With stocks down for a second day, attention has been focused on the UK vote potentially in favor of leaving the EU. It seems like a naturally disruptive event, or at least in theory, an outcome that the mainstream globalist persuasion continues to emphasize. That is certainly one possible explanation, but a more likely scenario is one where CNY plays the most prominent role. Unfortunately, we have no idea how CNY might trade today since mainland markets are closed for a second day for the Dragon Boat Festival national holiday.

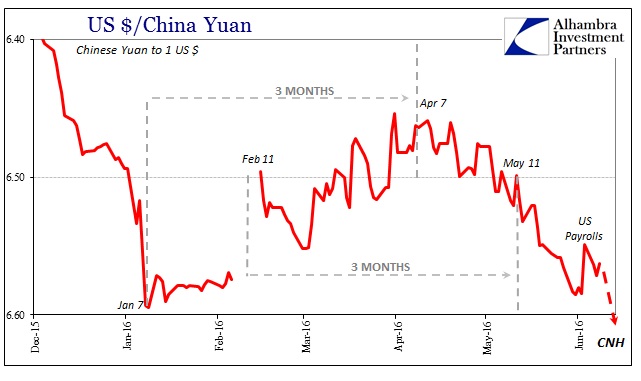

Instead, we are left to Hong Kong and offshore CNH. There we get a hint of still growing illiquidity. For the first time since early February, offshore RMB trades below 6.60, suggesting that last week’s “thank you” dollar selling is over and surpassed; the “ticking clock” can only be temporarily set aside. As has been the case for a long time now, CNY (or CNH) down = bad.

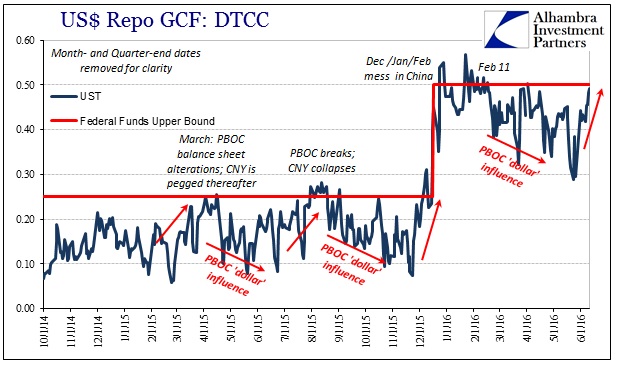

With onshore trading closed as CNH falls, it raises an intriguing proposition about the absence of the PBOC in these Asian “dollar” conditions. The move in CNH was easily out of line compared to recent trading behavior that has been steadily lower but not precipitously and disruptively so. It might suggest that the Chinese central bank continues to intervene in at least acting as a brake (so far) on CNY as it predictably falls again. Without the PBOC, CNH traded in a 45 degree, almost perfectly straight line across both days of the holiday. It may be just coincidence that global markets struggled at the same time.

What that might mean is the PBOC still fighting a battle it cannot possibly win, but also one that it only makes worse by trying to. This is what I called the nightmare scenario back at the start of last September in the aftermath of August’s jarring disorder; an outcome that increasingly looks inevitable if not all at once. As noted earlier today, these interventions have the effect of breaking up what is truly a single, underlying eurodollar decay. But having gained temporary calm it only makes the “next one” both unavoidable and that much worse.

There is another way to look at it, and this is really the nightmare scenario and not just for China but everywhere. By requiring private firms to deposit forex (mostly dollars) in October the PBOC might be planning for the worst case. It has, by now, appreciated just how limited actual mobilization of all those “reserves” actually can be, as even doing heavy intervention so far was largely ineffective despite all the convention about having all those protective reserves in the first place – the yuan still broke and China fell into the crosshairs of open disorder. And that is the larger point and confluence, where the PBOC “reserves” may contain further disruption if they aren’t properly calibrated (and they never are; again Brazil, Indonesia and the rest) just as the rest of the world wakes up to the fact that all those reserve piles were instead of being insurance against the worst case are the very problem itself – wholesale exposure as the decay in wholesale eurodollar reaches almost predetermined amplification. [emphasis in original]

A shorter, condensed version of that is getting more “short” in the face of this irreducible baseline is utter madness. That is what the PBOC does in its forward or wholesale interventions. Systemically, the Chinese system becomes “more short” for each iteration, leaving it that much more vulnerable and stressed as they come due. Just as I suggested then, the world is starting to wake up to all this as even the media and some economists have finally, belatedly figured out the direct correlation between CNY and global asset prices. Again, CNY down = bad. Thus, the PBOC doing more practically guarantees CNY down and down big. The nightmare scenario.