Riding on higher revenues, Citizens Financial Group, Inc. (NYSE:CFG) delivered a positive earnings surprise of 6.8% in second-quarter 2017. Earnings per share of 63 cents topped the Zacks Consensus Estimate of 59 cents. Also, the reported figure improved 37% year over year.

Continued growth in loan and deposit balances, aiding higher revenues, was recorded. Eased margin pressure and lower provisions were the positives. However, elevated expenses posed a concern.

Net income came in at $318 million, up 31% year over year.

Increased Revenues Partly Offset by Higher Expenses

Total revenue for the quarter was $1,396 million, lagging the Zacks Consensus Estimate of $1,399 million. However, revenues were up 9% year over year.

Citizens Financial’s net interest income increased 11% year over year to $1.03 billion. The rise is primarily attributable to average loan growth and improved margin. In addition, net interest margin expanded 13 basis points (bps) year over year to 2.97%, mainly due to enhanced loan yields and higher interest rates, partly mitigated by securities portfolio growth, and elevated deposit and funding costs.

Also, non-interest income climbed 4% year over year to $370 million. The rise was driven by strength in almost all components of income, partially offset by reduced net securities gains and other income.

Non-interest expenses were up 4% year over year to $864 million. The increase reflects rise in all categories of expenses except equipment-related costs.

Efficiency ratio declined to 62% in the second quarter from 65% in the prior-year quarter. Generally, lower ratio is indicative of the bank’s improved efficiency.

As of Jun 30, 2017, period end total loan and lease balances increased 1% sequentially to $109.8 billion while total deposits rose 1% from the previous quarter to $113.6 billion.

Credit Quality: A Mixed Bag

As of Jun 30, 2017, allowance for loan and lease losses increased 2% year over year to $1.2 billion. Also, net charge-offs for the quarter jumped 15% year over year to $75 million.

Provision for credit losses declined 22% year over year to $70 million. Additionally, total non-performing loans and leases were down 2% year over year to $1.03 billion.

Capital Ratios

Citizens Financial remained well capitalized in the quarter. As of Jun 30, 2017, Common equity Tier 1 capital ratio was 11.2% compared with 14.9% at the end of the prior-year quarter. Further, Tier 1 leverage ratio came in at 9.9% compared with 10.3% as of Jun 30, 2016. Total Capital ratio was 14.0% compared with 14.9% in the prior-year quarter.

Capital Deployment Update

As part of its 2016 Capital Plan, the company repurchased 3.7 million shares during the quarter. Notably, including common stock dividends, the company returned $957 million to shareholders as of Jun 30, 2017.

Outlook 2017

The company’s Tapping Our Potential (TOP) initiatives remain on track. In 2016, TOP II recorded about $105 million of annual pre-tax benefits. Further, TOP III is expected to result in pre-tax revenue and expense run-rate benefits of $110 million, including $20 million of tax benefits in 2017.

Further, TOP IV initiatives are expected to deliver $90–$105 million of run-rate pre-tax revenue and expense benefits by the end of 2018. These initiatives are expected to help drive continued positive operating leverage and fund investments for future growth.

Our Viewpoint

Results highlight a decent quarter for Citizen Financial. We are optimistic as the company remains focused on several of its initiatives to grow revenues and improve efficiency. With a diversified traditional banking platform, Citizens Financial is well poised to benefit from the recovery of economies where it has a footprint.

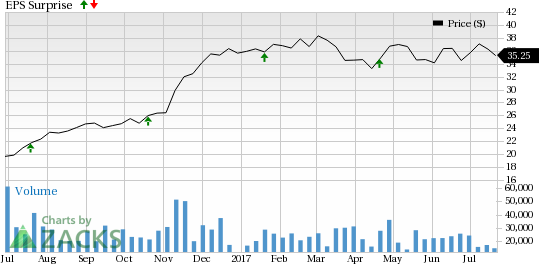

Citizens Financial Group, Inc. Price and EPS Surprise

Currently, Citizen Financial carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

Driven by high net interest income, U.S. Bancorp (NYSE:USB) reported a positive surprise of 1.2% in second-quarter 2017. The company reported earnings per share of 85 cents, beating the Zacks Consensus Estimate by a penny. Results also came ahead of the prior-year quarter earnings of 83 cents.

First Horizon National Corporation (NYSE:FHN) reported second-quarter 2017 adjusted earnings per share of 27 cents, surpassing the Zacks Consensus Estimate by a penny. Further, the figure reflects an increase of 12.5% from the year-ago quarter.

Comerica Inc. (NYSE:CMA) reported a positive earnings surprise of 7.5% in second-quarter 2017. Adjusted earnings per share of $1.15 surpassed the Zacks Consensus Estimate of $1.07. The adjusted figure excludes restructuring charges and tax benefit from employee stock transactions.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Comerica Incorporated (CMA): Free Stock Analysis Report

U.S. Bancorp (USB): Free Stock Analysis Report

First Horizon National Corporation (FHN): Free Stock Analysis Report

Citizens Financial Group, Inc. (CFG): Free Stock Analysis Report

Original post