Last year, U.S. power plants produced 4,093 billion kilowatt-hours of electricity. And 39% of it came from coal.

Coal is still the No. 1 source of electricity generation in the U.S. However, that number is declining steadily. Why? A steady stream of increasingly tighter greenhouse gas emissions rules issued by the U.S. Environmental Protection Agency (EPA).

Here’s what President Obama told the San Francisco Chronicle back in January 2008 (when he was still a senator): “So if somebody wants to build a coal-fired plant they can. It’s just that it will bankrupt them...”

He wasn’t kidding. The tighter regulations already in place... the new Mercury and Air Toxics Standards... the proposed Cross State Air Pollution Rule...

These all spell the end of coal-fired plants here in the U.S.

Over 72 gigawatts of coal-fired generating capacity will soon be retired due to EPA regulations. That’s enough generating capacity to power 44.7 million homes -- as many as there are in all the states west of the Mississippi (excluding Texas).

More than 20% of existing coal-fired plants in use today will shut down. (A few newer units are converting to natural gas.) And there could be even more closures as new regulations take effect.

What impact will all this have on coal producers? It’s not pretty, but some will survive. Let’s take a look...

The Coal Miner Blues

Right now in the U.S., more than 50% of states have coal-mining operations. But 79% of all production comes from just five states: Wyoming (39%), West Virginia (12%), Kentucky (8%), Illinois (5%) and my home state of Pennsylvania (5%).

Two of the largest coal producers are in Wyoming: Peabody Energy (NYSE:BTU) operating its North Antelope Rochelle Mine and Arch Coal (NYSE:ACI) with its Black Thunder Mine.

CONSOL Energy (NYSE:CNX), another big producer, operates out of Pennsylvania.

Then there’s Alliance Resource Partners (NASDAQ:ARLP) in Oklahoma. (We’ll talk about this one, in greater detail, in a minute.)

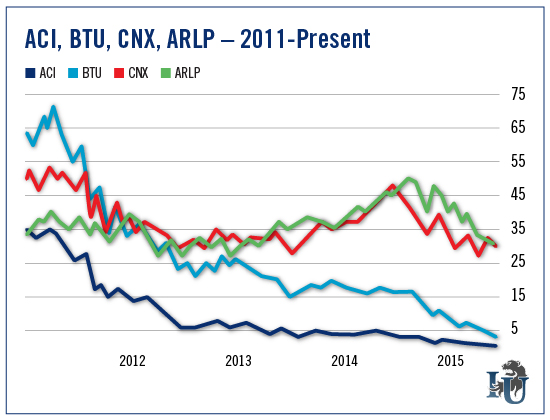

So how have shares of these companies performed in recent years? Take a look at the chart below.

For Arch Coal and Peabody Energy, it’s not a pretty picture. Shares have declined 98.6% and 94.8%, respectively.

What’s Consol doing different? It’s the only U.S. coal company that owns something its competitors don’t -- a sprawling export terminal, located on the Chesapeake Bay in Baltimore.

This Coal Company’s Magic Bullet

Consol’s Baltimore terminal is capable of exporting about 15 million tons of coal a year. The company used some of that capacity to export a 30% chunk of its 2014 production, totaling 28.5 million tons.

The terminal’s excess capacity is sold to other coal miners, including Rosebud Mining and Murray Energy Corporation. These companies pay a fee of $4 to $8 per ton to use Consol’s facility.

In a recent interview, Bob Hodge, a coal analyst at IHS Energy, referred to Consol’s Baltimore terminal as “its magic bullet.” He noted that the company can increase exports to help keep U.S. prices from tanking.

Coal exports are the one bright spot for U.S. producers, in spite of global warming concerns. As U.S. coal-fired power plants are replaced by natural gas-fired units, coal producers will increasingly turn to the export markets.

My Favorite Coal Stock

Consol is in great shape and should continue to be as coal exports become a larger and larger part of its future earnings. However, my favorite coal stock is Alliance Resource Partners (No. 4 on the chart above).

Alliance is the third-largest eastern coal producer, with 40.7 million tons mined in 2014. It’s structured as a master limited partnership (MLP), which means it offers tax-free income to unit holders.

So how have Alliance units fared as the price of coal has dropped? Since 2011, they’re down only 14.3%. (To compare, Consol has slid more than 40% during the same period.)