I shy away from working with friends or family because the old adage about "business and pleasure". That makes some sense to me because Thanksgiving dinner shouldn't be awkward.

Commodity markets are leveraged and trading is risky NO MATTER WHAT. That said, I'm telling some friends and family to consider passive (ETF) investments in Coffee before too long. I firmly believe it's darkest before the dawn and the fact that a POUND of green/unroasted coffee is trading around $1.00 and countless people stand in line to pay $4.00 for a single drink at Starbucks makes me believe that margin compression is coming. To be clear, I'm NOT advising investing in Starbucks or Dunkin. They benefit from Coffee this cheap. When the input costs go up....their margin gets squeezed.

Alternatively, I'm interested in working with people who are looking to get in the Coffee business because the time seems ripe (half kidding).

I've had some good ideas over the years that I put in front of friends/family. Most recently Silver around $18 and Copper proxies (FCX, etc) when futures flirted with $3.00/lb US. I've had plenty of bad ideas too.

Take that for what it's worth. Coffee traded just through the Dec 2008 lows today. The fundamentals are overtly bearish. Also keep in mind that a year ago Corn was $6.50 a bushel after a horrible drought. Today it's plumbing 3 year lows around $4.20 with a USDA report on Friday.

Commodities Lesson: High prices incent planting, mining, and exploration. Low prices do not. Prices act to ration demand.

This may be ridiculous, but it's possible that Crude (WTI), Coffee, Cotton, and Corn all bottom in the same week. Time will tell. Watching Commodities that start with "C".

Moving on: ECB meeting tomorrow along with weekly jobless claims and the EMPLOYMENT SITUATION on Friday. The long end of the Treasuries moved up fairly quickly (rates higher) over the past few sessions.

Also, this paper is getting a great deal of attention in many circles. The fixed income markets are also doing some interesting things. I.E. the 5/30 spread is STEEPER than it's been in two years. (Fed owns the preponderance of short-end belly).

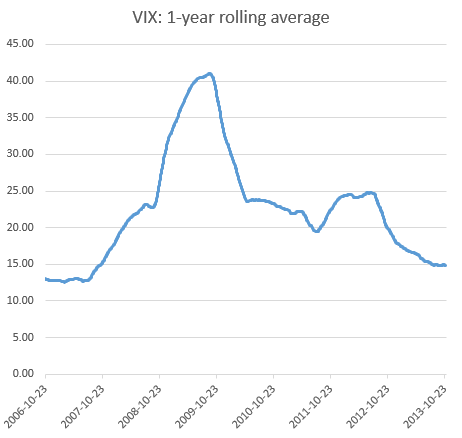

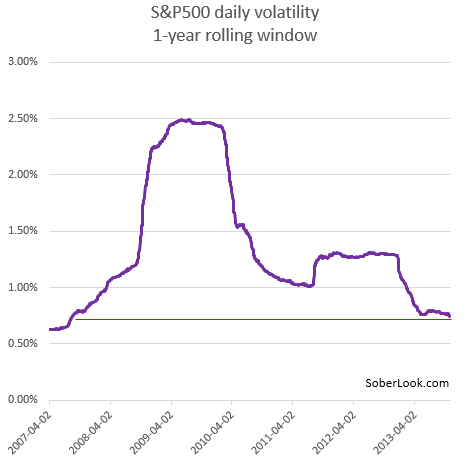

I found the following charts interesting.

Daily Volatility:

Both smoothed averages lead me to believe volatility might be too low. I also realize the POMO (Fed's $85 billion in monthly buying) serves as an analgesic where volatility is concerned.

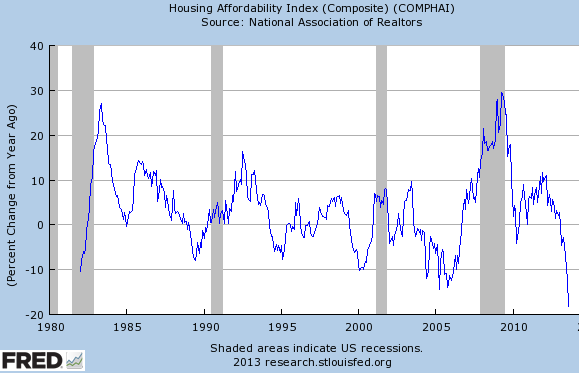

Another shadow of 2006/2007 is the Housing meme (equity markets on highs, volatility very low, and cheap money leading to mal-investment):

Is Housing still "cheap"? Not according to this data.

