About a month has gone by since the last earnings report for CMS Energy Corporation (NYSE:CMS) . Shares have added about 5.1% in that time frame, outperforming the market.

Will the recent positive trend continue leading up to the stock's next earnings release, or is it due for a pullback? Before we dive into how investors and analysts have reacted of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

CMS Energy Q2 Earnings Miss, Retains '17 EPS View

CMS Energy reported second-quarter 2017 earnings per share of $0.33. The figure missed the Zacks Consensus Estimate of $0.41 by 19.5%. Quarterly earnings also dropped 26.7% from the year-ago figure of $0.45.

Operational Performance

In the quarter under review, CMS Energy’s operating revenues came in at $1,449 million, beating the Zacks Consensus Estimate of $1,355.5 million by nearly 7%. Moreover, on a year-over-year basis, revenues improved 5.7% from $1,371 million.

The company’s operating expenses increased 10.2% to $1,208 million during the quarter.

Operating income during the second quarter was $241 million, down 12.4% from $275 million a year ago.

CMS Energy’s interest charges were $110 million, up 1.9% from $108 million in the year-ago period.

Financial Condition

CMS Energy had cash and cash equivalents of $418 million as of Jun 30, 2017, up from $235 million as of Dec 31, 2016.

As of Jun 30, 2017, total debt, capital leases and financing obligations stood at $9,715 million, up from $9,706 million as of Dec 31, 2016.

At the end of the second quarter, cash from operating activities was $1,119 million compared with $1,101 million in the year-ago period.

Guidance

CMS Energy reaffirmed its 2017 adjusted earnings per share guidance in the range of $2.14–$2.18. Adjusted earnings are still expected to grow year over year in the range of 6–8% in 2017.

How Have Estimates Been Moving Since Then?

Analysts were quiet during the last month as none of them issued any earnings estimate revisions.

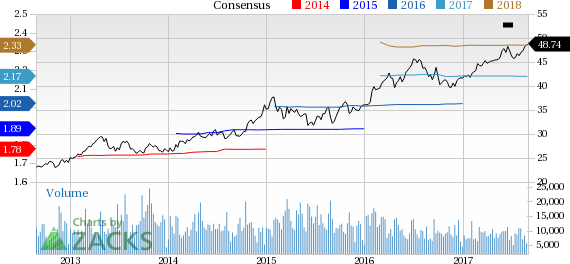

CMS Energy Corporation Price and Consensus

VGM Scores

At this time, CMS Energy's stock has a subpar Growth Score of D, though it lags a bit on the momentum front with an F. The stock was allocated a grade of C on the value side, putting it in the middle 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of D. If you aren't focused on one strategy, this score is the one you should be interested in.

Zacks' style scores indicate that the company's stock is solely suitable for value investors.

Outlook

Notably, the stock has a Zacks Rank #3 (Hold). We expect in-line returns from the stock in the next few months.

CMS Energy Corporation (CMS): Free Stock Analysis Report

Original post

Zacks Investment Research