Cracked.Market University:

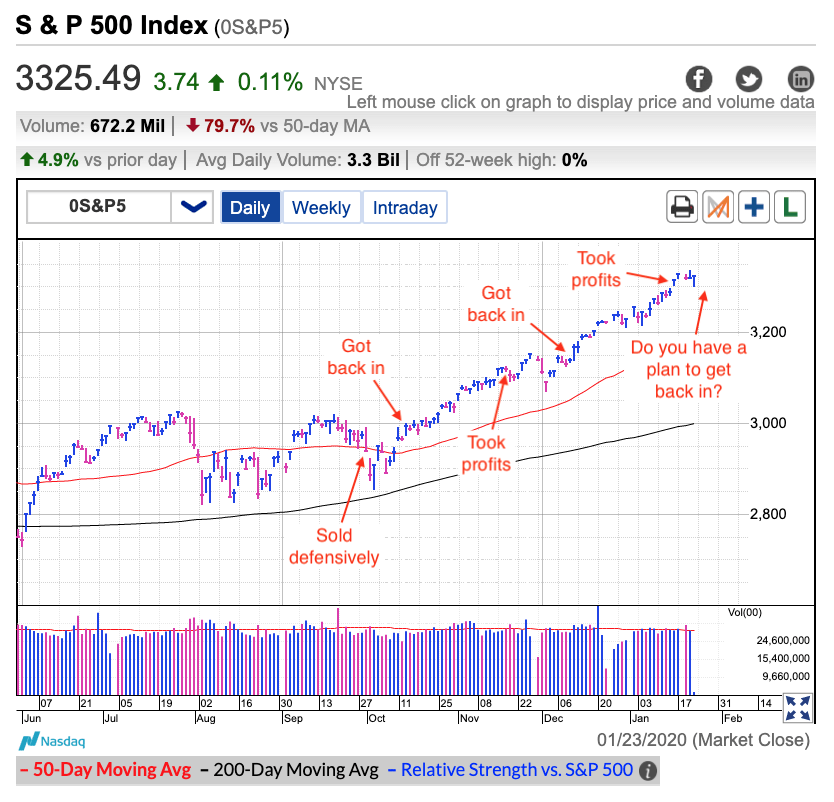

There is plenty of advice on how to get out of the market. Whether that is taking profits when the market hits your price target or bailing out defensively when the market retreats to your stop-loss. But what you don’t hear very often is how important it is to get back in when you realize you sold too early.

The single greatest strength we have as independent traders is the nimbleness of our size. While institutional investors have impressive degrees, decades of experience, an army of researchers, and industry contacts we could never duplicate, what they don’t have is speed. It takes them weeks, even months to establish full positions, something we do in the amount of time it takes to make a few mouse clicks.

But with that nimbleness comes responsibility. Taking profits early and often is always a good idea. But so is continuing to watch the market for the opportunity to get back in. All too often people flip their outlook on a trade as soon as they sell. All of a sudden what was a great and profitable trade transforms into an outdated and used up idea. But a lot of times there is life still left in a good ideal and we should not let ourselves miss out on it just because we sold last week, yesterday, or even an hour ago.

Every time you sell, have a plan on what it would take to get back in. Maybe you jump back in if the market pulls back to a certain level. But what if the pullback never happens? Do you have a plan to get back in if it keeps going higher? While we never recklessly chase a move higher, maybe the stock is more resilient than we expected. But rather than missing the next leg higher because we are stubborn, have a plan to buy when prices exceed the prior highs.

There is nothing wrong with taking profits when your trading plan tells you to take profits. In fact, it would be wrong to not follow our trading plan. But once we are out, always be looking for that next entry point. It could happen a lot sooner than you expect.