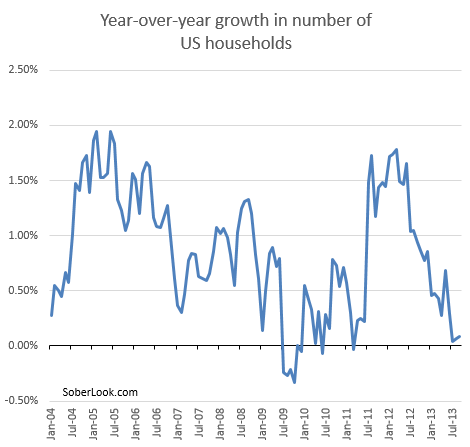

And, it looks like more and more college grads are moving into their parent's basement, not buying insurance, but using social media. Here's a look at Household Formation figures:

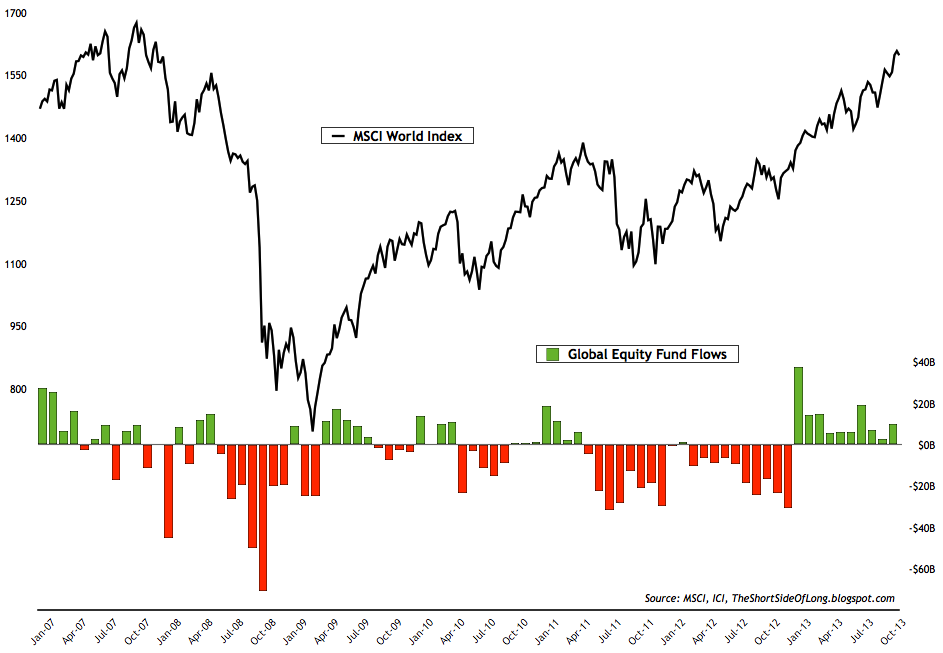

Retail money has been flowing into Equity markets for all of 2013 (and OUT of bond funds):

