Last week, short seller Citron Research tweeted that AbbVie Inc (NYSE:ABBV) stock is on its way to $60, calling it "the next great drug short." Since then, and ahead of earnings on Friday, July 27, ABBV put buying has been accelerated, suggesting options traders are betting bearishly on the pharmaceutical stock. Today, however, AbbVie shareholders appear to be shrugging off the first of Citron's bearish reports on the firm, with the stock up 1.6% at $93.04.

Specifically, Citron cited a "double whammy" for AbbVie last week: a speech from Food and Drug Administration (FDA) Chairman Scott Gottlieb, where he criticized companies trying to delay or derail biosimilar competition; and "a proposed change in government policy to get rid of the safe harbor provision and eliminate the rebates that have allowed AbbVie to maintain dominance." Assuming the government acts, Citron says, AbbVie -- "one of the worst abusers" of the system with "egregious pricing practices" -- will head much lower.

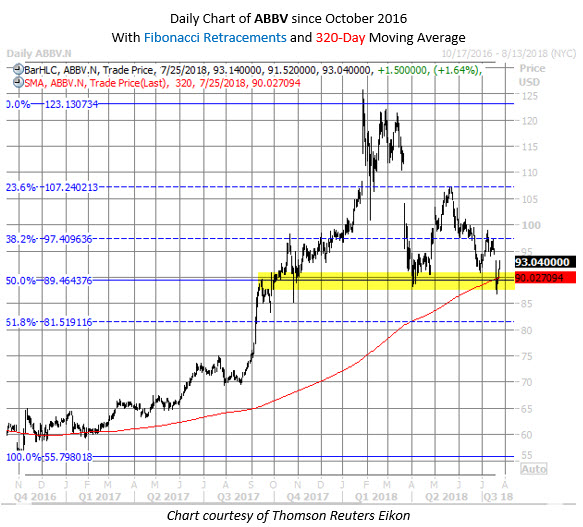

ABBV stock gapped lower last Thursday after the aforementioned Citron tweet, hitting a year-to-date low of $86.76 in the following session. However, the shares seem to have found support from a familiar ally in the round-number $90 region. This level contained ABBV's pullback earlier this year, and represents a 50% Fibonacci retracement of the stock's rally from its October 2016 closing low of $55.78 to its January 2018 closing high of $123.21. It's also home to ABBV's ascending 320-day moving average.

However, it seems recent options buyers are expecting AbbVie stock to retreat in the short term, with put buying ramping up ahead of the company's earnings release. On the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the stock has racked up a 10-day put/call volume ratio of 1.01 -- in the 96th percentile of its annual range. This indicates that options buyers have picked up ABBV puts over calls at a near annual-high clip in the past two weeks.

The August 75 and September 85 puts saw notable increases in open interest in that time frame, with more than 2,900 contracts added at each strike. Data from the major exchanges indicates a healthy portion of the puts were bought to open. By buying the puts to open, the speculators expect ABBV to breach the $75 and $85 levels by August and September options expiration, respectively. It's worth noting, though, that the pharma stock moved higher after its last three earnings reports, including a one-day pop of 13.8% in January.

Whether bullish or bearish, recent premium buyers can perhaps rest a little easier knowing ABBV stock has tended to exceed options traders' volatility expectations in the past year. This is evidenced by the equity's lofty Schaeffer's Volatility Scorecard (SVS) of 90 out of 100.