CME Group Inc. (NASDAQ:CME) reported fourth-quarter 2018 adjusted earnings per share of $1.77, beating the Zacks Consensus Estimate of $1.75. Moreover, the bottom line improved 58% year over year.

The quarter witnessed increased volatility and higher customer demand for diverse risk management products driving strong trading volumes, exceeding 20 million contracts per day.

Net income came in at $1.09 per share, which plunged 87% year over year.

Performance in Detail

CME Group’s revenues of $1.2 billion increased 37.4% year over year. The top line beat the Zacks Consensus Estimate by 6.5%. Increase in revenues can be attributed to higher market data and information services (up 36.4% year over year), access and communication fees (up 27.6% from the year-ago quarter) as well as other (up 80.8% from the prior-year period).

Total expenses increased 61.6% year over year to $586.7 million during the reported quarter, attributable to higher compensation and benefits, technology expenses, licensing and other fee agreements, professional fees and outside services, depreciation and amortization as well as other.

Operating income improved 21% from the prior-year quarter to $649.9 million.

Average daily volume improved 31% year over year to 20.8 million contracts driven by higher volumes across four of the six product lines. Average rate per contract rose in five of the four product lines.

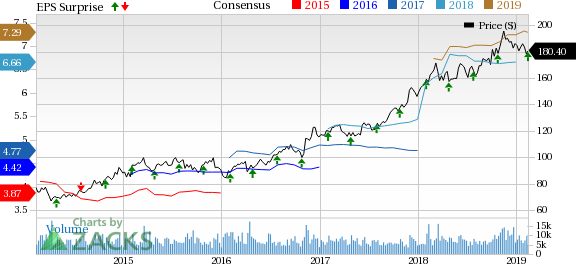

CME Group Inc. Price, Consensus and EPS Surprise

Full-Year Highlights

Adjusted earnings per share of $6.82 beat the Zacks Consensus Estimate of $6.80. Moreover, the bottom line improved 43% year over year.

CME Group’s revenues of $4.3 billion increased 18.2% year over year. The top line beat the Zacks Consensus Estimate of $4.1 billion.

Financial Update

As of Dec 31, 2018, CME Group had $1.4 billion of cash and marketable securities, which plunged 27.8% from 2017 end. As of Dec 31, 2018, long-term debt of $3.8 billion increased 71.4% from 2017 end.

As of Dec 31, 2018, the company had total assets worth $77.5 billion, up 2.2% from $75.8 billion at 2017 end.

Dividend Update

In 2018, the company paid dividends worth $1.6 billion.

Zacks Rank

CME Group currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Companies in Securities Exchange Industry

Intercontinental Exchange Inc. (NYSE:ICE) and Cboe Global Markets, Inc. (NYSE:CBOE) earnings beat the respective Zacks Consensus Estimate while that of Nasdaq Inc. (NASDAQ:NDAQ) met estimates.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research. It's not the one you think.

CME Group Inc. (CME): Free Stock Analysis Report

Intercontinental Exchange Inc. (ICE): Free Stock Analysis Report

Nasdaq, Inc. (NDAQ): Free Stock Analysis Report

Cboe Global Markets, Inc. (CBOE): Free Stock Analysis Report

Original post

Zacks Investment Research