AUD: Private sector credit gain 0.4% but slightly below 0.5% expected

CNY: China issue a warning to global nations to not interfere with its internal affairs.

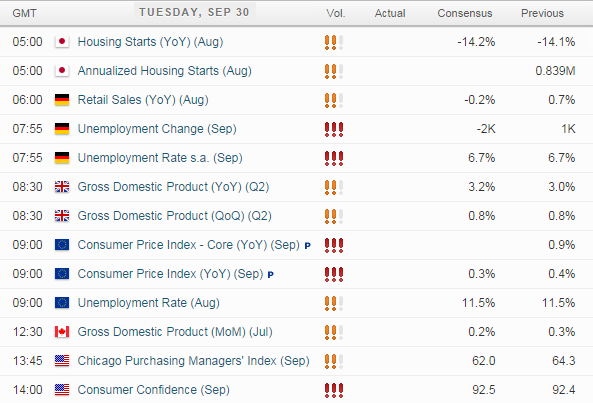

UP NEXT:

GBP: With GDP expected to tick up then failure to deliver could be GBP bearish.

EUR: Data from Europe tonight is the prelude to the important ECB Press conference and Rate Decision on Thursday. Any strength in tonights figures will releive a little pressure from ECB to outlay a firm QE program. However traders are heavily positioned to the short side in hope of stimulus from the Central bank leading up to Thursday, so if we see strong numbers tonight try not to get too carried away on the long side.

CAD: View today's post for a breakdown

TECHNICAL ANALYSIS:

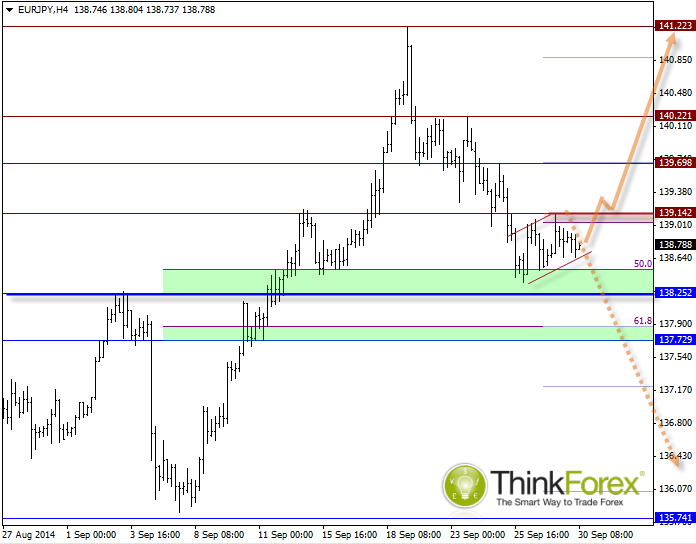

EUR/JPY: Catalysts are approaching

With tonight's growth data warming us up for ECB action on Thursday we should see a breakout this week.

Technically I suspect price will remain above 138.25 support for the following:

- D1 has produced a Morning Star Reversal pattern with increased volume to suggest buying at these levels

- Price action from the 141 high appears to be corrective (potential double Zig-Zag / Double 3)

For this scenario to play out we would require string growth from Eurozone along with no action from ECB on Thursday (resulting in short covering).

The counter analysis highlights potential for a bearish flag which if confirmed would target 136. For this scenario we would require poor GDP growth and a string plan for QE (to weaken the euro).

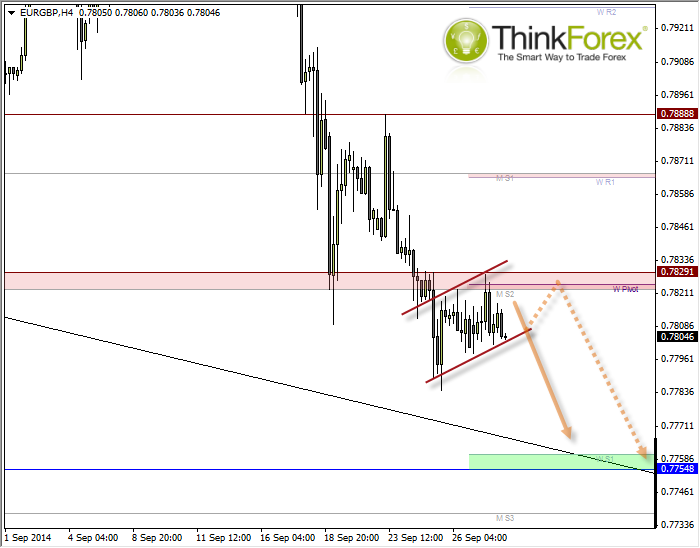

EUR/GBP: Bear flag below string resistance

We have data from Eurozone and UK tonight so this significantly increases the odds of a movement. Price is within an established downtrend on higher timeframes and has respected resistance around 0.7820, whilst trading within a potential bear flag formation.

We also have a clear profit objective around 0.77.

For those wanting to increase reward/ risk ratio (and risk) we can assume a downside break (eventually) but fade within the bear flag formation, if we see any pullback towards 0.782 resistance. A break above this resistance zone invalidates the bearish view and would confirm a bullish reversal pattern, to favour counter-trend traders.