Cobalt International Energy, Inc. (CIE) is an independent, oil-focused exploration and production company with a salt prospect inventory in the deepwater of the United States Gulf of Mexico and offshore Angola and Gabon in West Africa.

This is a vol note on a stock that just released some very good news that has pushed the price up by more than 1/3. Here's the news:

Cobalt International Energy Inc said results from tests at a deep sea oil well off the coast of Angola had exceeded expectations and had increased the company's confidence in its West African pre-salt exploration prospects.

"Cameia is an extraordinary success. The results have exceeded our pre-drill expectations and have increased our confidence in our entire West Africa pre-salt exploration inventory," said Cobalt Chief Executive Joseph Bryant in a statement on Friday.

Source: Reuters via Yahoo1 Finance, Cobalt Intl: Angola oil test beats expectations

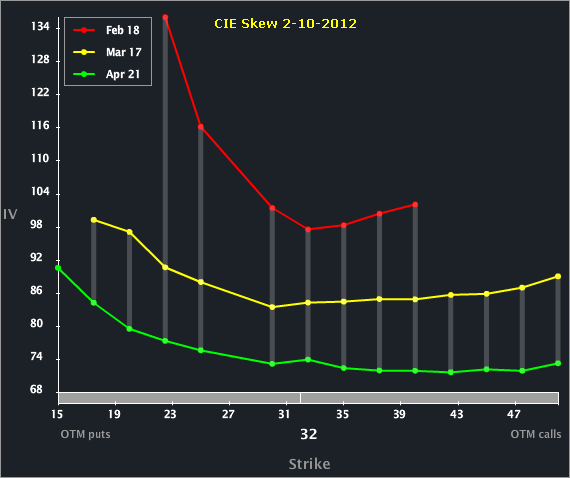

That's pretty good news... Before we look to the Charts Tab, I want to point some stuff out in the Skew.

There's a beautiful monotonic spread with increasing vol from the back to the front across the three expiries pictured. Or, in English, Feb vol is higher than Mar which is higher than Apr. The spread between Mar and Apr is likely due to the next earnings report (due out in late Feb or early Mar but outside Feb expiry). The spread between Feb and Mar (and Apr) is due to the gap up today. Just looking at the first three hours, the range in CIE is [$30.25, $36.51] with an opening print basically in the middle ($33.98). So the gamma in Feb is pricey and likely should be.

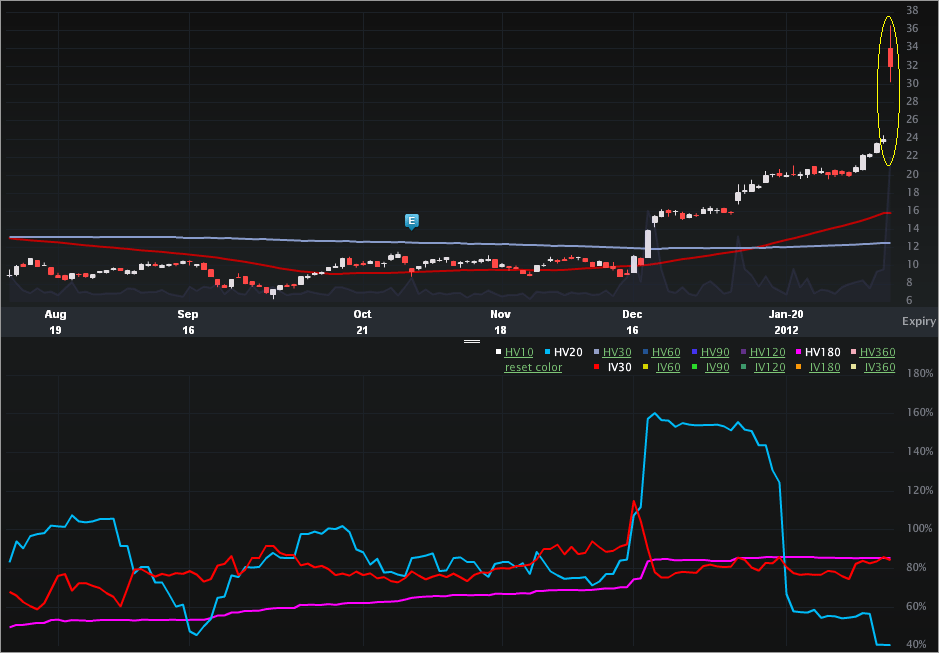

Let's turn to the Charts Tab (six months), below. The top portion is the stock price, the bottom is the vol (IV30™ - red vs HV20™ - blue vs HV180™ - pink).

What's absolutely fascinating (OK, maybe that's a bit too far) is the stock price rise in the last two months. Specifically, on 12-14-2011 the stock closed at $8.80 -- that's 72.5% in less than two months. On the vol side, even with this news, the IV30™ is down. That might be interpreted as this news was a surprise -- not the results one way or the other, just that news was coming at all. I say that because the vol was not elevated into this event and did not drop after the news. Weird given what the news actually was...

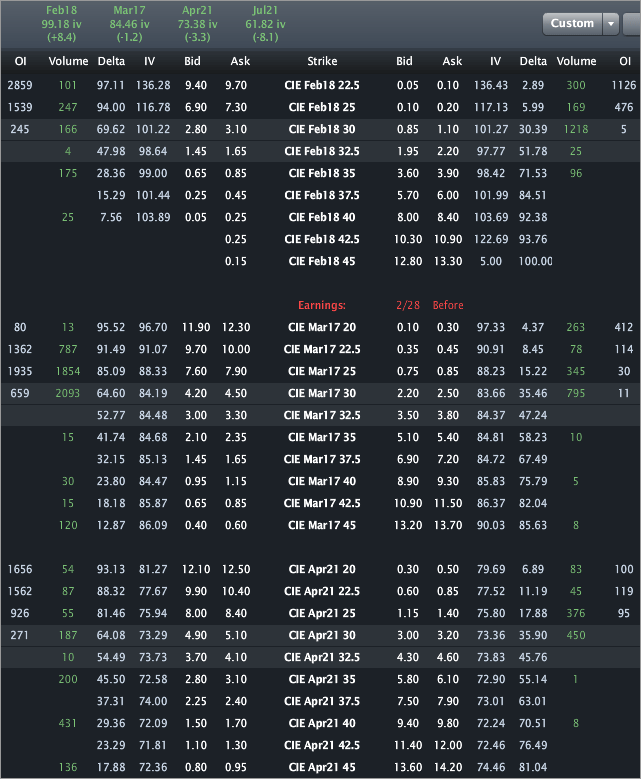

Let's turn to the Options Tab.

It's that vol diff between the front and the Mar (earnings) expiry that has me interested. Feb is priced to 99.18% vol with Mar priced to 84.46%. Granted, the gamma in Feb should be expensive (see prior discussion of the day's range).

This is trade analysis, not a recommendation.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Cobalt Internationall Energy: Stock Pops on

Published 02/12/2012, 12:06 AM

Updated 07/09/2023, 06:31 AM

Cobalt Internationall Energy: Stock Pops on

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.