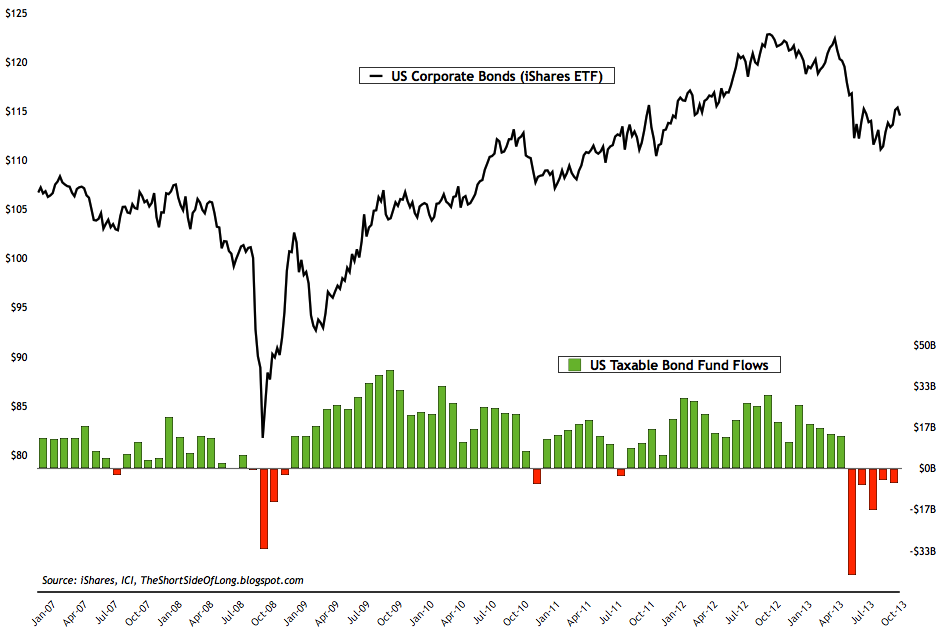

Here's the flow OUT of Fixed Income (the Taper threat occurred 5/22 and the exodus took place in June)

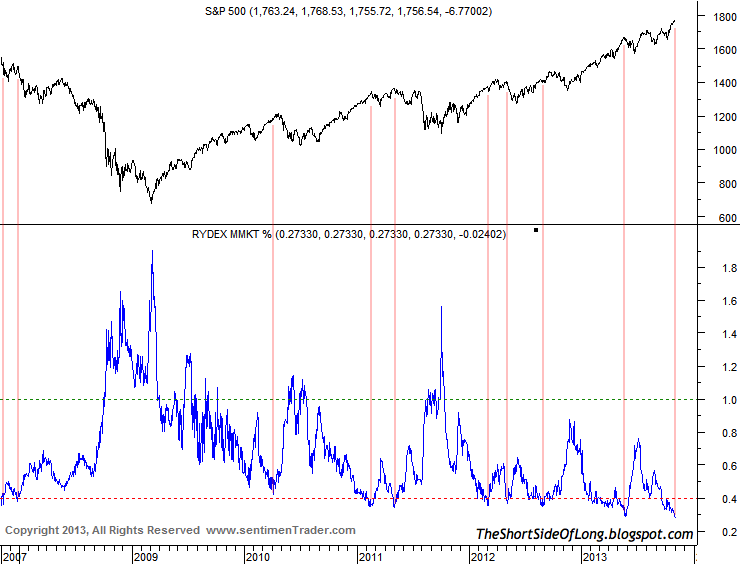

Rydex Retail Cash Levels (Yikes):

