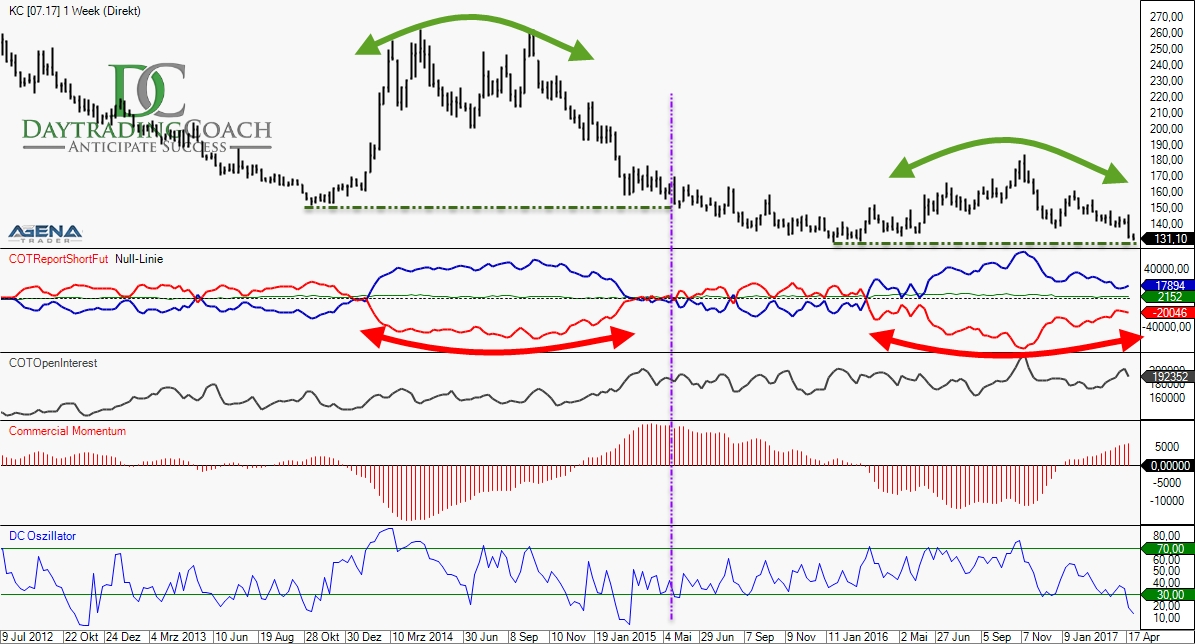

The coffee futures saw its high in November of last year, precisely at the moment when the non-commercials, the large group of speculators, had reached their biggest historical long positioning in the coffee market. At the same time, the commercials had their historically largest short positioning in this market.

In fig. 1 you can see the net positions of the big speculators represented in blue; those of the commercial hedgers in red. In the case of coffee, the commercials, that is the hedgers, are the two groups of coffee farmers and coffee roasters. The farmers sell, the roasters buy. In the falling prices, the roasters built up their long positions bit by bit once more, whereby the net short positioning of the commercials decreased from approx. 70,000 contracts in November 2016 to the current approx. 20,000 contracts. It can be observed in the past that the commercials can definitely reach a net long positioning in coffee, but this is, however, not absolutely necessary for starting a larger correction.

Sourse: Trading Software "AgenaTrader"

