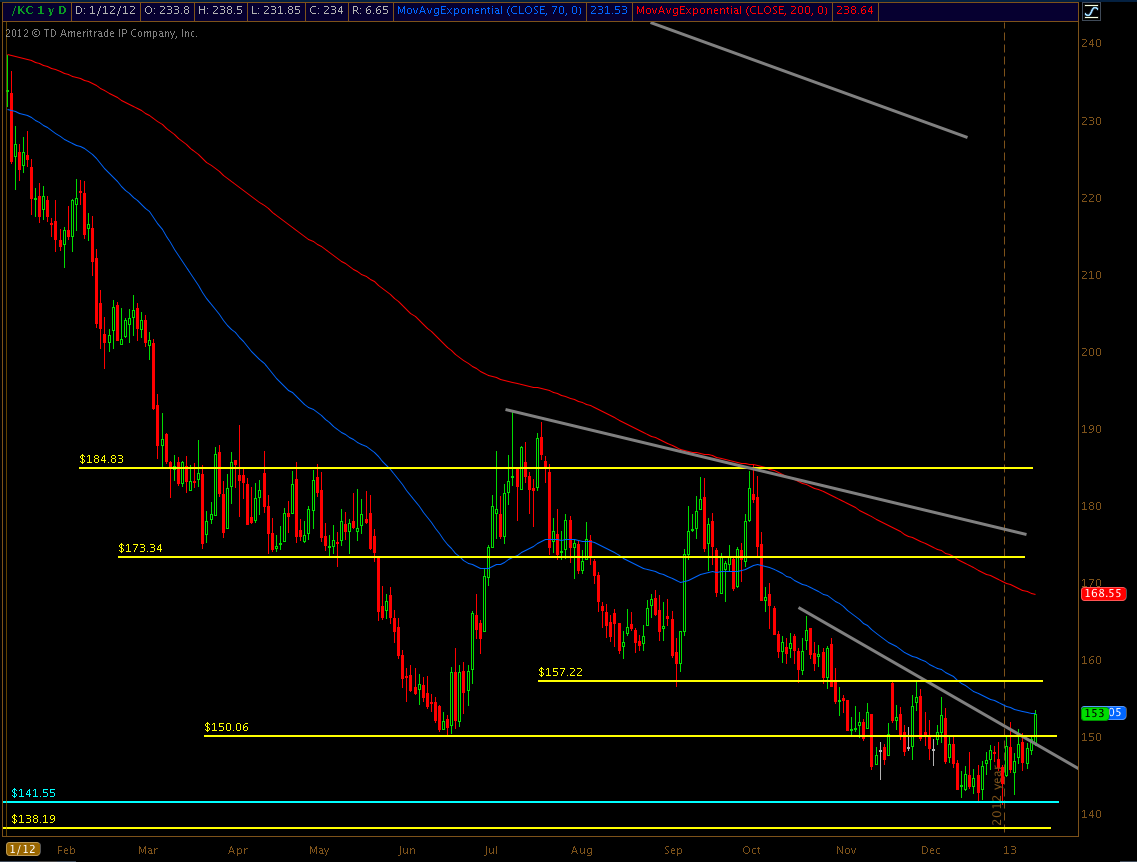

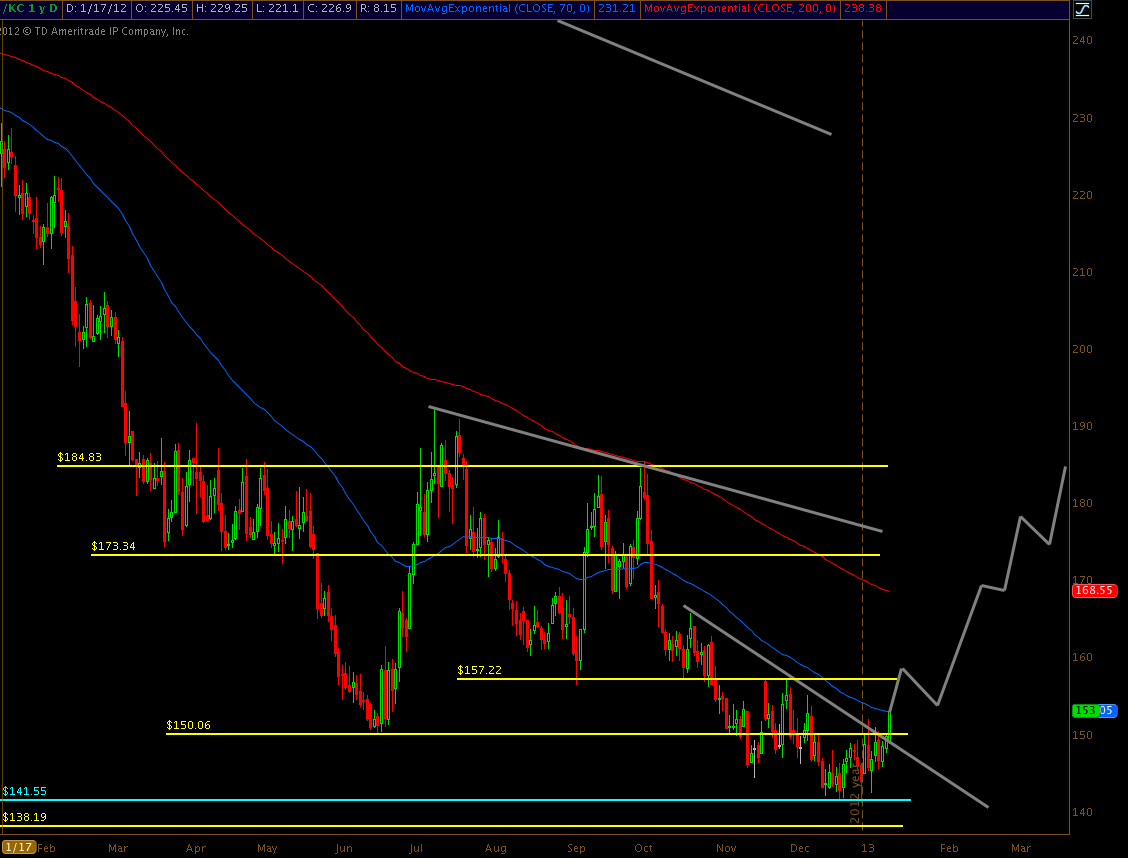

Short-Term Bullish Breakout: The key bullish break for coffee was the breakout on Friday which broke above resistance at 150 and more importantly the immediate-term downtrend line. The break above the 150 levels is a new potential support level and new stepping stone to move upwards. The 70-day ema stopped the lastest move upwards and have been the measuring stick to see if a rally can happen. A break above this would add to the bullishness of the stock. Coffee’s decline has also caused a large amount of short speculation which leaves it open to a short-squeeze and potentially higher prices.

Support and Resistance: If coffee continues to rise a long-term potential target is 181.53 which is only a 23% retracement from the fall in 2011. But since coffee is in its beginning stages of a run upwards, we need to take a short-term view first. The 150 level should hold as support, if not expect the 141 to be tested again. The next resistance level is at 157.22, above this level is where Coffee can really run, since there lacks resistance till 173.34.

Above this level resistance is at the 23% retracement and the highs from 2012 which will be resistance. Coffee could continue lower if it fails to move upwards and breaks back below 141. The drop would not be to far just 8-10% to 130-123 which would provide even more historical support.

How to Play this: (JO) is the coffee ETF that can be used to play this bounce and get exposed to a coffee trade. For JO support is at 34 and the key long-term support is at 31.38. JO potential 23% retracement is at 43.53. JO needs to get above 36.35 to really get a run up to the 43 level.

Overall, Coffee appears to be ready to run upwards after its year and a half decline. This will be good for the coffee growers but it could potentially hurt the roasters and sellers of coffee. It won’t affect them right away since Starbucks makes its own prices and buys well out in advance. But if we get a rise of 20% and a price that stays 20% higher, the great margins the coffee industry is enjoying now will be affected and you the coffee drinker may be forced to pay for this.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Coffee JO And KC Look Ready To Rise

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.