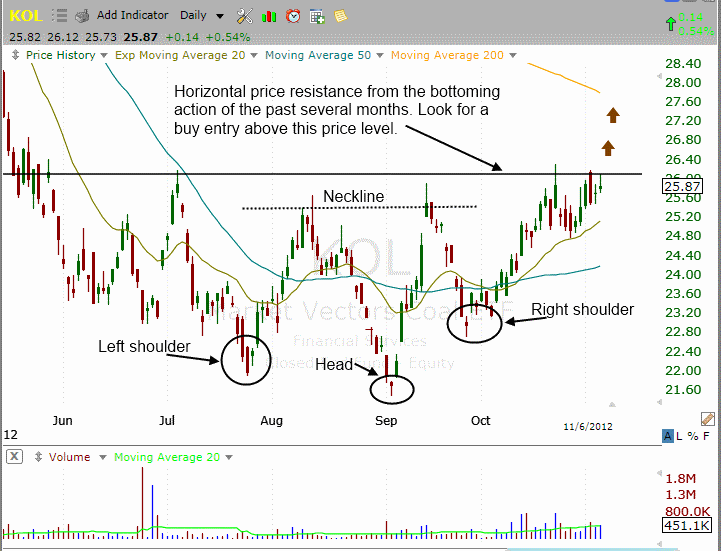

Going into today, we’re stalking a new potential ETF buy entry in Market Vectors Coal ETF (KOL). After being in downtrend from April 2011 until September 2012, KOL is now setting up as a short-term, momentum-based bullish trend reversal play.

On the daily chart below, notice that the 20 day moving averages recently crossed above the 50 day moving average, which is a bullish signal, although the 200-day moving average (orange line above the current price) has not yet started sloping higher. Nevertheless, there is a clearly defined area of horizontal price support and daily chart, and the ETF is also formed a pattern that is similar to an inverse head and shoulders.

The head and shoulders chart pattern is bearish when it forms near the highs after an extended rally, and usually leads to new near-term lows. Conversely, an inverse head and shoulders is bullish when it forms around the near-term lows of a protracted downtrend, and will frequently lead to new “swing highs.” On the chart below, we have annotated the components of the inverse head and shoulders pattern.

As such, we are adding KOL as an “official” trade setup today:

In addition to being an inverse head and shoulders pattern, notice that the right shoulder is higher than the left shoulder. This tells us there were less sellers on the pullback after the formation of the head. A higher right shoulder than the left shoulder with this type of pattern is a bullish indicator. Although this is a trade setup for a long position, the fact it is a commodity ETF means the play has relatively low correlation to the direction of the broad market. Otherwise, we would not be looking at bullish trade setups because our market timing model remains in “sell” mode at the present moment.

Yesterday, our existing long position in Global X Silver Miners ETF (SIL) got off to a rough start in the morning, but reversed to close near its intraday high, this resulted in the formation of a bullish hammer candlestick pattern that also “undercut” key intermediate-term support of its 50-day moving average. This is exactly type of price actually like to see during periods of consolidation, as it serves to shake out the “weak hands” who typically sell when stocks and ETFs break obvious technical levels of price support. If you are a new subscriber or happened to miss our initial buy entry, SIL presents a low-risk buy entry on a rally above yesterday’s high (around the $24.45 level).

At the time of this writing, all eyes are focused on the results of the US presidential election. However, we encourage you not to get too wrapped up in the results and its perceived impact on the market. Other than perhaps a short-term, knee-jerk reaction, the winner of each presidential election typically has much less to do with the future direction of the stock market than one may wish to believe. Rather, it is technical analysis and time cycles that really determines the direction of the market’s next move.

Some subscribers to our swing trading service do not follow our actual entry and exit points for our stock and ETF swing trade setups, but rather subscribe to The Wagner Daily to benefit from our reliable system for market timing. If this is you, be assured it is technically not yet the time to re-enter the market and start buying your favorite stocks and ETFs. As mentioned in yesterday’s stock commentary section of our newsletter, it is simply too easy to dig yourself into a whole when trying to fight the dominant broad market trend. Still, we realize market conditions can change quickly, so we’ll be sure to alert subscribers if/when our market timing signal shifts back into “neutral” or “buy” mode.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Coal ETF Heating Up For

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.