Yes Jon, I know, it is shocking. For over 4 years I have responded to any inquiry about the shiny black rock or companies that have anything to do with it by saying: “coal sucks”. End of story. Nothing else to say. The trend in coal was lower for even longer than that. It was just the human desire to pick a bottom and be a hero driving most of the questions. It was easier for me because my mother taught me not to pick a bottom many many years ago.

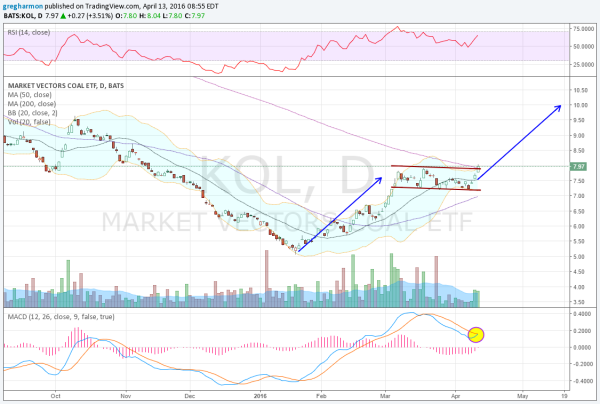

As a technical trader and investor I need confirmation. And it seems that may be here now in coal. The chart below tells the story. After that 4 and a half year run lower in the Market Vectors Coal (NYSE:KOL) ETF it may have found a bottom in January. The ETF bounced then off of a bottom at 5 and rose to 7.50. A 50% gain. Not much though if you had rode it all the way down (I did not). From there it consolidated, moving sideways for 6 weeks.

What makes coal look like a buy now is a series of events in that chart. The price Monday broke above its 200 day SMA for the first time since September 2014. During the consolidation momentum had a chance to reset. The RSI pulled back, but held over the mid line and is moving higher now. The MACD pulled back as well and is now about to make a bullish cross up. Continuation the rest of the week would set a Measured Move to about 10. That would make for a warm feeling inside.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.