As boring as the Dow Jones Utility Average might sound, it’s actually a fascinating little beast. It provided the most gorgeous topping pattern imaginable back in 2007-2008, and it behaves itself quite well with respect to its trendlines and Fibonaccis. Observe the chart below and take note of the Fibonacci fan lines, which date back for many years.

This particular line has acted like a magnet for the entire recovery, and recently it has been banging against it, respecting it as support each time.

What’s especially interesting to me is that the Utilities Select SPDR ETF (XLU) (the fund based on the UTIL) is how its failure would signal quite strongly an upswing in interest rates which, aside from nuclear attack, is the bears’ only hope for a diminishment in equity prices.

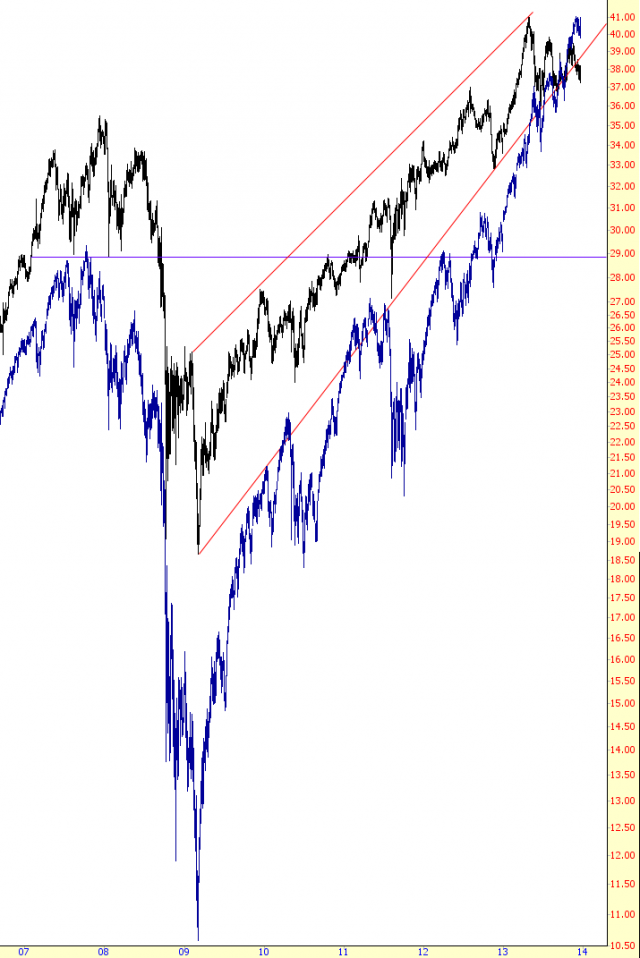

Take a look at the chart below, in which I have overlaid the SPY (in blue) with the XLU (in black). In particular, notice how the XLU has recently been weakening, chipping away at its trendline, and creating quite a spread between itself and the terribly-strong SPY. My contention is that this divergence will be rectified to the downside.

Focusing on the XLU by itself, the erosion of that supporting trendline is what has my attention. I am short XLU (surprise!) and will use it as an important guide. A break to new lows for the year will be a surefire signal that the party is over, because interest rates are going to ruin the bull’s sunshine quicker than Roseanne Barr can scarf down a box of Krispy Kreme hot glazed.