As of September 10, the CME has the odds of a September hike by the Fed at 24%. Bloomberg says the probability of a move is 28%.

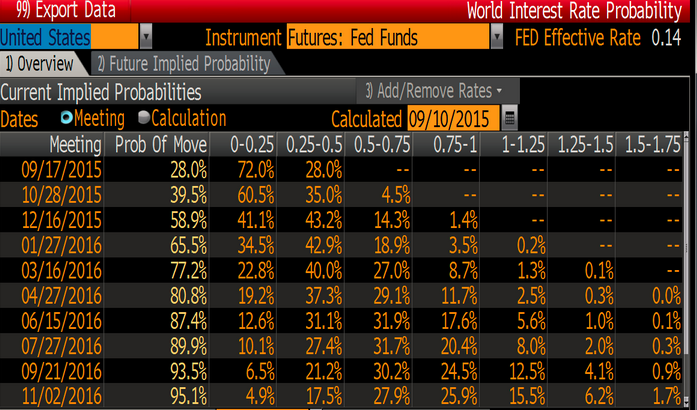

Bloomberg Rate Hike Odds

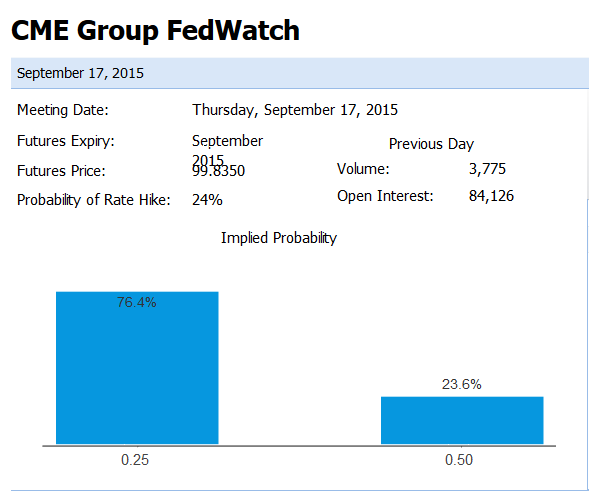

CME Fedwatch Odds

Both Models Wrong

What's wrong with both models is they still presume a quarter point hike.

Neither Bloomberg nor the CME allows for the possibility of a Fed hike to precisely 0.25% or to a smaller tighter range.

Given the effective Fed Funds Rate is 0.14% (see upper right of Bloomberg chart), a setting the rate to a flat 0.25% from the current range of 0.00-0.25% (now at 0.14%), would be both a "move" and a "hike".

Tighter Range

The Fed could also use ranges as Bloomberg and CME imply, but target ranges in 1/8 of a point increments rather than 1/4 point increments.

For example the Fed could target a range of 0.25% to 0.375%.

I suspect the odds of a move to a flat 0.25 or a range (0.25% to 0.375%), are far greater than Bloomberg's "probability of a move" set at a mere 28%.

