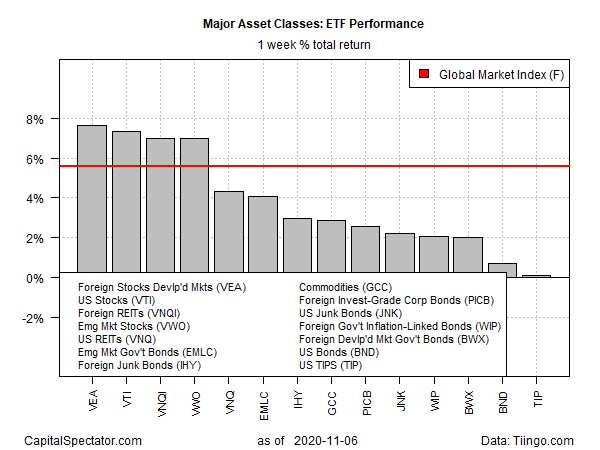

Global markets rebounded last week, posting across-the-board gains, based on a set of exchange-traded funds as of Friday, Nov. 6. With the pandemic resurging in the US and Europe, however, the prospects for a sustained, broad-based rally look challenged.

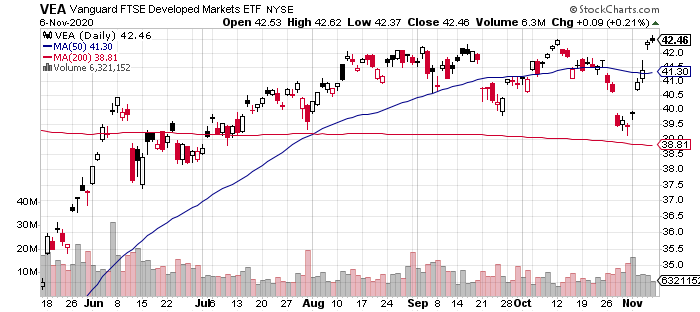

Nonetheless, the trading week begins with a solid performance tailwind. Last week’s leader: equities in foreign developed markets Vanguard FTSE Developed Markets Index Fund ETF Shares (NYSE:VEA) surged 7.6%—the fund’s strongest weekly increase since April. The rally lifted the ETF to its highest close so far in the post-coronavirus-crash rebound.

US (NYSE:VTI) and emerging markets stocks (VWO) were strong performers last week, too, along with US and foreign property shares (VNQ and VNQI, respectively).

US bonds delivered the weakest performance. Inflation-indexed Treasuries rose fractionally, posting the softest gain for the major asset classes.

The widespread rallies dispensed a strong increase for the Global Markets Index (GMI.F) last week. This unmanaged benchmark, which holds all the major asset classes (except cash) in market-value weights via ETFs, rose sharply with a 5.6% increase – GMI’s best weekly rise since April.

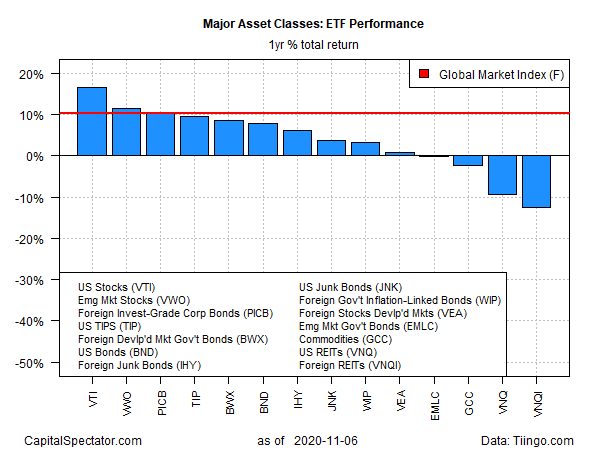

US equities continue to hold the top spot for the trailing one-year trend. Vanguard Total US Stock Market (VTI) ended trading on Friday with a 16.9% total return vs. the year-ago level (based on trailing 252 trading days).

The weakest one-year performance for the major asset classes: foreign real estate stocks. Vanguard Global ex-U.S. Real Estate (VNQI) is in the red by 12.5% over the past 12 months.

GMI.F, on the other hand, is ahead with a solid 10.4% total return for the trailing one-year period.

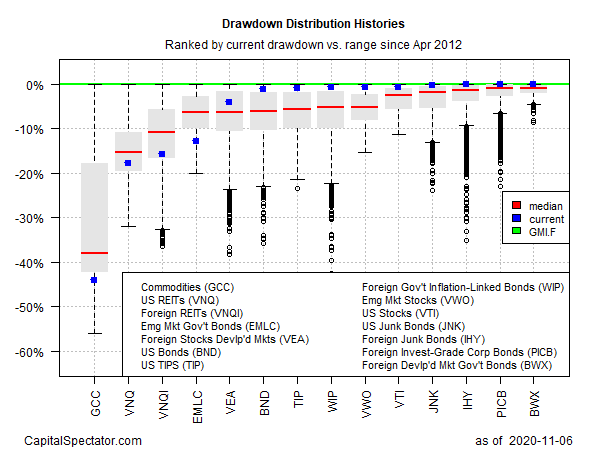

Looking at global markets through the lens of current drawdown, broadly defined commodities (GCC) are currently posting the deepest setback within the major asset classes via a 44% peak-to-trough decline as of last week’s close.

Meanwhile, three funds share honors for posting zero drawdowns at the moment: foreign junk bonds (IHY)), foreign corporate bonds (PICB) and foreign government bonds in developed markets (BWX).

GMI.F’s current drawdown is also zero.