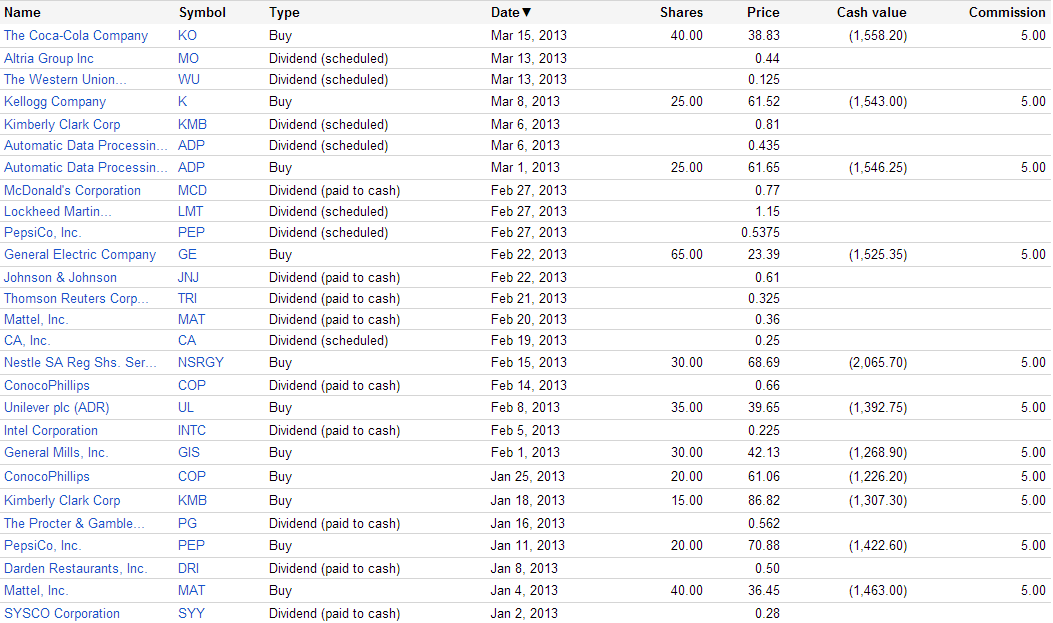

I keep it short; Coca Cola (KO) is the next purchase for the Dividend Yield Passive Income Portfolio (DYPI). I bought 40 shares for a price of $38.30. The total purchase amount was $1,553.20. KO shares representing 1.7 percent of the full portfolio. It’s the eleventh biggest position.

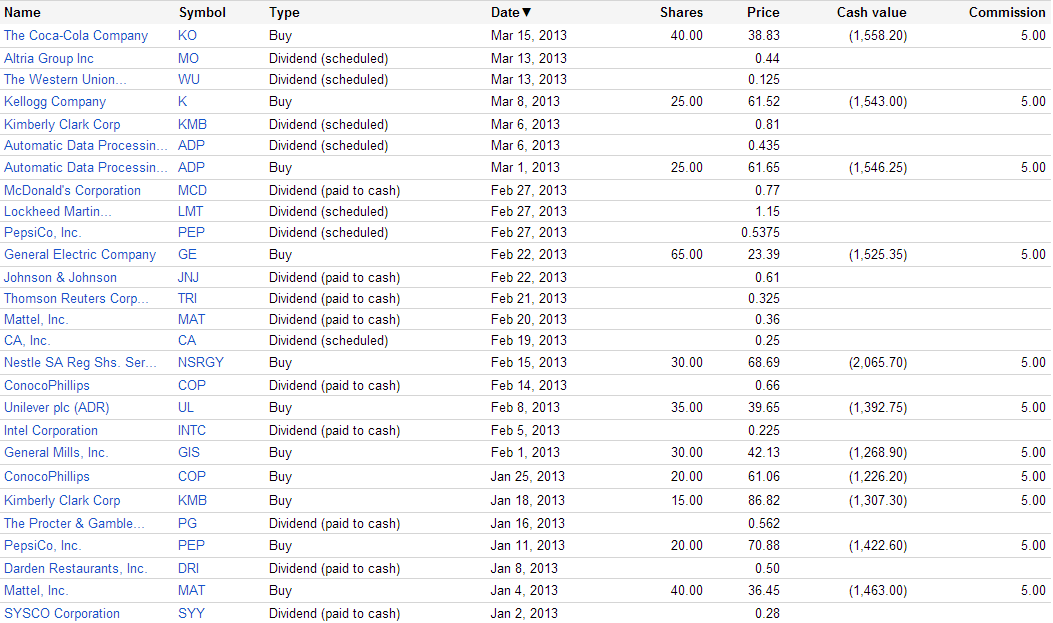

Every Friday I plan to put one new stake into the DYPI-Portfolio. As of now, 24 companies are part of the portfolio and I have $65,609 in cash for further acquisitions. With this capital I plan to increase to total number of stock holdings to 50-70 by the end of this year. The DYPI-Portfolio was funded virtual on October 03, 2012.

