Shares of Citrix Systems, Inc (NASDAQ:CTXS) are hovering near breakeven at $102.20 today, as traders gear up for the company's third-quarter earnings, which are set for release after the market closes tonight. Below we will take a look at how CTXS has been faring on the charts, and at what the options market has priced in for the stock's post-earnings moves.

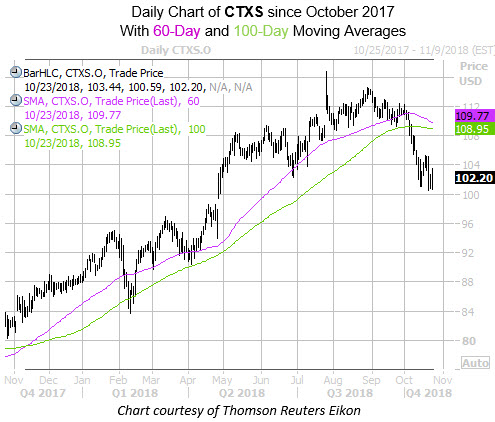

Long term, CTXS spent most of the past year climbing atop support at the 60-day and 100-day moving averages, with the security touching a record closing high of $114.42 in late August. However, the equity breached this pair of trendlines earlier this month, as Citrix stock slide with the broader stock market. The shares seem to have found a foothold atop the round-number century mark, though.

Digging into its earnings history, CTXS closed higher the day after reporting in four of the last eight quarters, including the last three in a row. Looking broader, the shares have averaged a 2.8% move the day after earnings over the last two years, regardless of direction. This time around, CTXS options traders are expecting a much larger-than-usual 7.0% swing for Thursday's trading.

While absolute options volume runs light on Citrix, the software stock sports a Schaeffer's put/call open interest ratio (SOIR) of 1.75, which ranks in the highest percentile of its annual range. In other words, short-term speculators are much more put-heavy than usual toward CTXS stock ahead of earnings.

In the same pessimistic vein, 14 of 17 covering analysts offer up tepid "hold" or worse ratings on the tech name. Plus, short interest accounts for 7.3% of the equity's total available float, and would take about seven days to buy back, at CTXS' average daily trading volume. Should the shares once again pop higher after earnings, a round of analyst upgrades or an exodus of option bears or short sellers could propel the security higher.