There does seem to be internal financing adjustments going on inside the arcane and cumbersome framework of USD/CNY. Whether or not that is desirable remains to be seen, but the case of the past few weeks suggests, and somewhat strongly, that the PBOC is again losing control. What it is almost certainly like is trying to squeeze a balloon: every time the Chinese central bank aims and endeavors to stamp out volatility in one factor it only shows up in another.

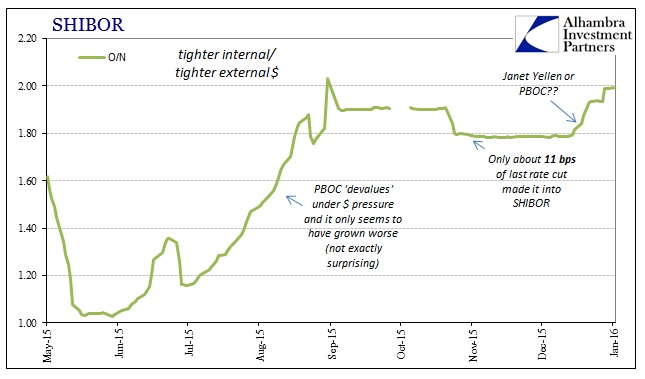

That was the setup for the global August liquidations, as the PBOC was impressing the entire exchange rate CNY in increasing intensity for five months March to August. Through that period, it is not surprising to find it was then that Chinese stocks collapsed. The steadily rising SHIBOR rate (Shanghai Inter Bank Offered Rate), in the shortest terms, told of the internal illiquidity struggle even though the PBOC was desperately trying to mask the related tendency of CNY (and CNH) to “devalue”; which is just a more troublesome and expensive “dollar” problem. That it would lead to so much havoc in mid-August explains the attempt as a means to suppress a very intense and acute imbalance that was developing, with the PBOC somewhat understandable in its orthodox instincts (to override “markets”).

Since then, the PBOC has shifted its focus to internal mechanics and only intermittently against CNY. O/N SHIBOR has now been suppressed while the PBOC relents upon the currency fix where it can no longer hold it something like stable. In other words, the “cost” of fixing CNY appears to be internal liquidity through SHIBOR, whereas the “cost” of holding SHIBOR internally seems to be the CNY (and CNH) fix. As if Werner Heisenberg were running the show in China, the PBOC can only do one or the other.

In more recent weeks, however, there have been suggestions that they can’t do either one all that well. In the week surrounding the FOMC’s rate decision, the huge depreciation in the fix was brought down to less of an intense slope only to see SHIBOR suddenly depart the very narrow range the PBOC was trying so hard to maintain. From mid-November until late December, the middle rate (or PBOC policy reference fix for the band governing US$ exchange) moved down from about 6.35 all the way to 6.46 or 6.47; during that same time, O/N SHIBOR moved in nearly a perfectly straight line, 1.786% in early- and mid-November to 1.788% the day of the FOMC decision.

Through the end of the year, however, the fix stopped moving so far down—only 6.478 on December 23 and 6.4912 New Year’s Eve. Against that, O/N SHIBOR has suddenly restarted, maybe to its prior ascent.

Yesterday morning, both the CNY fix and SHIBOR were moving rather noticeably together in the “wrong” direction, with SHIBOR only half a bp below 2%, the highest since late August, while the middle rate was “devalued” all the way to 6.539! With the PBOC apparently unable to find even artificial peace with one of the two, it may not be so surprising that Chinese stocks so handily succumbed to violent selling.

The selloff saw the CSI300 index of the largest listed companies in Shanghai and Shenzhen lose 7.0 percent before trading was suspended, its worst single-day performance since late August 2015, the depth of a summer stock market rout.

The blame for the selloff was placed at the foot of Chinese industry, not without good reason given another uncomfortable round of PMIs.

Chinese stocks plunged Monday, spurring a trading halt for the rest of the session, and leading stock markets in Asia Pacific lower after feeble manufacturing surveys revived concerns over the mainland’s economic slowdown…

The Caixin December manufacturing PMI was down at 48.2, compared with 48.6 in November. The Caixin PMI is a closely-watched gauge of nationwide manufacturing activity, which focuses on smaller and medium-sized companies, filling a niche that isn’t covered by the official data.

The PMIs, however, don’t offer compelling explanations for the intensity of the selloff, as there have been nothing much other than alarming PMIs for some time, merely the catalyst for why it may have started and turned. Liquidity is the answer, and the comparisons to August are becoming too frequent and inescapable. That includes potentially ratcheted PBOC desperation and money market conditions for the “dollar.”

The last time we found such behavior, especially in conjunction between US$ repo and T-bills, was the middle of August when the PBOC shocked the world by letting go yuan to dollar. As then, CNY and especially CNH liquidity show up as highly unusual, the artifact of China’s unique connection to the eurodollar world. For SHIBOR and internal yuan liquidity, the week immediately following the FOMC decision saw O/N SHIBOR suddenly rise where it had been clearly under the depressive influence of the PBOC dating back to early September. ~ China Goes Desperately For 'Flexibility'

I have doubts as to whether the FOMC rate decision was the cause, as China’s financial and economic course long predate the more immediate policy step. The “dollar’s” intensification in the past few weeks, however, may speak to the vulnerability with which so much optimism had been clinging. The ability of the PBOC to manage either SHIBOR or CNY was at best tenuous, and “something” forced it, apparently, to lose once more even that. While that “something” might have been the FOMC, it is entirely possible that it was just the latest in the line of discrete “dollar” episodes stretching back nearly three years now.

In the end, the proximate cause of the latest outburst may be immaterial; what is most relevant is that the narrative that prevailed ever since the PBOC unleashed its wholesale arsenal in September is being peeled back. It was taken as a given that the misdirection provided by swaps and forwards (and repos and T-bills) that made it appear as if the financial imbalance of August was over and done with (“capital outflows” appeared to have reversed in the traditional accounting of such things), only to see such hopefulness taken aback once more. The Chinese industrial reality goes hand in hand with that more realistic financial interpretation, as one reinforces the other.

In total, for the “dollar” as for the global economy, there's no end or bottom yet in sight. In more technical terms, being short the “dollar” (synthetic or not) is the same as being “long” China’s economy. It’s an opportunity for speculators, such as they may exist in those terms, though Chinese banks have no choice in the matter; leaving the PBOC with little options of its own. It appears we might be seeing that confirmed once again.