Those that view the message of the market on daily basis are likely confused by trading noise. While trading noise contributes to the long-term trends, it does not define them. Human behavior tries to explain trading noise as a meaningful trend. This confuses the majority which, in turn, contributes to their role as bagholders of trend transitions.

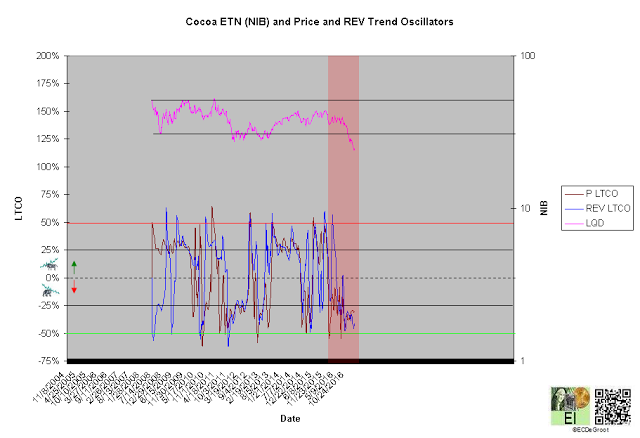

P and REV, both less than zero (red box), define an down impulse (chart). These trends favor continuation of the decline.

The Matrix shows cocoa (NYSE:NIB) has been a focused bear opportunity in the the fourth week of July 2016. This opp has produced a 93% annualized return for the bears. A focused bear opp within a down impulse maintains cocoa as a sell.

The Matrix updates the the progress of this trade as well 32 other markets. It also includes Intermarket analysis that includes market leadership and risk appetite, a true economic activity composite for the United States (EAC), and long-term concentration (cycles) and direction for U.S. stocks, bonds, and commodities. The later is important for long-term timing.