CMS Energy Corporation (NYSE:CMS) reported fourth-quarter 2017 adjusted earnings per share of 51 cents which was in line with the Zacks Consensus Estimate of 51 cents. Quarterly earnings however surged 75.9% from the year-ago figure of 29 cents.

Excluding the one-time tax reform’s impact of 52 cents, the company reported loss of a penny as against earnings of 28 cents per share in the year-ago quarter.

For 2017, CMS Energy’s adjusted earnings were $2.17 per share, up from $2.03 from the year-ago period. The full-year adjusted earnings also came in line with the Zacks Consensus Estimate.

Operational Performance

In the quarter under review, CMS Energy’s operating revenues came in at $1,778 million, which surpassed the Zacks Consensus Estimate of $1,676 million by 6.1%. Moreover, on a year-over-year basis, revenues surged 8.4% from $1,640 million in the year-ago period.

For 2017, the company generated revenues worth $6.58 billion, which also surpassed the Zacks Consensus Estimate of $6.56 billion. Moreover, on a year-over-year basis, revenues surged 2.9% from $6.40 billion in the year-ago period.

The company’s operating expenses rose 2.9% year-over-year to $1,399 million during the quarter.

Operating income during the fourth quarter was $379 million, up 35.4% from $280 million a year ago.

CMS Energy’s interest charges were $110 million, compared with $111 million in the year-ago period.

Financial Condition

CMS Energy had cash and cash equivalents of $182 million as of Dec 31, 2017, down from $235 million as of Dec 31, 2016.

As of Dec 31, 2017, total debt, capital leases and financing obligations was $10,185 million, up from $9,706 million as of Dec 31, 2016.

At the end of 2017, cash from operating activities was $1,705 million compared with $1,629 million in the year-ago period.

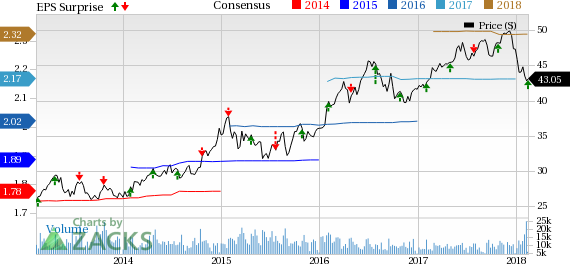

CMS Energy Corporation Price, Consensus and EPS Surprise

CMS Energy Corporation (CMS): Free Stock Analysis Report

CenterPoint Energy, Inc. (CNP): Free Stock Analysis Report

NextEra Energy, Inc. (NEE): Free Stock Analysis Report

Dominion Energy Inc. (D): Free Stock Analysis Report

Original post

Zacks Investment Research