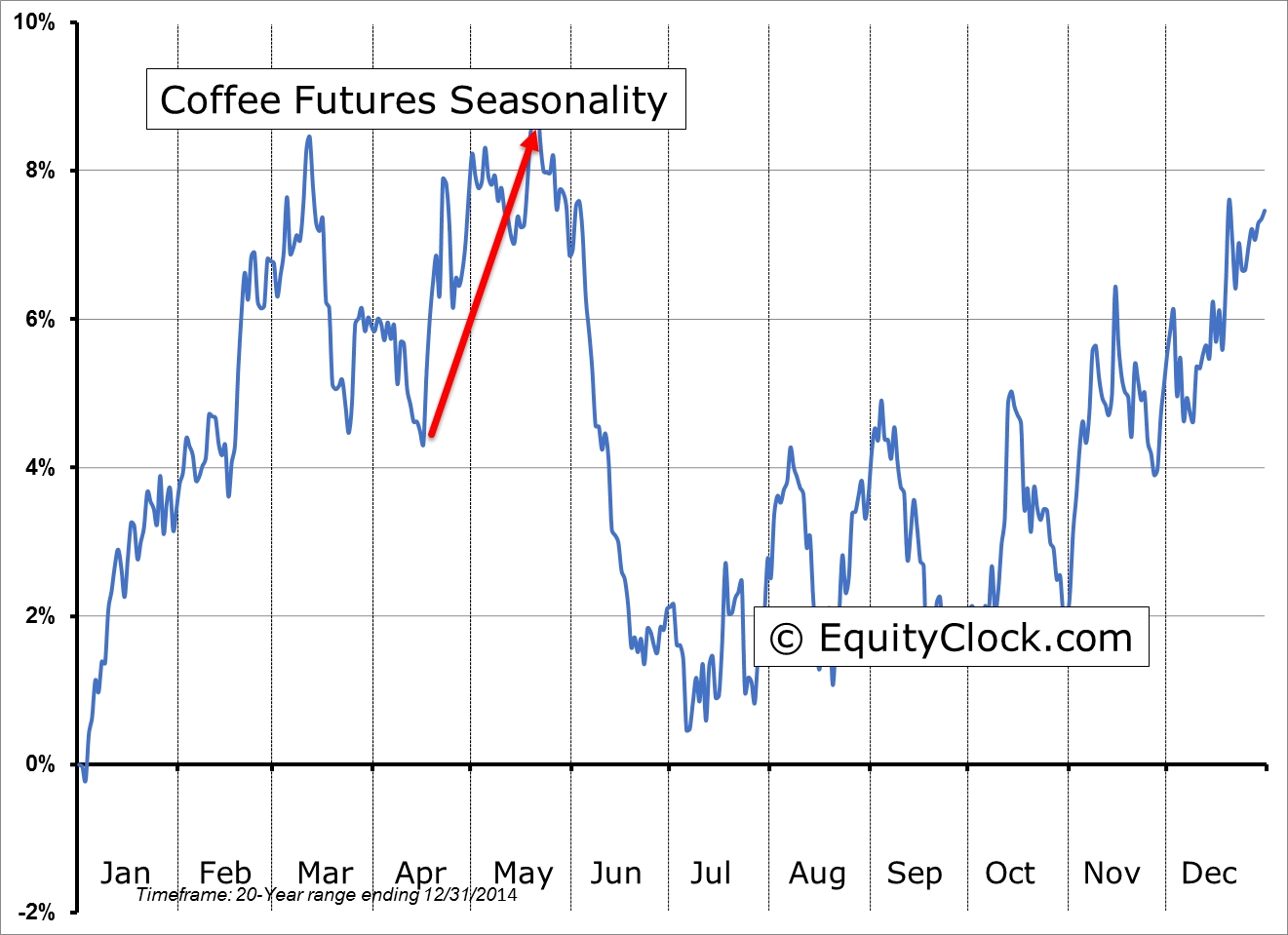

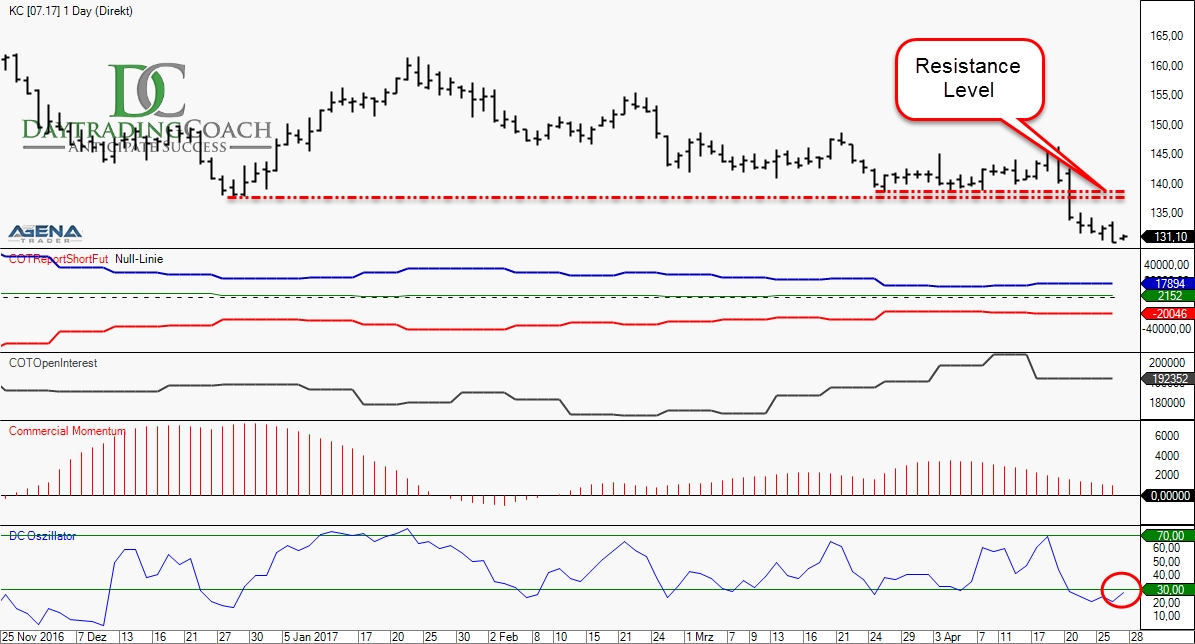

The question at the moment is whether the long-term support area at 129 dollars will hold. In this case, we could expect a recovery of the coffee prices back up to 140 dollars. The seasonality of the coffee prices currently speak in favor thereof. Until the end of May, there should be relative strength present in the coffee price.

The horizontal line in fig. 1 shows that the situation at the end of April 2014 was almost identical to the current situation. Two years ago, the coffee price was also located at a long-term support level and the coffee roasters had a heavily bullish orientation in the market. Back then, the support level held and the seasonality prevailed. There was a three-week price rise before the old low was undercut and the price went ahead with its downward movement for several months.

Source: www.equityclock.com

The current price is being waged between the speculators, who are recovering their positions on the short side, and the coffee roasters, who are building up their long hedges in the falling prices. By historical standards, the 129$ marker should further fuel the purchasing propensity of the coffee producers. It is probable, therefore, that the volatility in the coffee market will increase again if the buying pressure of the commercials forces the speculators to buy up their short positions.

A first short-term buy signal will arise if the price runs from the oversold area back into the 30-70 range (red circle in fig. 3).

Sourse: Trading Software "AgenaTrader"

IMPORTANT NOTE:

Exchange transactions are associated with significant risks. Those who trade on the financial and commodity markets must familiarize themselves with these risks. Possible analyses, techniques and methods presented here are not an invitation to trade on the financial and commodity markets. They serve only for illustration, further education, and information purposes, and do not constitute investment advice or personal recommendations in any way. They are intended only to facilitate the customer’s investment decision, and do not replace the advice of an investor or specific investment advice. The customer trades completely at his or her own risk.