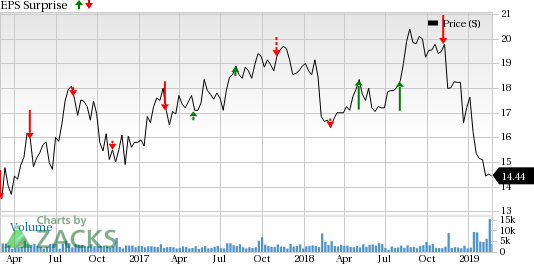

Clearway Energy, Inc. (NYSE:CWEN) is scheduled to release fourth-quarter earnings on Feb 28. In the last reported quarter, it reported a negative earnings surprise of 62.26%.

Let’s see how things are shaping up for the company prior to the earnings announcement.

Factors to Consider

Clearway Energy will gain from the high quality of renewable assets under management. In addition, the company is expected to benefit from cost-management initiatives.

The Zacks Consensus Estimate for fourth-quarter earnings per share is pegged at 5 cents, reflecting a year-over-year decline of 73.7%.

What Our Quantitative Model Predicts:

A stock needs to have both a positive Earnings ESP (which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate) and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) to surpass estimates. However, the company does not have the right mix.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Earnings ESP of the company is pegged at -120.00%.

Zacks Rank: Currently, Clearway Energy carries a Zacks Rank #3. Even though the company’s favorable Zacks Rank increases the possibility of an earnings beat, its -120.00% ESP makes positive earnings surprise unlikely this season.

Conversely, we caution against Sell-rated stocks (#4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Here are some companies from the Zacks Oil and Energy sector, which have the right combination of elements to deliver an earnings beat this season.

Denbury Resources Inc. (NYSE:DNR) has an Earnings ESP of +2.86% and a Zacks Rank of 3. It is anticipated to report fourth-quarter 2018 earnings on Feb 27. You can see the complete list of today’s Zacks #1 Rank stocks here.

Cheniere Energy, Inc. (NYSE:LNG) has an Earnings ESP of +50.4% and a Zacks Rank of 3. It is expected to report fourth-quarter 2018 earnings on Feb 26.

Southwestern Energy Company (NYSE:SWN) has an Earnings ESP of +6.06% and a Zacks Rank of 3. It is expected to report fourth-quarter 2018 earnings on Feb 28.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Southwestern Energy Company (SWN): Free Stock Analysis Report

Cheniere Energy, Inc. (LNG): Free Stock Analysis Report

Denbury Resources Inc. (DNR): Free Stock Analysis Report

Clearway Energy, Inc. (CWEN): Free Stock Analysis Report

Original post

Zacks Investment Research