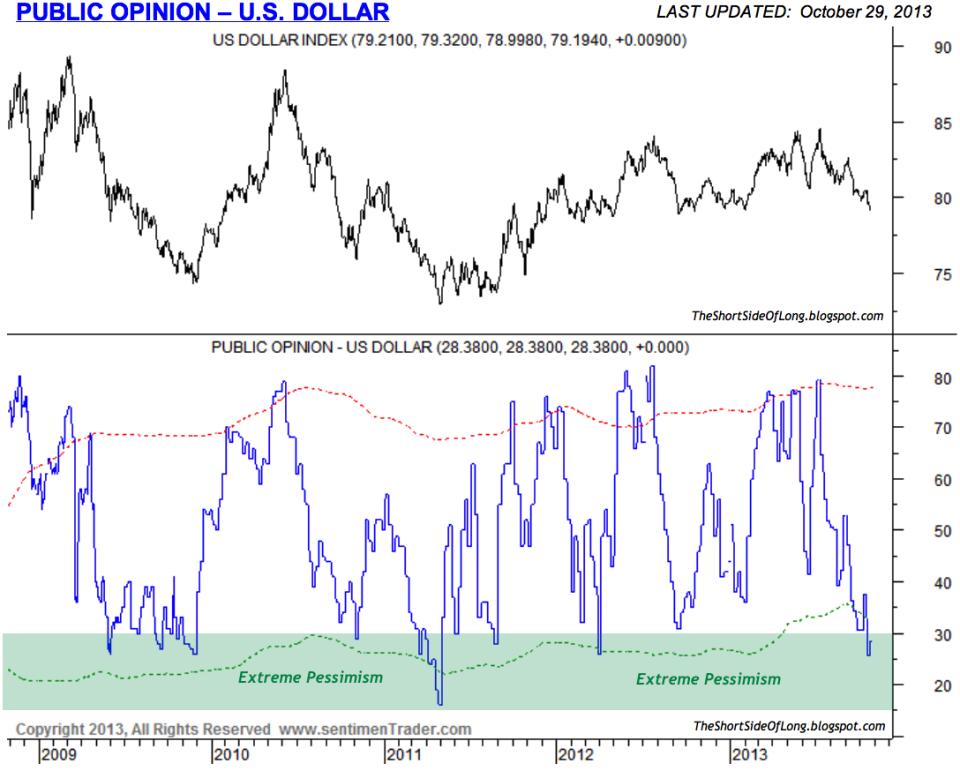

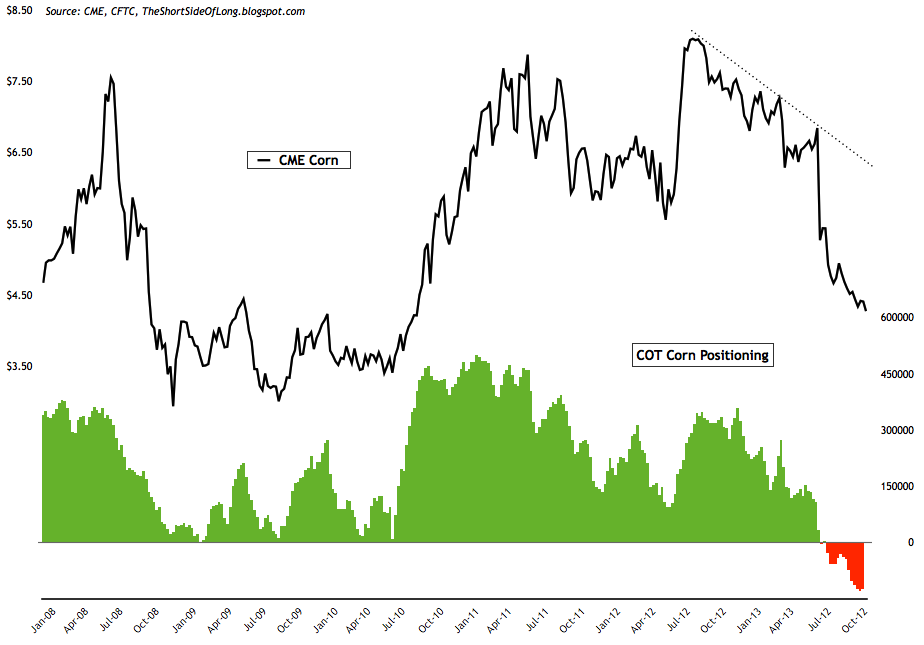

In some specific markets......Dollar Sentiment and Corn sentiment seems stretched. The Dollar has already traded well off lows. I wouldn't be shocked if Corn bottomed on USDA figures on Friday.

Corn Commitment of Traders:

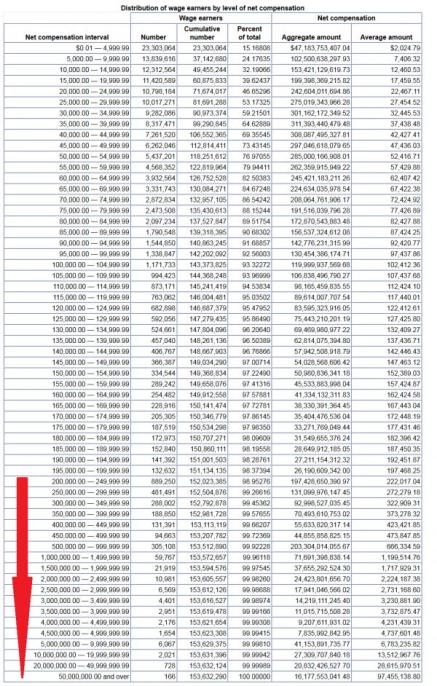

Finally, here's a look at Income Distribution in the United States: I understand this is difficult to read.... let me break it down a little bit. Roughly 153 million wage earners in the country.

- 142 million earned less than $100,000.00 (93% of wage earners)

- 113 million earned less than $50,000.00 (73% of wage earners)

- 91 million make less than $35,000.00 ((59% of wage earners)

- 61 million made less than $20,000.00 (40% of wage earners)

It's difficult to afford a "median home" when you're making less than $50k.

The nationwide median price for an existing single-family home rose 12.5 percent in the third quarter from a year earlier to $207,300 the Realtors group said.