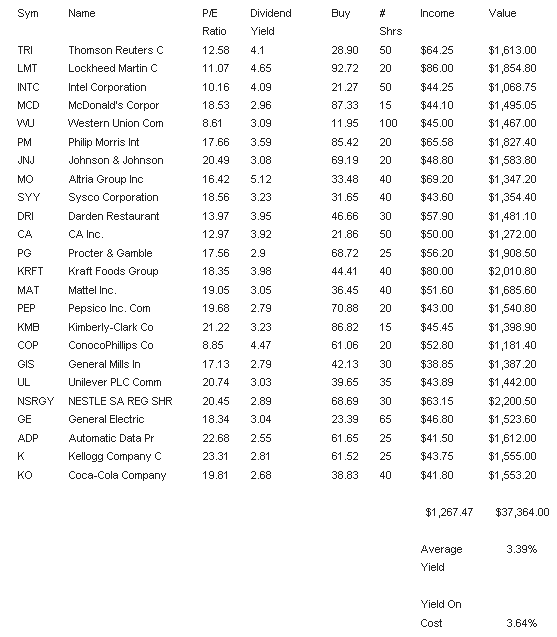

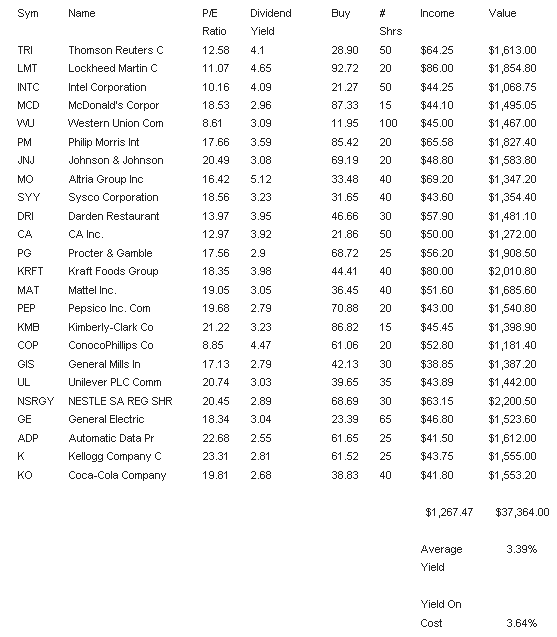

The new Coke position will give me additional $44.80 of yearly dividend income. It represents a yield on cost of 2.88 percent. The full portfolio income is estimated at $1,267.47. I plan to boost the passive capital income to $3,000 to $4,000 by the end of this year. All I need to do is to keep the yield on cost of the portfolio over 3 percent. This plan developed to a tough fight because the yield is going rapidly down for high-quality stocks. The reason is a very strong gaining stock market.

If the prices still rise, I needed to make a longer break or must cut my own target. For the time being, the current yield on cost is still over 3 percent at 3.64 percent but the actual portfolio yield is now below 3.4 percent.

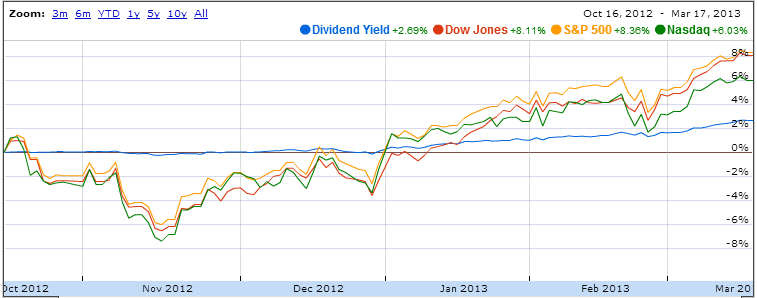

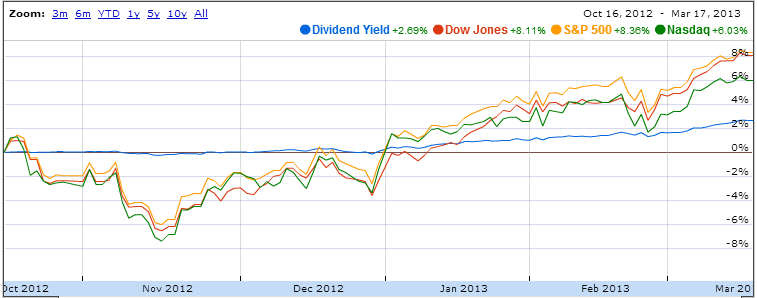

The difference is reasonable with a small capital gain from the existing portfolio holdings (6.96 percent). This is still in-line with the performance of the market and major indices. Because of the high cash amount (65 percent of the mony is not invested), the full performance is only 2.63 percent or $2,409.95.