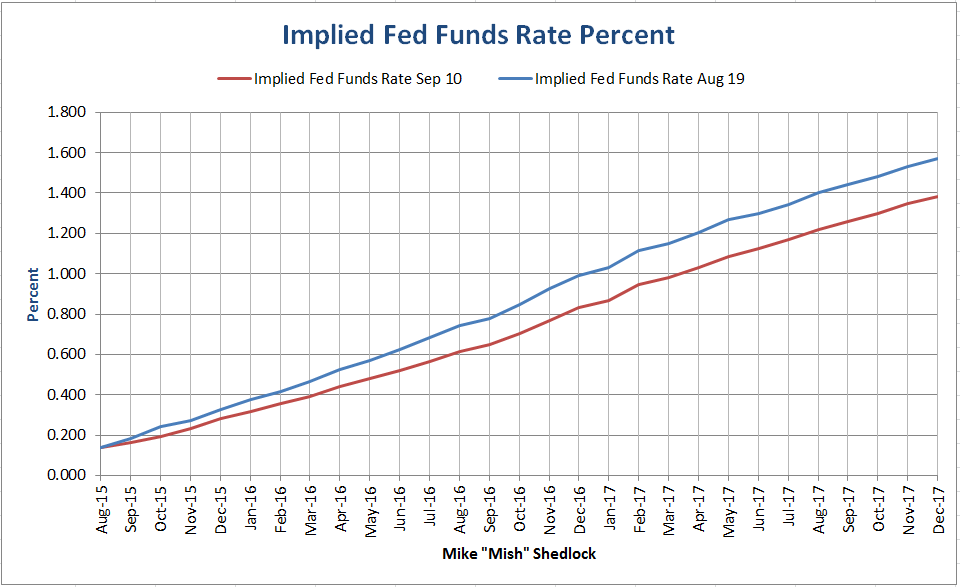

I updated my charts today.

Flattening of Rate Hike Expectations

Using Fed fund futures from CME, I calculated implied interest rates through December 2017. The line in Blue shows what futures implied on August 19. The line in red is from September 10.

Note the flattening of the curve. This has been happening pretty much all year.

The market initially penned in hikes for January. The hikes then shifted to March, then June, then September, and now December by both the Bloomberg and CME models.

Range Watch

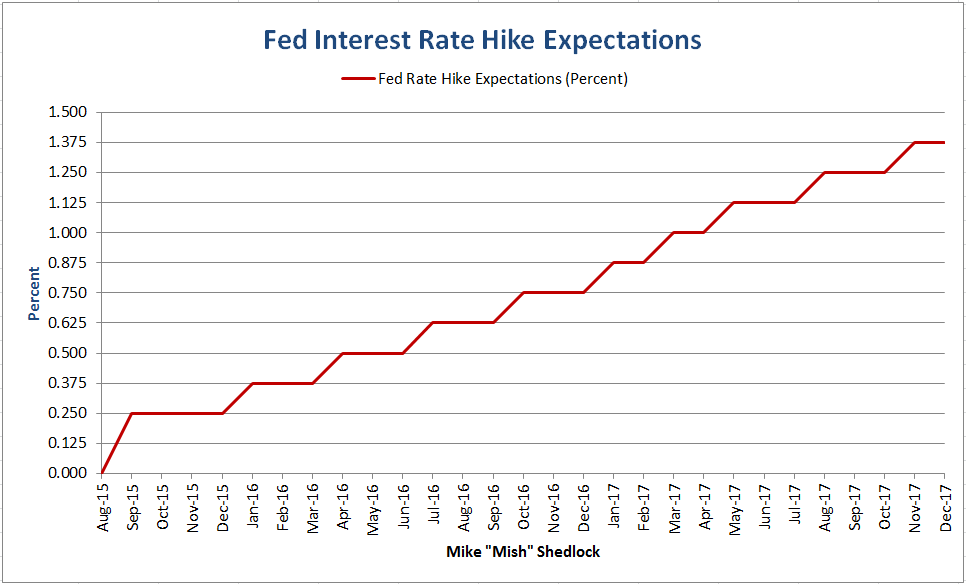

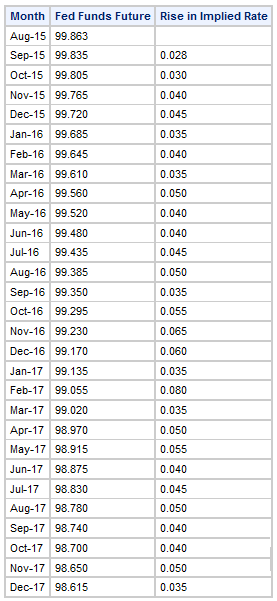

Curve Watchers Anonymous is closely watching the implied baby steps in the the Fed fund futures. Incrementally, the hikes appear as follows.

Baby Steps Plotted

Fed fund futures imply a very slow tightening of 3-6 basis points a month. The only exception is January to February of 2017 where the incremental rise is 8 basis points (0.080 percentage points).

The Fed does not set policy every month. Instead it does so about eight times a year. FOMC dates are not yet set for 2017, but futures imply something like the following.

Fed Rate Hike Expectations Through 2017

Yellen vs. Greenspan

- The above market expectations are clearly similar to Greenspan's famous statement: Hikes will be at a "pace that's likely to be measured".

- The Yellen expected "pace" is half as often.

- The Yellen expected "measure" is half as much.