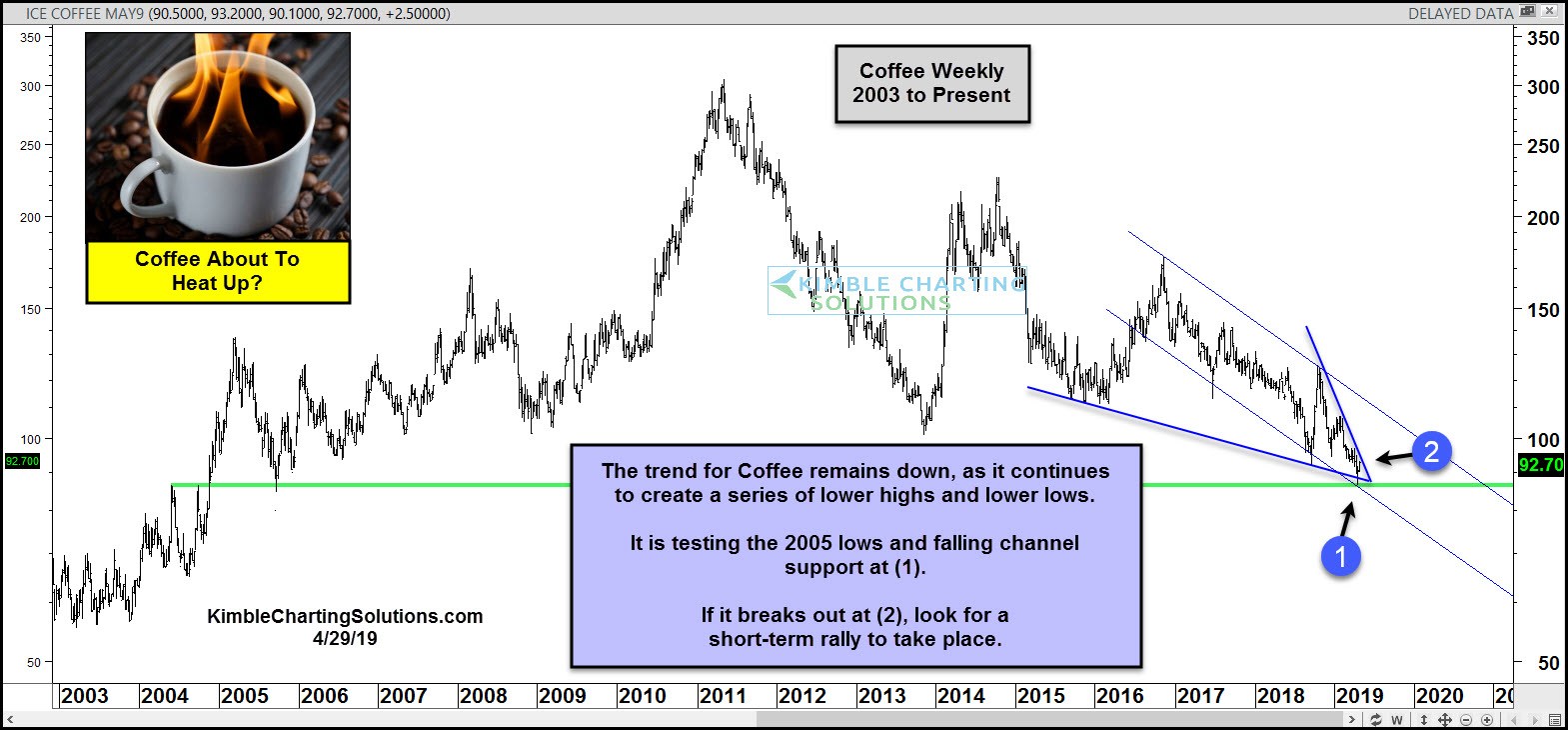

Coffee has been anything but hot over the past 3 years, declining by nearly 50%. Is cold coffee about to heat up? It's possible in the short-term.

This chart looks at Coffee futures over the past 16 years. The 50% decline has it testing its 2005 lows and the bottom of a 3-year falling channel at (1).

While testing this support zone two weeks ago at (1), it created a bullish reversal pattern (bullish wick).

No doubt the trend in coffee is down and this one-week bullish reversal pattern does NOT change the trend.

If coffee can break above resistance at (2), look for it to heat up in the short-term.

Currently, hedgers have a very big bet in play that coffee will rally. Keep a close eye on coffee and coffee ETF (NYSE:JO) over the next couple of weeks, as an upside bullish breakout test is in play.