I accept this underperformance because I like to buy stocks slowly in order to get better prices when single investments have starting difficulties. In addition I have many optionalities when there are new investment targets.

The disadvantage of this strategy is that I will lose performance when the market goes strongly up. This happened over the past months.

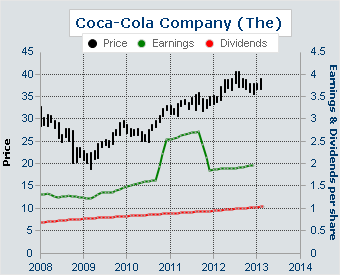

Why Coca Cola? Coke is a leading beverage company, engages in the manufacture, marketing, and sale of nonalcoholic beverages worldwide. The company primarily offers sparkling beverages and still beverages. KO is the dominating player followed by PepsiCo which is still part of my portfolio.

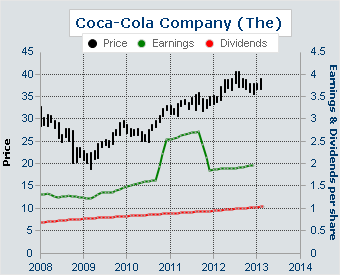

Coca-Cola is one of the safest long-term dividend growth stocks. The board from Coca-Cola managed to raise dividends over a period of 51 consecutive years. The beta ratio is very low (0.5). This figure is an expression of the high diversification and global presence of the company - KO generates 57% percent of its sales in Americans countries, 11.76% in Europe and 18.11% in Asian areas. Coke is also one of the world’s top brands with a very sustainable operating margin of 22.45 percent.

The drawback is that KO shares are highly priced. The current P/E is 19.71 and the yield at 2.88. Compared to other high-quality dividend growth stocks it’s in my view still a good ratio. Remember: The low yields from long-term bonds are not far away.

Coke’s future earnings are expected to grow in a range of 8 percent. The dividends should top this growth rate because of the smaller amount of outstanding shares (KO still purchases own shares for $3 billion).

Here is the income perspective of the Dividend Yield Passive Income Portfolio:

Every Friday I plan to put one new stake into the DYPI-Portfolio. As of now, 24 companies are part of the portfolio and I have $65,609 in cash for further acquisitions. With this capital I plan to increase to total number of stock holdings to 50-70 by the end of this year. The DYPI-Portfolio was funded virtual on October 03, 2012.

The new Coke position will give me additional $44.80 of yearly dividend income. It represents a yield on cost of 2.88 percent. The full portfolio income is estimated at $1,267.47. I plan to boost the passive capital income to $3,000 to $4,000 by the end of this year. All I need to do is to keep the yield on cost of the portfolio over 3 percent. This plan developed to a tough fight because the yield is going rapidly down for high-quality stocks. The reason is a very strong gaining stock market.

If the prices still rise, I needed to make a longer break or must cut my own target. For the time being, the current yield on cost is still over 3 percent at 3.64 percent but the actual portfolio yield is now below 3.4 percent.

The difference is reasonable with a small capital gain from the existing portfolio holdings (6.96 percent). This is still in-line with the performance of the market and major indices. Because of the high cash amount (65 percent of the mony is not invested), the full performance is only 2.63 percent or $2,409.95.

I accept this underperformance because I like to buy stocks slowly in order to get better prices when single investments have starting difficulties. In addition I have many optionalities when there are new investment targets.

The disadvantage of this strategy is that I will lose performance when the market goes strongly up. This happened over the past months.

Why Coca Cola? Coke is a leading beverage company, engages in the manufacture, marketing, and sale of nonalcoholic beverages worldwide. The company primarily offers sparkling beverages and still beverages. KO is the dominating player followed by PepsiCo which is still part of my portfolio.

Coca-Cola is one of the safest long-term dividend growth stocks. The board from Coca-Cola managed to raise dividends over a period of 51 consecutive years. The beta ratio is very low (0.5). This figure is an expression of the high diversification and global presence of the company - KO generates 57% percent of its sales in Americans countries, 11.76% in Europe and 18.11% in Asian areas. Coke is also one of the world’s top brands with a very sustainable operating margin of 22.45 percent.

The drawback is that KO shares are highly priced. The current P/E is 19.71 and the yield at 2.88. Compared to other high-quality dividend growth stocks it’s in my view still a good ratio. Remember: The low yields from long-term bonds are not far away.

Coke’s future earnings are expected to grow in a range of 8 percent. The dividends should top this growth rate because of the smaller amount of outstanding shares (KO still purchases own shares for $3 billion).

Here is the income perspective of the Dividend Yield Passive Income Portfolio: