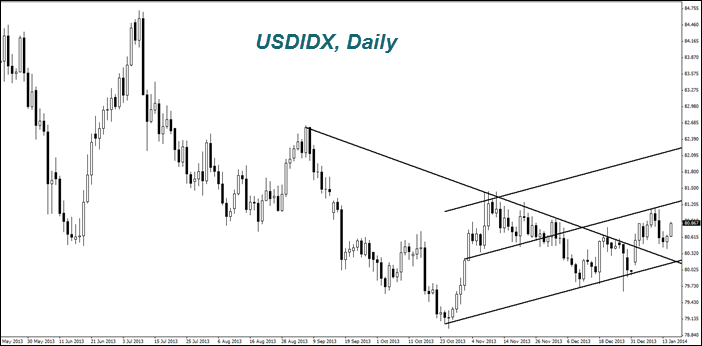

The dollar index grew on Tuesday. This trend continues upon the release of the U.S. retail sales of Decembern which came out much better than the preliminary forecasts. Now some investors suggest that U.S. GDP growth for the fourth quarter of 2013 may also be higher than the forecast. Recall that the GDP data will be released on January 30. Besides the good statistics, the U.S. currency added positive with remarks of the Fed heads in Dallas and Philadelphia. While Charles Plosser of Philadelphia has even stated that the program of purchasing government bonds should be completed before the end of this year. Note that today we expect the statements of regional Fed heads from Chicago and Atlanta. In addition at 13-30 GMT (0), we expect the PPI for December. In our opinion its preliminary forecasts are neutral. The exchange rate may be affected by the "Beige Book "review, which is to be published at 19-00 GMT (0).

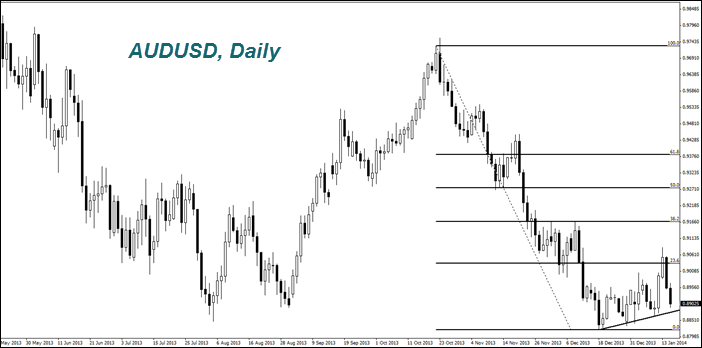

As we anticipated in yesterday's report, the Australian dollar (AUD/USD) and Japanese yen (USD/JPY) showed the sagnificant weakening against the U.S. dollar. The volume of loans in RMB in China for December was worse than the preliminary forecasts and fell to 482.5 billion slight cooling of the Chinese economy has had a negative impact on the Australian dollar. Its further progress will depend on the unemployment data for Australia in December. They will come out tomorrow.

In general, the yen is weakening due to purshasing of Japanese government bonds by the Bank of Japan, printing money (by the Fed example). However, there is an opposite tendency of increasing demand for the Japanese currency. According to the Bank of Japan, it reached 8.3 trillion yen ($80 billion) in November from foreign banks . This is the highest level for the last five years. Due to low interest rates, foreign banks actively take loans in yen for later purchase of higher-yielding assets in other currencies (the so-called carry trade operations). Note that today at 23-50 GMT (0) we expect the manufacturing and services PMI's in Japan for November. We believe that their preliminary forecasts are negative. It can support a further weakening of the yen (increase in the chart).

The British pound (GBP/USD) gets cheaper after yesterday growth. Market participants reduced their activity on anticipation of important events that may affect its rate. Today at 14-15 GMT (0), we expect the Bank of England Governor, Mark Carney's speach about the state of the British economy in the Parliament. Tomorrow on 00-01 GMT (0) , we expect the index of property prices in the UK. After yesterday inflation growth data, it is expected to be highest in the last 10 years. Besides it, tomorrow, there will be the auction of ten-year government bonds in the amount of 2 billion pounds. Now it is difficult to say how successful it will be.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US Dollar Index Grows On Positive Data

Published 01/15/2014, 10:02 AM

Updated 12/18/2019, 06:45 AM

US Dollar Index Grows On Positive Data

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.